How much does Square charge to run a card?

How much does it cost to run a Square reader

When a customer taps or inserts their card in person, you pay 1.9% per transaction with the Square Reader. Sellers using Square Terminal or Square Register pay 1.6% per transaction. There is a lower risk of fraudulent activity when the cardholder is present.

How do I avoid Square fees

Afterpay Fees

Square sellers using Afterpay get paid the full amount at the time of purchase, minus a processing fee on the total order. Enabling Afterpay with Square is free — there are no monthly fees or startup costs.

CachedSimilar

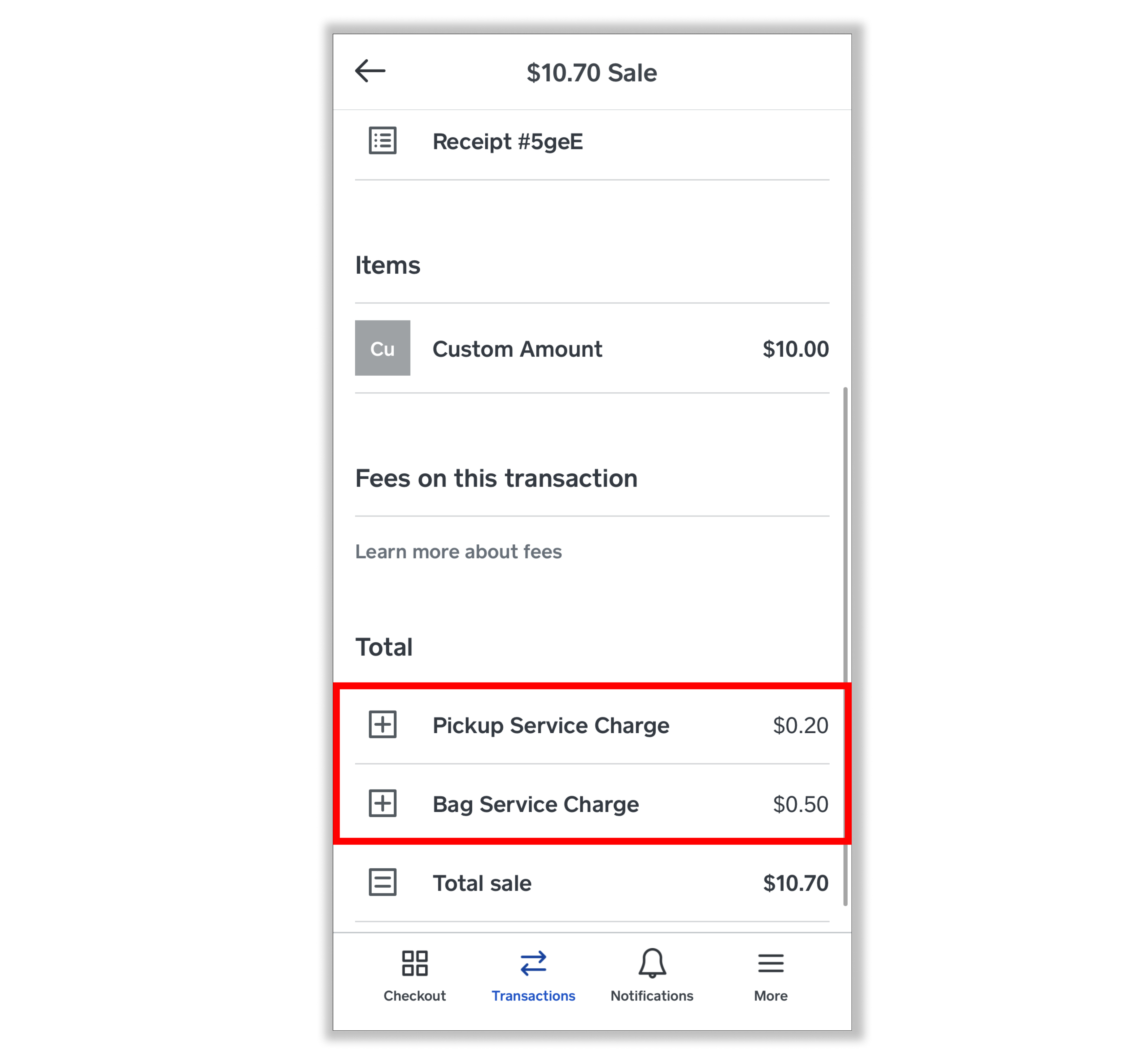

How do I charge a Square fee to a customer

Go to Account & Settings on your online Square Dashboard. Click Business information > Service charges > Create service charge. Name your charge, choose a percentage-based or fixed-price service charge, then enter the amount of the charge. Select the location where the charge applies and add any applicable taxes.

Does Square have a monthly fee

Free. Sell in person, online, over the phone, or out in the field. No setup fees or monthly fees — only pay when you take a payment.

What is the cheapest way to use Square

If you're looking for the cheapest Square fees possible, you can use the Square mobile POS app on your smart device and process payments through the free magstripe card reader you receive with your account. In this case, you'll only pay the 2.6% + $0.10 processing fee per transaction.

Is Square Reader charging

To charge it up plug the cable into your reader. And a computer USB wall charger car charger or USB battery pack it should take two to three hours to get a full charge.

What percentage does Square take

What are your fees The Square standard processing fee is 2.6% + 10¢ for contactless payments, swiped or inserted chip cards, and swiped magstripe cards. Payments that are manually keyed-in, processed using Card on File, or manually entered using Virtual Terminal have a 3.5% + 15¢ fee.

How do I legally charge a credit card fee

There is no prohibition for credit card surcharges and no statute on discounts for different payment methods. Sellers may impose a credit card surcharge of no more than 5 percent of the purchase price. Surcharges must be clearly posted and communicated before payment.

Can I pass on credit card fees to customers

With surcharging, merchants are able to automatically pass credit card fees to their customers when a credit card is used at checkout. Credit card surcharging allows businesses to pass on the financial burden of credit card processing fees by attaching an extra fee to each customer's credit card transaction.

Is Square completely free

Is it really free Yes. With our free plan, you can use the online store builder to create, design, and launch your site—all for free. Your only cost comes when you make a sale—just 2.9% + 30¢ per transaction.

Is Square worth it for small business

Square is a standout point-of-sale system and often a good option for small businesses. Its wide range of features and hardware can be tailored to fit a variety of business types. The pricing is transparent, and the free plan is one of the most powerful no-cost POS systems we've seen.

Does Square charge too much

Square does not charge a monthly or annual fee. Instead, the company makes money through a percentage of every credit card transaction it processes. Square charges 2.6% plus 10 cents for most in-person transactions. However, if the card must be entered manually, it charges 3.5% plus 15 cents per transaction.

What are the cons of Square cash

The app is easy to use, and you can find the money in your account within a few seconds. However, the app doesn't offer any protection when you send money. You can't track the status of a transaction. There are no protections if somebody gets your account details.

What is the most you can charge on Square

Large Transactions

All Square merchants have a per transaction limit of $50,000. If you'd like to accept individual transactions above $50,000 each, you'll need to split the payment into multiple installments. Make sure to record the receipt number and the total amount charged for each installment.

Does Square invoicing charge a fee

When you process a payment in person, Square charges a fee of 1.6% per tap or insert on Square Terminal and Square Register and 1.9% per tap or insert on Square Reader or Square Stand.

Why does Square charge so much

Square does not charge a monthly or annual fee. Instead, the company makes money through a percentage of every credit card transaction it processes. Square charges 2.6% plus 10 cents for most in-person transactions. However, if the card must be entered manually, it charges 3.5% plus 15 cents per transaction.

Can I use Square without a business

If you're not a business, you can state that you're using Square as an individual or you can select a specific business type to best reflect the goods or services you provide. Licensed healthcare providers and pharmacies can accept HSA and FSA cards with Square if the business type is set to Medical.

Can you legally charge a customer a credit card fee

If you're wondering if it is legal to charge credit card fees, the short answer is yes. The practice of surcharging was outlawed for several decades until 2013 when a class action lawsuit permitted merchants in several U.S. states to implement surcharges in their businesses.

Can you charge a customer a credit card fee

There is no prohibition for credit card surcharges and no statute on discounts for different payment methods. Sellers may impose a credit card surcharge of no more than 5 percent of the purchase price. Surcharges must be clearly posted and communicated before payment.

How much does it cost a merchant to accept a credit card

Credit card processing fees will typically cost a business 1.5% to 3.5% of each transaction's total. For a sale of $100, that means you could pay $1.50 to $3.50 in credit card fees.