How much does it cost to add a tradeline to your credit?

How much will a tradeline increase my score

Usually buying one trade line will increase your score 40-45 points. If you need a bigger increase you can just purchase more accounts. There are companies that offer up to 5 accounts that you can purchase which will give you an approximate increase of 200-225 points in your fico score.

Cached

Do you have to pay for tradelines

An installment tradeline is a fixed loan that you have to pay back. It's essentially when an installment loan of yours, like a student loan, auto loan, mortgage or other personal loan, is included on your credit report.

Cached

How to get tradelines for free

As mentioned, the only way you can add free primary tradelines to your credit report and boost your credit is to open new credit accounts with varying lenders. Keep in mind you then have to ensure you are paying off any money spent through credit every month, so you don't build up debt.

How much are trade lines

Buying a tradeline isn't cheap, with consumers paying as much as $1,000 for the privilege. While that may seem steep, a borrower who secures a low interest rate on a loan may save thousands or even tens of thousands in interest over the lifetime of the loan.

Can my credit score go up 200 points in a month

There are several actions you may take that can provide you a quick boost to your credit score in a short length of time, even though there are no short cuts to developing a strong credit history and score. In fact, some individuals' credit scores may increase by as much as 200 points in just 30 days.

How fast do tradelines work

Trade lines may show up on your credit report as soon as 15 days after the time of purchase. Alternatively, a trade line may be delayed on showing on your report up to 45 days depending on the timing of the purchase.

Is it worth getting tradelines for credit

Experian warns that buying tradelines could put you in danger of committing bank fraud. If you pay money to piggyback on a stranger's credit card and then misrepresent your true creditworthiness to a lender when you borrow money, it could be a problem — especially if you later default on the loan.

What is the minimum tradeline requirements

Most lenders require a minimum of 3 credit tradelines requirements. There are lenders that will require 4 seasoned credit tradelines. Others have higher credit tradeline requirements. Some lenders may require a 12-month seasoning on credit tradelines while others may require 24 months.

How long does buying a tradeline last

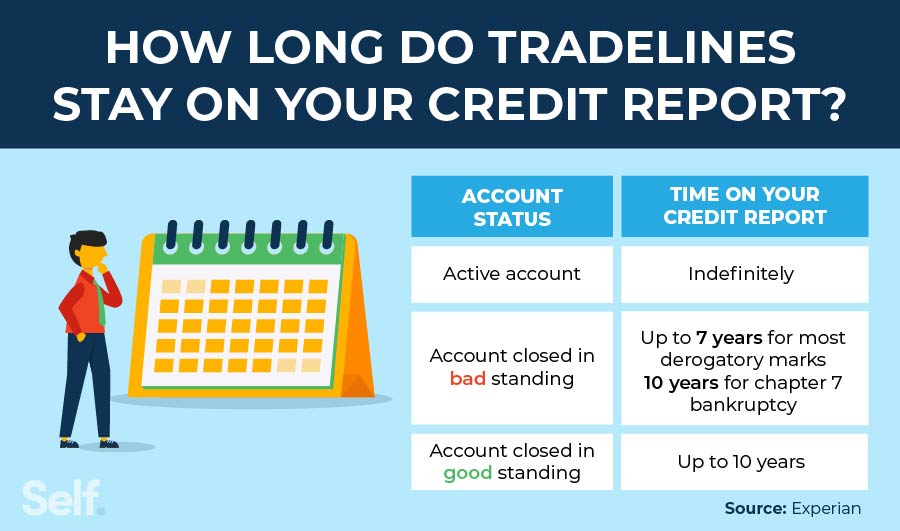

When you close an account in good standing, each reporting agency will decide how long to maintain the tradeline, though it's typically 10 years. In contrast, tradelines for closed accounts with a negative history are generally removed from your report after seven years.

How long does tradeline last

Each credit reporting agency may have varying terms on how long a trade line is maintained. In general, a trade line is often maintained on your account 10 years after the trade line has been closed. Trade lines with a negative history are generally closed between seven to 10 years.

How to get 800 credit score in 45 days

Here are 10 ways to increase your credit score by 100 points – most often this can be done within 45 days.Check your credit report.Pay your bills on time.Pay off any collections.Get caught up on past-due bills.Keep balances low on your credit cards.Pay off debt rather than continually transferring it.

How to get a 700 credit score in 30 days

Best Credit Cards for Bad Credit.Check Your Credit Reports and Credit Scores. The first step is to know what is being reported about you.Correct Mistakes in Your Credit Reports. Once you have your credit reports, read them carefully.Avoid Late Payments.Pay Down Debt.Add Positive Credit History.Keep Great Credit Habits.

What is the downside of tradelines

Buying tradelines will do nothing to help you build good credit habits because you will not be able to use the card for purchases. In addition, you put yourself in danger of identity theft anytime you give your personal information to strangers.

How long does it take to go from 550 to 750 credit score

How Long Does It Take to Fix Credit The good news is that when your score is low, each positive change you make is likely to have a significant impact. For instance, going from a poor credit score of around 500 to a fair credit score (in the 580-669 range) takes around 12 to 18 months of responsible credit use.

How to raise credit score 100 points in 30 days

Quick checklist: how to raise your credit score in 30 daysMake sure your credit report is accurate.Sign up for Credit Karma.Pay bills on time.Use credit cards responsibly.Pay down a credit card or loan.Increase your credit limit on current cards.Make payments two times a month.Consolidate your debt.

How to get a 900 credit score in 45 days

Here are 10 ways to increase your credit score by 100 points – most often this can be done within 45 days.Check your credit report.Pay your bills on time.Pay off any collections.Get caught up on past-due bills.Keep balances low on your credit cards.Pay off debt rather than continually transferring it.

How long does it take to go from a 500 credit score to a 700

around 12 to 18 months

Average Recovery Time

For instance, going from a poor credit score of around 500 to a fair credit score (in the 580-669 range) takes around 12 to 18 months of responsible credit use. Once you've made it to the good credit zone (670-739), don't expect your credit to continue rising as steadily.

How long do you stay on a tradeline

Tradelines Stay on Your Report for Years

As long as any account is open and active, the tradeline will stay on your credit report. A mortgage, for example, might be a tradeline on your report for as long as 30 years. A credit card may show as a tradeline for even longer if you keep it open in good standing.

How to get a 750 credit score in 6 months

How to Increase Your Credit Score in 6 MonthsPay on time (35% of your score) The most critical part of a good credit score is your payment history.Reduce your debt (30% of your score)Keep cards open over time (15% of your score)Avoid credit applications (10% of your score)Keep a smart mix of credit types open (10%)

How to go from 500 to 700 credit score in a year

Pay all your dues on time and in full if you wish to increase your credit score from 500 to 700. Missing a repayment or failing to repay the debt will significantly impact your credit score.