How much do you have to make to get the earned income credit?

Can you get EIC with no income

You must have at least $1 of earned income (pensions and unemployment don't count). You must not have to file Form 2555, Foreign Earned Income; or Form 2555-EZ, Foreign Earned Income Exclusion. If you're claiming the EITC without any qualifying children, you must be at least 25 years old, but not older than 65.

Cached

Why am I not getting the full EIC

The most common reasons people don't qualify for the Earned Income Tax Credit, or EIC, are as follows: Their AGI, earned income, and/or investment income is too high. They have no earned income. They're using Married Filing Separately.

How does the earned income credit work

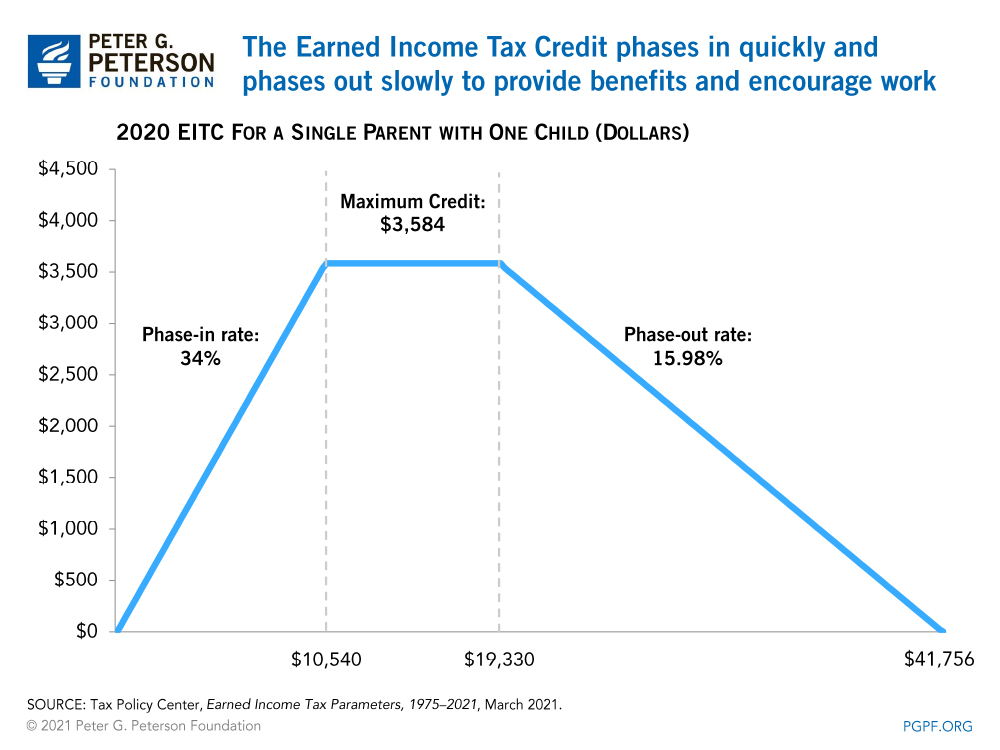

The Earned Income Tax Credit (EITC) is a federal tax credit for working people with low and moderate incomes. It boosts the incomes of workers paid low wages while offsetting federal payroll and income taxes.

Cached

Do I qualify for EITC if I was unemployed

Unemployment benefits are not earned income and can't be used to claim the EITC. But they are taxable income and may affect the amount of EITC a person may get.

Can I file taxes if I didn’t work but have a child

You can still file your taxes even if you have no income if you choose. Can you file taxes with no income but have a child or dependent If you have no income but have a child/dependent, you can still file your taxes.

Can you make too much for EIC

You must have earned income to qualify, but you can't have too much. Earned income includes all wages you earn from employment, as well as some disability payments. Both your earned income and your adjusted gross income (AGI) must be less than a certain threshold to qualify for the EITC.

Why am I getting EIC with no kids

If you don't have a qualifying child, you may be able to claim the EITC if you: Earn income below a certain threshold. Live in the United States for more than half the tax year. Meet the age requirements.

What is the difference between EITC and EIC

The Earned Income Credit (EIC), otherwise known as Earned Income Tax Credit (EITC) is a valuable credit for low-income taxpayers who work and earn an income of a certain amount. This credit is highly valuable and is often missed — allowing you to keep more of your hard-earned money.

Can you file taxes with no income but have a dependent

If you have no income but have a child/dependent, you can still file your taxes. This may allow you to get a refund if the tax credits you're eligible for are more than your income.

What disqualifies me from EITC

EITC income requirements

Retirement income, Social Security income, unemployment benefits, alimony, and child support don't count as earned income. More restrictions: You must have $11,000 or less in investment income and you can't file a foreign earned income exclusion form.

Do I get EIC if self employed

Your self-employment income, minus expenses, counts as earned income for the Earned Income Credit (EIC). You must claim all deductions allowed and resulting from your business. This determines your net self-employment income. You must claim all deductions — including depreciation.

What disqualifies you from earned income credit

For the EITC, we don't accept: Individual taxpayer identification numbers (ITIN) Adoption taxpayer identification numbers (ATIN) Social Security numbers on Social Security cards that have the words, "Not Valid for Employment," on them.

Can a stay at home mom claim child on taxes

A stay-at-home mom can claim her child as a dependent even if she has no income. To do so, both spouses must agree that they can claim the child before filing. In most cases, it would be more advantageous for the spouse with income to claim the child.

Can I claim EIC if I am single

If You Have No Qualifying Children

You may qualify for the EITC if you are 19 years old or older and not a student.

Does EIC increase refund

It is also refundable, so even if you do not have enough tax liability to eat up the credit, the EIC will increase your refund, which you'll get as a check from the IRS.

Can a single person with no children get EIC

The maximum amount of credit you can claim: No qualifying children: $529. 1 qualifying child: $3,526. 2 qualifying children: $5,828.

How do I know if I qualify for EIC

To qualify for the EITC, you must: Have worked and earned income under $59,187. Have investment income below $10,300 in the tax year 2023. Have a valid Social Security number by the due date of your 2023 return (including extensions)

Is it good to claim EIC

The Earned Income Tax Credit (EITC) helps low- to moderate-income workers and families get a tax break. If you qualify, you can use the credit to reduce the taxes you owe – and maybe increase your refund.

How do I get a big tax refund with no dependents

6 Ways to Get a Bigger Tax RefundTry itemizing your deductions.Double check your filing status.Make a retirement contribution.Claim tax credits.Contribute to your health savings account.Work with a tax professional.

Can you get EIC if you did not work

You can still qualify for the Earned Income Credit (EIC) as long as you have earned income and meet all the other EIC qualifications. Being unemployed, not working, and/or not meeting the filing threshold doesn't automatically disqualify you from the EIC.