How much does Square charge for credit card transactions?

How much are Square prices per transaction

Square's Payment Processing Fees1.75% for each contactless, chip and PIN or swiped card-present transaction.2.5% for payments manually keyed-in to the Point of Sale app, recurring payments facilitated via Online Checkout links, Square Invoices and Virtual Terminal.

Does Square fees include credit card fees

Credit card fees are included in Square's fees, so there are no charges from credit card companies. Every card brand accepted has the same rate. Payment processing fees are taken out of the total amount of each transaction, including tax and tip.

CachedSimilar

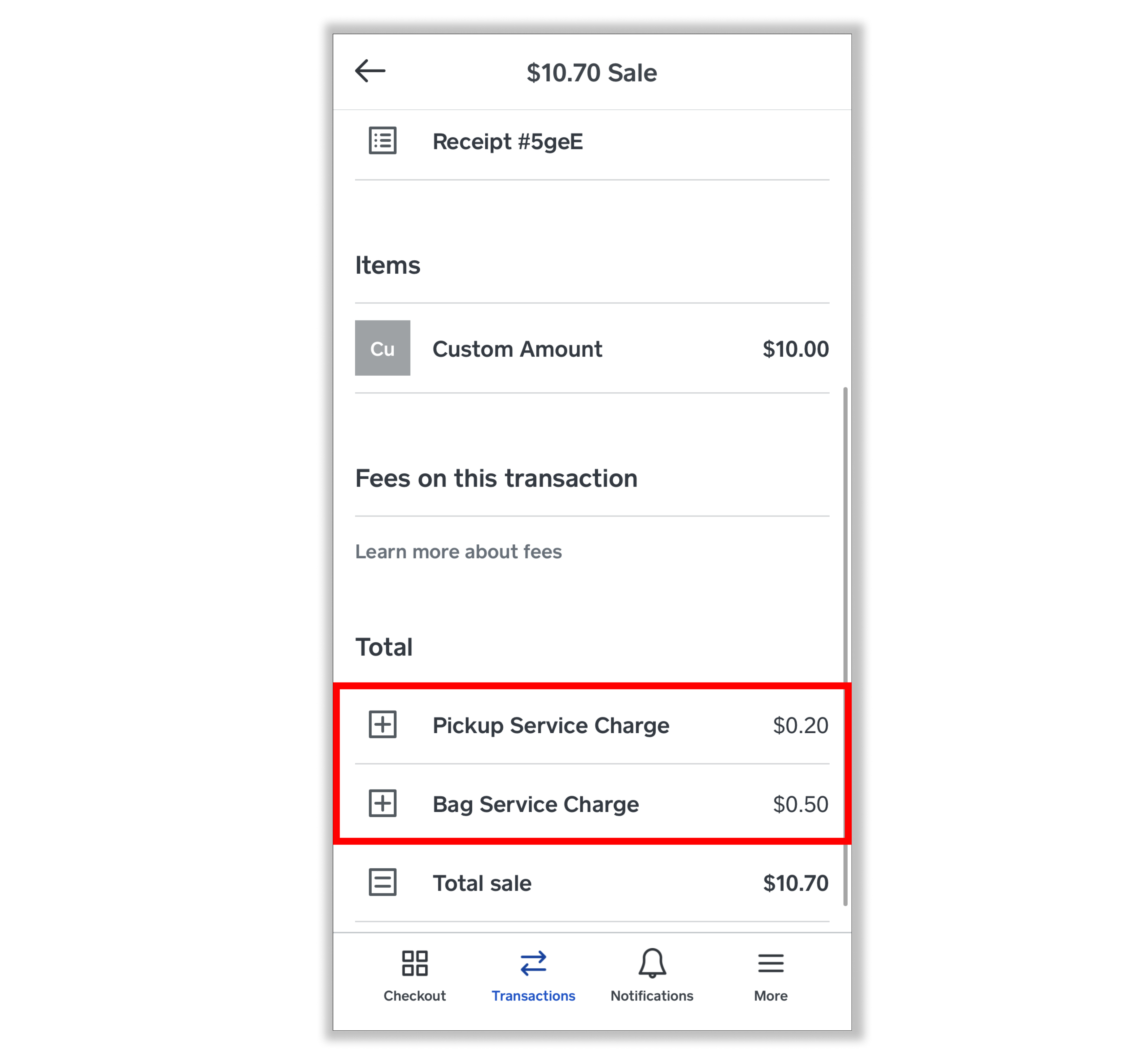

How do I charge customers for credit card fees in Square

Go to Account & Settings on your online Square Dashboard. Click Business information > Service charges > Create service charge. Name your charge, choose a percentage-based or fixed-price service charge, then enter the amount of the charge. Select the location where the charge applies and add any applicable taxes.

How much is a credit card transaction fee

between 1.5% and 3.5%

The average credit card processing fee ranges between 1.5% and 3.5%. Just where do all these fees come from, and what can a merchant do to minimize them

Does Square have a monthly fee

Free. Sell in person, online, over the phone, or out in the field. No setup fees or monthly fees — only pay when you take a payment.

Does Square take a percentage of tips

Square will charge merchants a 3.5 percent fee, plus 15 cents, on the total amount — including taxes and tips — for transactions that don't require a credit card and cardholder to be present when a payment is made.

Who gets the credit card processing fees

Credit card processing fees are paid by the vendor, not by the consumer. Businesses can pay credit card processing fees to the buyer's credit card issuer, to their credit card network and to the payment processor company. On average, credit card processing fees can range between 1.5% and 3.5%.

Why does Square charge so much

Square does not charge a monthly or annual fee. Instead, the company makes money through a percentage of every credit card transaction it processes. Square charges 2.6% plus 10 cents for most in-person transactions. However, if the card must be entered manually, it charges 3.5% plus 15 cents per transaction.

Should I charge my customer a credit card fee

There is no prohibition for credit card surcharges and no statute on discounts for different payment methods. Sellers may impose a credit card surcharge of no more than 5 percent of the purchase price. Surcharges must be clearly posted and communicated before payment.

Can I charge my clients a credit card fee

If you're wondering if it is legal to charge credit card fees, the short answer is yes. The practice of surcharging was outlawed for several decades until 2013 when a class action lawsuit permitted merchants in several U.S. states to implement surcharges in their businesses.

Can I charge my customer a credit card processing fee

If you're wondering if it is legal to charge credit card fees, the short answer is yes. The practice of surcharging was outlawed for several decades until 2013 when a class action lawsuit permitted merchants in several U.S. states to implement surcharges in their businesses.

Who pays the credit card processing fee

Credit card processing fees are paid by the vendor, not by the consumer. Businesses can pay credit card processing fees to the buyer's credit card issuer, to their credit card network and to the payment processor company. On average, credit card processing fees can range between 1.5% and 3.5%.

Is Square worth it for small business

Square is a standout point-of-sale system and often a good option for small businesses. Its wide range of features and hardware can be tailored to fit a variety of business types. The pricing is transparent, and the free plan is one of the most powerful no-cost POS systems we've seen.

What is the average tip on Square

The average tip on the Square platform in January 2023 was 20%, up from 16% before the pandemic. The company also reported that the average tip rose to 17% in 2023 and 2023.

What is smart tipping on Square

Square makes it easy to allow your customers to sign for their payments. And add gratuity on digital or printed receipts to collect tips from your customers go to the menu tap Settings then tap

Can you pass credit card processing fees to customers

If you're wondering if it is legal to charge credit card fees, the short answer is yes. The practice of surcharging was outlawed for several decades until 2013 when a class action lawsuit permitted merchants in several U.S. states to implement surcharges in their businesses.

What percentage does square take

What are your fees The Square standard processing fee is 2.6% + 10¢ for contactless payments, swiped or inserted chip cards, and swiped magstripe cards. Payments that are manually keyed-in, processed using Card on File, or manually entered using Virtual Terminal have a 3.5% + 15¢ fee.

Are there any hidden fees with Square

There are no monthly or hidden fees for credit card processing. All fees are deducted before funds are transferred to your linked bank account. Note: Processing fees are deducted before each transfer and cannot be charged on a monthly basis.

Does Square charge a fee to customers

When you send an invoice to a customer and take a payment the fee is 3.3% + 30 cents for cards or 1% with a minimum $1 per transaction for ACH bank transfers.

Can I pass on credit card fees to customers

With surcharging, merchants are able to automatically pass credit card fees to their customers when a credit card is used at checkout. Credit card surcharging allows businesses to pass on the financial burden of credit card processing fees by attaching an extra fee to each customer's credit card transaction.