How much does it cost to cancel TransUnion monthly?

How do I cancel my TransUnion monthly fee

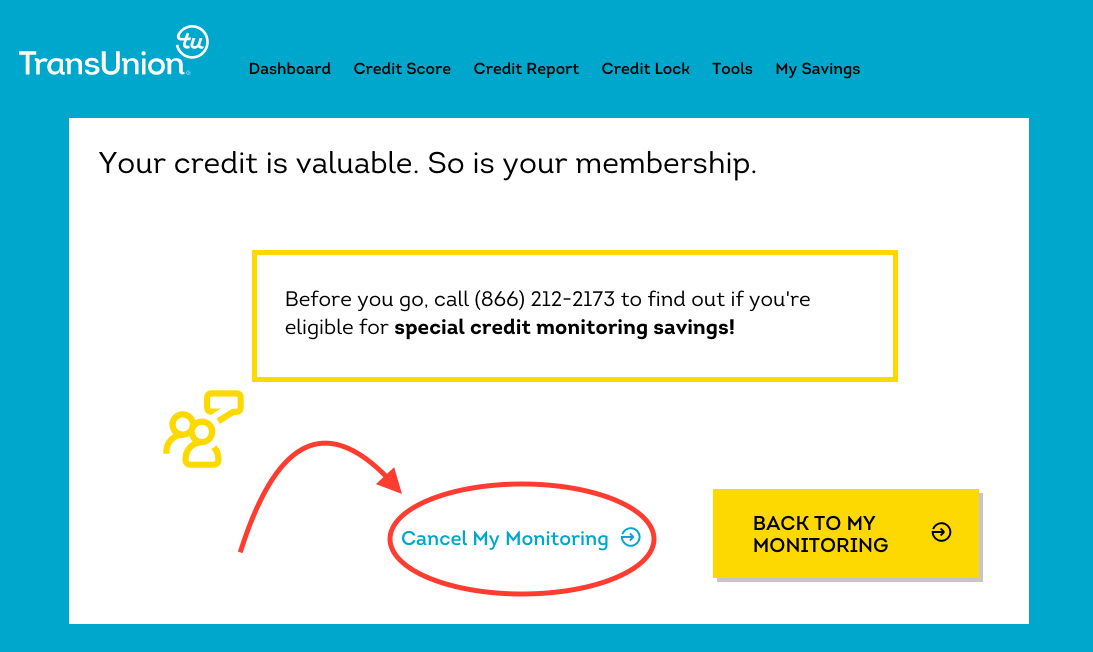

Cancellation. To cancel your Products or subscriptions, please go to Contact Us or call toll-free at (855) 681-3196 and contact our Customer Service Team.

CachedSimilar

Does TransUnion charge a monthly fee

The credit scores provided are based on the VantageScore® 3.0 model. Lenders use a variety of credit scores and are likely to use a credit score different from VantageScore® 3.0 to assess your creditworthiness. Subscription price is $29.95 per month (plus tax where applicable). Cancel anytime.

How do I cancel my TransUnion plan

You may also terminate your membership by talking to a Customer Service Team Member at (833) 598-0673. Customer Service is available: 8AM – 6PM Eastern Time Monday-Friday.

Cached

Do you have to pay for a TransUnion account

Sign in to the TransUnion Service Center. If you don't have an account, you can create one for free.

Can I opt out of TransUnion

How can I stop TransUnion from selling my personal information If you want to opt out of having TransUnion sell the information that's found in your data privacy disclosure, you can start an opt-out request online or by calling us at 833-395-6938.

What is a charge off TransUnion

The statement, "payment after charge off/collection," means that the account was either charged off as a loss by the company with whom you had credit, or that the account was sent to a collection agency for payment.

Does TransUnion drop your credit score

Question: Will checking my credit report hurt my credit score Answer: Checking your own credit report won't hurt your score because it's considered a soft inquiry.

Which is better FICO or TransUnion

In short, FICO is more transparent than the three credit bureaus and, most times, the least costly for all parties involved. However, reports from the three credit bureaus are vital to monitor your progress on your journey to that ideal credit score so that you can get the best loan rates and credit cards.

What happens when you opt out of credit bureaus

Opting out simply removes your name from those mailing lists. It doesn't cause your credit history to disappear. Your existing credit accounts will continue to be reported and updated, and any new accounts you open likely will be added to your credit history.

What is TransUnion charges

Costs, services, etc.

You can sign up for credit monitoring services with TransUnion for $24.95 per month. Through this service, you'll receive access to your credit report and credit score at any time.

Should I go off of TransUnion or Equifax

Scores from Equifax and TransUnion are equally accurate as they both use their own scoring systems. Both credit agencies provide accurate scores, and whichever your lender opts for will provide suitable information.

Is it illegal to pay for delete

"As to the debt collector, you can ask them to pay for delete," says McClelland. "This is completely legal under the FCRA. If going this route, you will need to get that in writing, so you can enforce it after the fact."

Can you remove a charge-off without paying

Having an account charged off does not relieve you of the obligation to repay the debt associated with it. You may be able to remove the charge-off by disputing it or negotiating a settlement with your creditor or a debt collector. Your credit score can also steadily be rebuilt by paying other bills on time.

Which credit score is better FICO or TransUnion

In short, FICO is more transparent than the three credit bureaus and, most times, the least costly for all parties involved. However, reports from the three credit bureaus are vital to monitor your progress on your journey to that ideal credit score so that you can get the best loan rates and credit cards.

Which credit score matters more TransUnion or Equifax

No credit score from any one of the credit bureaus is more valuable or more accurate than another. It's possible that a lender may gravitate toward one score over another, but that doesn't necessarily mean that score is better.

Is a TransUnion credit score of 650 good

A very poor credit score is in the range of 300 – 600, with 601 – 660 considered to be poor. A score of 661 – 720 is fair. And an excellent score is in the range of 781 – 850.

Do lenders use FICO or TransUnion

When you are applying for a mortgage to buy a home, lenders will typically look at all of your credit history reports from the three major credit bureaus – Experian, Equifax, and TransUnion. In most cases, mortgage lenders will look at your FICO score. There are different FICO scoring models.

Does cancelling credit affect credit score

Closing a credit card could lower the amount of overall credit you have versus the amount of credit you're using (your debt to credit utilization ratio), which could impact your credit scores.

Why is TransUnion so much lower

Equifax and TransUnion have different scores because slightly different information is reported to each credit reporting agency. In addition, TransUnion reports your employment history and personal information. Equifax's different credit scoring model results in lower scores.

Which score is higher Equifax or TransUnion

Neither score is more or less accurate than the other; they're only being calculated from slightly differing sources. Your Equifax credit score is more likely to appear lower than your TransUnion one because of the reporting differences, but a “fair” score from TransUnion is typically “fair” across the board.