How much does the FDIC insure for credit unions?

Do both FDIC and NCUA insure accounts for up to $250000

Currently, both the FDIC and the NCUA insure deposits of up to $250,000. But that doesn't mean you can't protect more than that with government insurance. The amount of coverage you receive ultimately depends on the types of accounts you have and whether you have a joint account holder.

Cached

Does FDIC cover $500000 on a joint account

Each co-owner of a joint account is insured up to $250,000 for the combined amount of his or her interests in all joint accounts at the same IDI.

Does FDIC insurance apply to credit unions

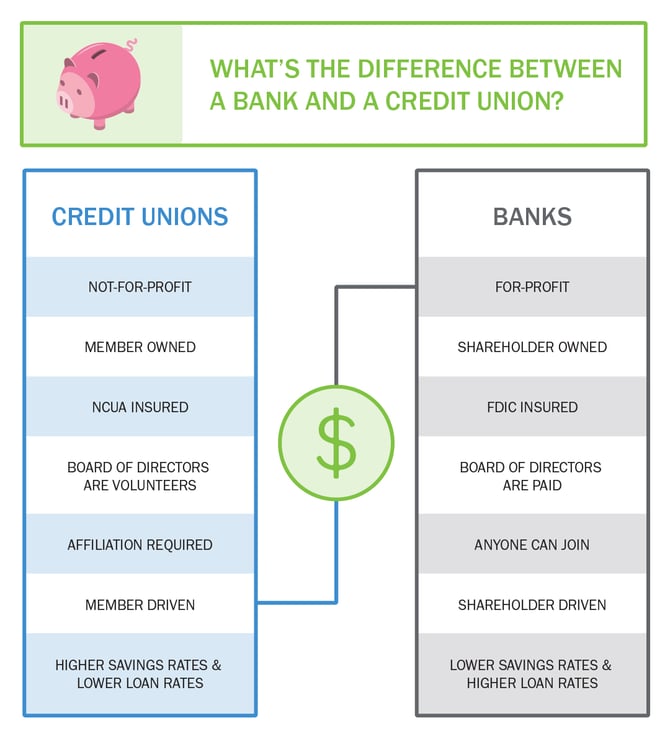

No, the Federal Deposit Insurance Corporation (FDIC) only insures deposits in banks. Credit unions have their own insurance fund, run by the National Credit Union Administration (NCUA).

Cached

Is NCUA insurance as good as FDIC

Just like banks, credit unions are federally insured; however, credit unions are not insured by the Federal Deposit Insurance Corporation (FDIC). Instead, the National Credit Union Administration (NCUA) is the federal insurer of credit unions, making them just as safe as traditional banks.

Cached

Should you keep more than 250k in bank

Anything over that amount would exceed the FDIC coverage limits. So if you keep more than $250,000 in cash at a single bank, then you run the risk of losing some of those funds if your bank fails.

How to safely store deposits if you have more than $250000

Open an account at a different bank.Add a joint owner.Get an account that's in a different ownership category.Join a credit union.Use IntraFi Network Deposits.Open a cash management account.Put your money in a MaxSafe account.Opt for an account with both FDIC and DIF insurance.

What happens if you have more than 250k in the bank

Bottom line. Any individual or entity that has more than $250,000 in deposits at an FDIC-insured bank should see to it that all monies are federally insured. It's not only diligent savers and high-net-worth individuals who might need extra FDIC coverage.

How do I insure 2 millions in the bank

Here are some of the best ways to insure excess deposits above the FDIC limits.Open New Accounts at Different Banks.Use CDARS to Insure Excess Bank Deposits.Consider Moving Some of Your Money to a Credit Union.Open a Cash Management Account.Weigh Other Options.

Is my money safe in a credit union

Like banks, which are federally insured by the FDIC, credit unions are insured by the NCUA, making them just as safe as banks.

What to do if you have more than 250k in the bank

Open an account at a different bank.Add a joint owner.Get an account that's in a different ownership category.Join a credit union.Use IntraFi Network Deposits.Open a cash management account.Put your money in a MaxSafe account.Opt for an account with both FDIC and DIF insurance.

What does the NCUA not cover

While the NCUSIF coverage protects members at all federally insured credit unions from losses on a broad spectrum of savings and share draft products, it does not cover losses on money invested in mutual funds, stocks, bonds, life insurance policies, and annuities offered by affiliated entities.

Is it safe to keep a million dollars in the bank

The good news is nearly all banks have insurance through the Federal Deposit Insurance Corporation (FDIC). This protection covers $250,000 “per depositor, per insured bank, for each account ownership category.” This insurance covers a range of deposit accounts, including checking, savings and money market accounts.

What happens if you have more than $250000 in the bank

Generally, when your bank fails, deposits in excess of $250,000 are not protected. There can be exceptions, such as what happened to consumers and businesses with money at Silicon Valley Bank. If you have more than $250,000 in savings, consider splitting it between FDIC-insured banks.

How to safely bank your money if you have more than $250000

If you have more than $250,000 saved, it may be a good idea to set up a brokerage account with an institution such as Fidelity Investments or Charles Schwab. Brokerages typically offer CDs from different banks across the country, giving you the convenience of one-stop shopping.

Where do millionaires keep their money

Examples of cash equivalents are money market mutual funds, certificates of deposit, commercial paper and Treasury bills. Some millionaires keep their cash in Treasury bills. They keep rolling them over to reinvest them, and liquidate them when they need the cash.

Is it safe to have more than $250000 in a bank account

Some examples of FDIC ownership categories, include single accounts, certain retirement accounts, employee benefit plan accounts, joint accounts, trust accounts, business accounts as well as government accounts. Q: Can I have more than $250,000 of deposit insurance coverage at one FDIC-insured bank A: Yes.

What happens when you have more than $250000 at a bank

Bottom line. Any individual or entity that has more than $250,000 in deposits at an FDIC-insured bank should see to it that all monies are federally insured. It's not only diligent savers and high-net-worth individuals who might need extra FDIC coverage.

Is my money safe in a credit union in 2023

While banks are insured by the FDIC, credit unions are insured by the NCUA. "Whether at a bank or a credit union, your money is safe.

Is 100k in the bank too much

In fact, a good 51% of Americans say $100,000 is the savings amount needed to be financially healthy, according to the 2023 Personal Capital Wealth and Wellness Index. But that's a lot of money to keep locked away in savings.

Is my money safe at a credit union

Like banks, which are federally insured by the FDIC, credit unions are insured by the NCUA, making them just as safe as banks. The National Credit Union Administration is a US government agency that regulates and supervises credit unions.