How much do you need to open a credit card?

What is the minimum amount to get a credit card

Income of the Applicant: Your income plays an important role while applying for a credit card. This is a proof to the bank that you will be able to pay your credit card bill. You can also get a credit card against a fixed deposit. The minimum value generally ranges between INR 20,000 to INR 50,000.

How much does it cost to open a credit card account

Yes, getting a credit card is free in most cases. Most credit cards do not charge annual or monthly fees, or have upfront costs like a deposit or activation fee, and there is no fee for getting a credit card when you avoid those potential charges.

What do I need to qualify for a credit card

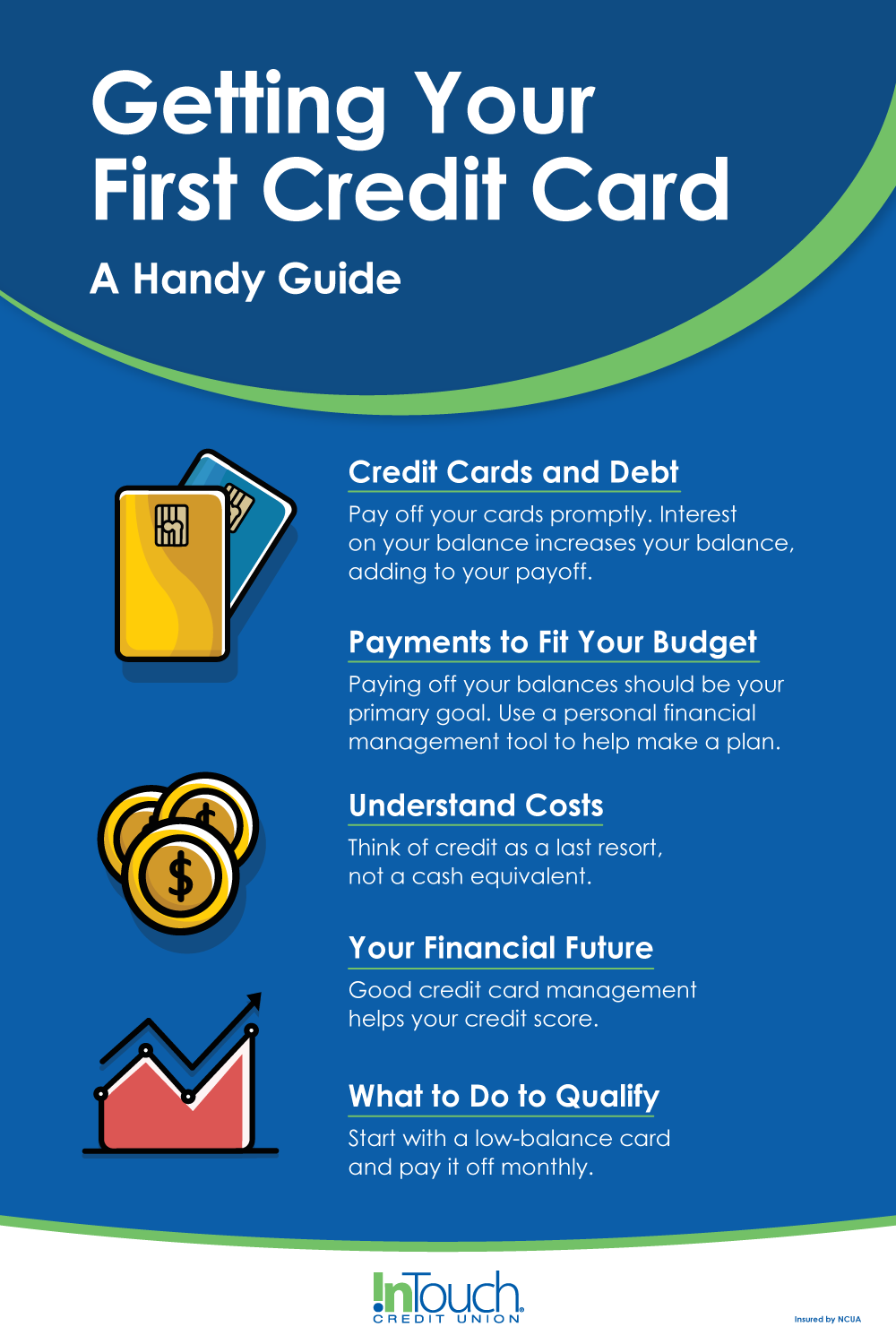

3. Understand the requirements needed to applyAge. You typically have to be at least 18 years old to open a credit card in your own name.Proof of identification. While some credit card issuers might require documentation to prove your income and that you have a U.S. address, others might not.Credit score.

Cached

Do you need a lot of money to get a credit card

No, you cannot get a credit card with no money because the law requires credit card issuers to verify that applicants have the ability to make monthly payments before approving them for an account. Still, you may be able to get a credit card without a paycheck from a job if you have reasonable access to other income.

What income is too low for a credit card

There's no specific annual income required to qualify for a credit card, especially because credit card companies look at many factors to help determine whether or not you qualify. However, one thing to consider is your debt-to-income ratio (DTI), which helps determine your risk as a borrower.

Is $1,000 on a credit card bad

A $1,000 credit limit is good if you have fair to good credit, as it is well above the lowest limits on the market but still far below the highest. The average credit card limit overall is around $13,000. You typically need good or excellent credit, a high income and little to no existing debt to get a limit that high.

Can you open just a credit card

While it will be much more convenient to pay your balance with a personal bank account, it is possible to have a credit card without a bank account.

How much is a credit card per month

Average Minimum Payment Due: $110.50. Average Individual Credit Card Debt: $5,525. Average Household Credit Card Debt: $8,006. Average Annual Percentage Rate: 14.54% (V)

Can I get a credit card with no income

For those without income or a credit history, using a cosigner can help get a credit card independently via a secured or student credit card option. Before choosing an option requiring help from someone else, ensure the person being asked is comfortable creating a financial relationship.

When can I get my first credit card

How old do you have to be to get a credit card You can be an authorized user as young as 13, but you have to be 18 to sign up for your first credit card on your own. When you're ready for this step, you'll need to be prepared to show some documentation.

Can I use a credit card with no money on it

A credit card lets you pay with a line of credit. You don't need the money in an account at the time you use the card—you'll pay it back later. A debit card, in contrast, is tied to an existing account with existing money. For example, most people have a debit card tied to their checking accounts.

Can you get a credit card with $0 income

If you're not currently working, you might be wondering whether you can get a credit card. The short answer is, while you may not have to be employed, you do need to show you can cover your bills. So you may want to be cautious if you currently have limited income.

Is credit card approval based on income

Credit card approval depends on your income, but it also hinges on your credit history and your debt-to-income ratio, which is your current debt payments as a percentage of your income.

Is $5000 in credit card debt a lot

It could lead to credit card debt

That's a situation you never want to be in, because credit cards have high interest rates. In fact, the average credit card interest rate recently surpassed 20%. That means a $5,000 balance could cost you over $1,000 per year in credit card interest.

What is 30% of $2000 credit limit

According to the Consumer Financial Protection Bureau, experts recommend keeping your credit utilization below 30% of your available credit. So if your only line of credit is a credit card with a $2,000 limit, that would mean keeping your balance below $600.

Can I open a credit card with no income

Being unemployed doesn't disqualify you from credit card approval. While issuers do ask for your income, you may offer alternative forms of income on your application.

Can you open a credit card without putting money down

Credit cards that don't require a deposit are referred to as unsecured. Secured credit cards require a deposit to open an account. Secured credit cards may be a good option for people who are working to build or rebuild their credit.

What is the minimum payment on a $1000 credit card

Method 1: Percent of the Balance + Finance Charge

1 So, for example, 1% of your balance plus the interest that has accrued. Let's say your balance is $1,000 and your annual percentage rate (APR) is 24%. Your minimum payment would be 1%—$10—plus your monthly finance charge—$20—for a total minimum payment of $30.

What’s the minimum payment on a $5000 credit card

The minimum payment on a $5,000 credit card balance is at least $50, plus any fees, interest, and past-due amounts, if applicable. If you were late making a payment for the previous billing period, the credit card company may also add a late fee on top of your standard minimum payment.

Which bank gives credit card without income proof

Banks that Offer Credit Cards without Proof of IncomeState Bank of India (SBI)Axis Bank.Andhra Bank.Bank of Baroda (BoB)Syndicate Bank.Central Bank of India.Kotak Mahindra Bank.