How much does Green Dot card cost?

Are Green Dot cards free

Green Dot Card Cons: There is a steep $7.95 monthly fee (waived with deposits of at least $1,000 a month). No free ATM network. There is a $3 ATM fee, in addition to any fees the ATM owner charges.

Cached

How much do I need to open a Green Dot account

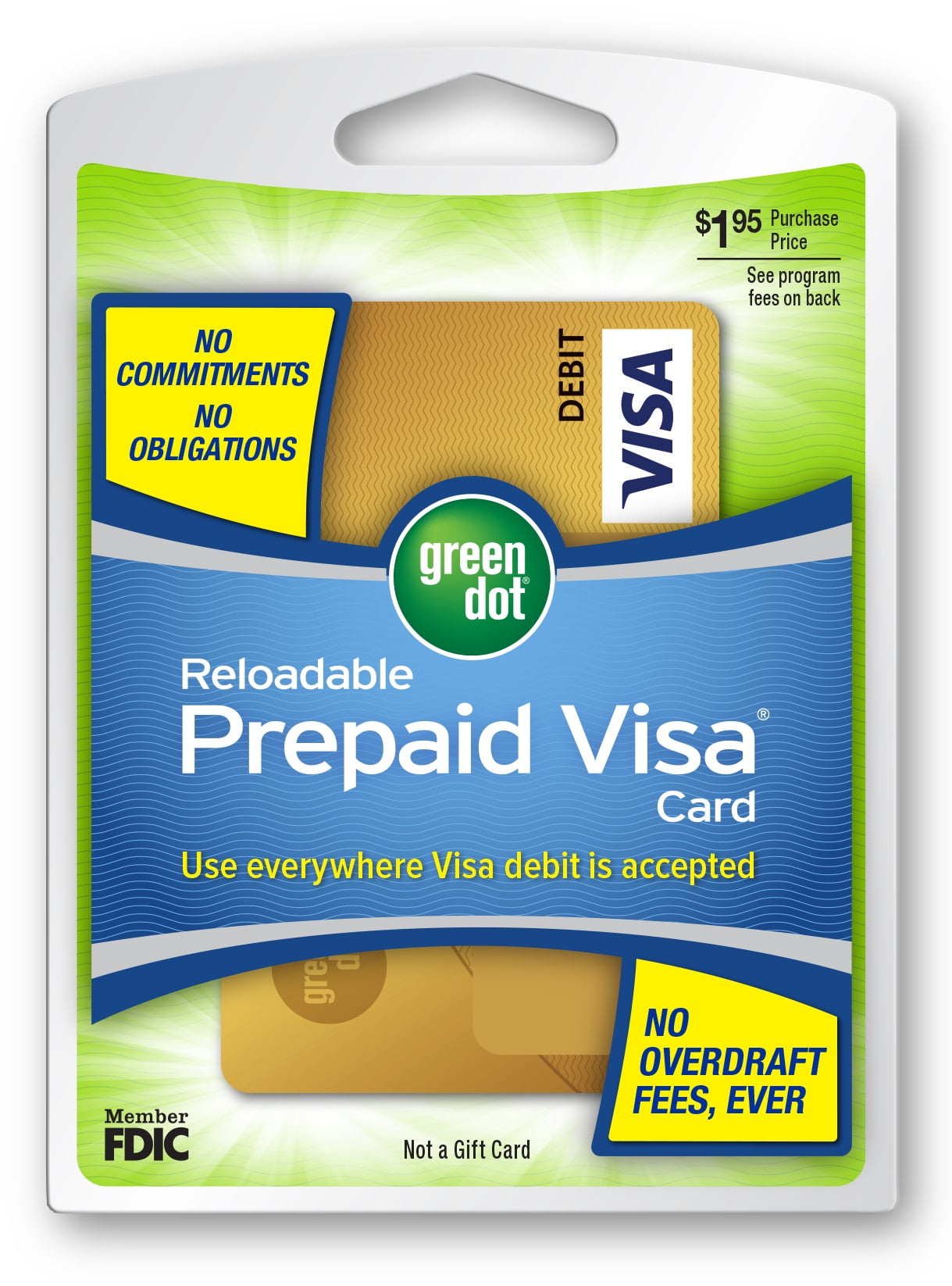

You can open an account online by purchasing a debit card for $1.95 at a retail store or ordering one online. Activate it as instructed on the card and download the Green Dot Bank mobile app.

Cached

Are Green Dot cards worth it

If you want to build up your cash rewards points, travel on miles earned, or pay down a credit card debt, there are better cards to fit those needs. However, if you are looking for a basic credit card that won't give you any complications, the Green Dot Prepaid Visa® card is a good choice.

Cached

How long does it take to get a Green Dot card

You will receive your chip-enabled personalized card 7-10 business days after activation. Upon activation of your personalized card, the money on your temporary card will automatically be transferred to the personalized card and you will no longer be able to use the temporary card.

Is there a monthly fee with DOT card

Rates and fees

$1.95 card purchase. $7.95 monthly usage fee (you can avoid this fee if you load at least $1,000 monthly). $5.95 cash reload fee. $3.00 fee per ATM withdrawal.

How do I put money on my Green Dot card

Simply log in to your account using the app and tap Deposit, Bank Transfer. Or log in to GreenDot.com and select Add Funds, Bank Transfer. No need for a trip to the bank. Manage your transfers all on our site.

Does Green Dot have a monthly fee

Green Dot Visa Debit Card: After the first monthly fee, the $7.95 monthly fee is waived whenever you direct deposit $500 or more in the previous monthly period. Other card fees apply. First monthly fee occurs upon the first use or the day after card activation or 90 days after card purchase, whichever is earlier.

How much money can I get off Green Dot card

For Registered Cards and Personalized Cards, you may only withdraw up to $500 from an ATM in a single day and $1,500 per teller transaction at a participating bank, unless otherwise indicated. You may withdraw up to $300 in cash per transaction at an ATM.

Does dot card have a monthly fee

Rates and fees

$1.95 card purchase. $7.95 monthly usage fee (you can avoid this fee if you load at least $1,000 monthly). $5.95 cash reload fee.

Can you use a Green Dot card immediately

Upon successful registration of your temporary card, you can make purchases in-store, online or everywhere Visa® debit is accepted in the U.S. Physical card transactions are restricted to U.S. and Puerto Rico.

How do I avoid Green Dot monthly fee

Green Dot Visa Debit Card: After the first monthly fee, the $7.95 monthly fee is waived whenever you direct deposit $500 or more in the previous monthly period. Other card fees apply.

How do I get rid of Green Dot monthly fee

Monthly fee is waived when you load $1,000 or more to your Card in the previous monthly period or have 30 posted transactions (excluding ATM decline withdrawals, ATM balance inquiries, teller cash withdrawals, and online bill payments at www.greendot.com) in the previously monthly period.

Can I put money on a Green Dot card with a debit card

The only way you can load a Green Dot card with a debit card is by using the debit card to purchase a MoneyPak. After that, you can load the money over the phone by calling the number on the back of your Green Dot card, choosing the "reload with MoneyPak" option and punching in the PIN listed on the MoneyPak card.

How much does it cost to put money on a prepaid card

Most prepaid cards charge monthly maintenance fees around $10, which is similar to checking account fees that can cost up to $15 a month. But you may also pay a fee to open your prepaid card, typically around $5. You can also expect to incur an ATM fee, reload fee and foreign transaction fee with many prepaid cards.

How do I avoid Green Dot monthly fees

Monthly fee $0 $7.95 Monthly fee is waived when you load $1,000 or more to your Card via direct deposit in the previous monthly period. A person-to-person transfer is not considered a load for the purpose of waiving the monthly fee. Your first monthly fee will be assessed when your Card is initially loaded with funds.

What ATM can I use my Green Dot card for free

What ATMs can I use with Green Dot Green Dot allows you to make fee-free withdrawals at in-network ATMs across the country, such as those found at participating CVS, Walgreens, and Rite Aid stores. You can use out-of-network ATMs, but withdrawals will incur a $3 fee per transaction.

Can I withdraw from Green Dot at Walmart

1. Visit any Walmart store and go to the MoneyCenter or Customer Service center. 2. Tell the associate you want to pick up cash, show your government-issued photo ID, and the barcode generated with the Green Dot app.

Does Green Dot charge monthly fee

Green Dot Visa Debit Card: After the first monthly fee, the $7.95 monthly fee is waived whenever you direct deposit $500 or more in the previous monthly period. Other card fees apply. First monthly fee occurs upon the first use or the day after card activation or 90 days after card purchase, whichever is earlier.

How does a Green Dot card work

How do Green Dot prepaid cards work As noted above, Green Dot cards function similarly to debit cards without requiring an existing bank account. In other words, a prepaid Green Dot card allows you to pay bills, buy stuff online, withdraw money from ATMs and cash checks, among other things.

What is the best prepaid card with no fees

Best Prepaid Debit Cards of 2023Best Overall, Best for No Monthly Fee: Bluebird by American Express.Best for Cash Reloads: American Express Serve FREE Reloads.Best for Walmart Shoppers: Walmart MoneyCard.Best for Rewards: American Express Serve Cash Back.Best for Tweens/Teens: FamZoo Prepaid Debit Card.