How much does rapid rescoring cost?

Can a borrower be charged for a rapid rescore

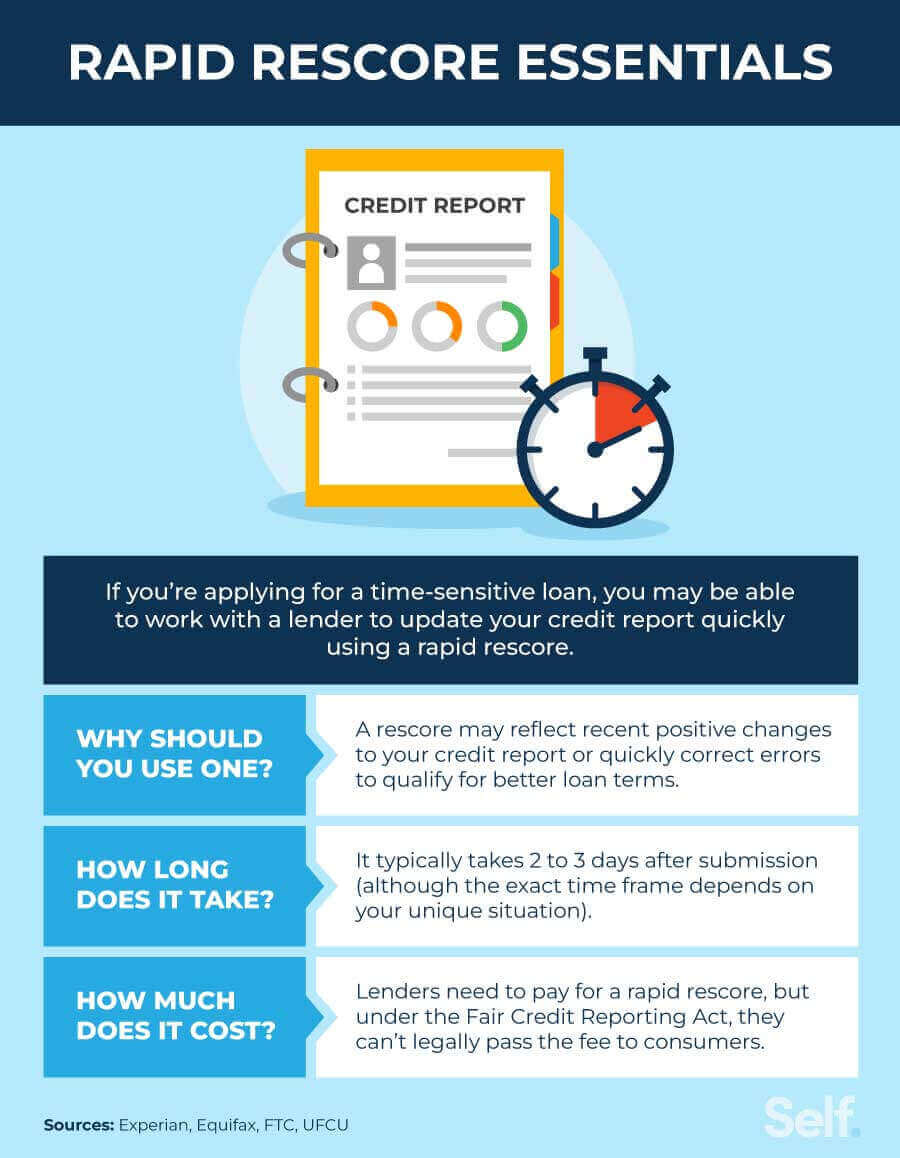

It is mentioned in the FCRA ACT that this fee cannot be charged from the borrowers by the Mortgage lenders and brokers. However rapid rescore is not available with all lenders or brokers.

What documents are needed for a rapid Rescore

Acceptable Documentation required:

For the bureau to accept CIC requests, all documents MUST be typed on letterhead, from the creditor reporting the account, Collection agency receipts with account number and current balance/status, and letter of discharge and all schedules for bankruptcies.

Cached

Does a rapid Rescore always work

While the intent of the process is to improve your credit score, there's no guarantee it will go up. For example, a mortgage lender may run a rapid rescore and find a new delinquent payment or another issue that results in a lower credit score.

Cached

Can a car dealership request a rapid rescore

Typically, rapid rescoring is reserved for mortgage loan approvals, but is possible for auto loans as well.

Who pays for a rapid rescore

mortgage lender

How Rapid Rescore Works. With a rapid rescore, a mortgage lender pays a fee to the credit reporting company (Experian, TransUnion or Equifax) to have recent account changes updated to a loan applicant's credit report in an expedited time frame.

How much can a lender charge for a credit report

Credit reports: Your lender will probably pull your credit reports a few times during the loan application process to make sure your financial situation hasn't changed. Expect to pay $10 to $100 per credit report for each person who has applied for the loan.

What is the minimum credit score for rapid finance

While other Rapid Finance reviews suggest minimum credit score requirements of 550, we recommend maintaining a good personal credit score (at least 670) to receive more favorable terms, such as low interest rates.

How to bring up a 550 credit score

Here are 10 ways to increase your credit score by 100 points – most often this can be done within 45 days.Check your credit report.Pay your bills on time.Pay off any collections.Get caught up on past-due bills.Keep balances low on your credit cards.Pay off debt rather than continually transferring it.

How do I get my creditor to update my credit report

Instead, get in touch with your creditors and ask them to update your records with your new address, name or employer. When your creditors send their monthly updates to the credit bureaus, they'll include your new information and your credit reports will be updated.

What credit score is more accurate

Simply put, there is no “more accurate” score when it comes down to receiving your score from the major credit bureaus. In this article, you will learn: Different types of credit scores.

Can a dealership remove a hard inquiry

If you did apply for a credit account or authorize a hard inquiry, you can't remove it from your reports.

How much does a copy of your credit score cost

Once you've received your annual free credit report, you can still request additional reports. By law, a credit reporting company can charge no more than $14.50 for a credit report. You may be able to view free credit reports more frequently online.

Can I pay to have my credit score cleared

While it may seem like a good idea to pay someone to fix your credit reports, there is nothing a credit repair company can do for you that you can't do yourself for free.

How much should a credit report fee be

Credit report fees may range from $30 to $50 per report, though some lenders cover the cost themselves.

Do you have to pay a fee for a credit report

You are entitled to get a free credit report annually from each of the nationwide credit reporting companies. It's a good idea to review your credit reports for free every 12 months. Most or all of the information that goes into a credit score comes from your credit report.

Can you get approved with a 480 credit score

With an 480 credit score, you're unlikely to get approved for a traditional credit card. Credit cards are unsecured forms of debt, so banks tend to be a bit more cautious compared to loans backed by specific assets, like mortgages and auto loans.

Can you finance with a 550 credit score

Though it may be more challenging to find a lender that's willing to work with you, it is indeed possible to obtain a loan with a credit score of 550. Most lenders require a minimum credit score of between 600 and 650, but some lenders specialize in personal loans for those with lower scores.

How long does it take to build credit from 500 to 700

6-18 months

The credit-building journey is different for each person, but prudent money management can get you from a 500 credit score to 700 within 6-18 months. It can take multiple years to go from a 500 credit score to an excellent score, but most loans become available before you reach a 700 credit score.

How long does it take to go from 550 to 650 credit score

The good news is that when your score is low, each positive change you make is likely to have a significant impact. For instance, going from a poor credit score of around 500 to a fair credit score (in the 580-669 range) takes around 12 to 18 months of responsible credit use.

How fast can I add 100 points to my credit score

For most people, increasing a credit score by 100 points in a month isn't going to happen. But if you pay your bills on time, eliminate your consumer debt, don't run large balances on your cards and maintain a mix of both consumer and secured borrowing, an increase in your credit could happen within months.