How much does visa charge merchants per transaction?

How much do merchants pay for Visa transactions

approximately 1.3% to 3.5%

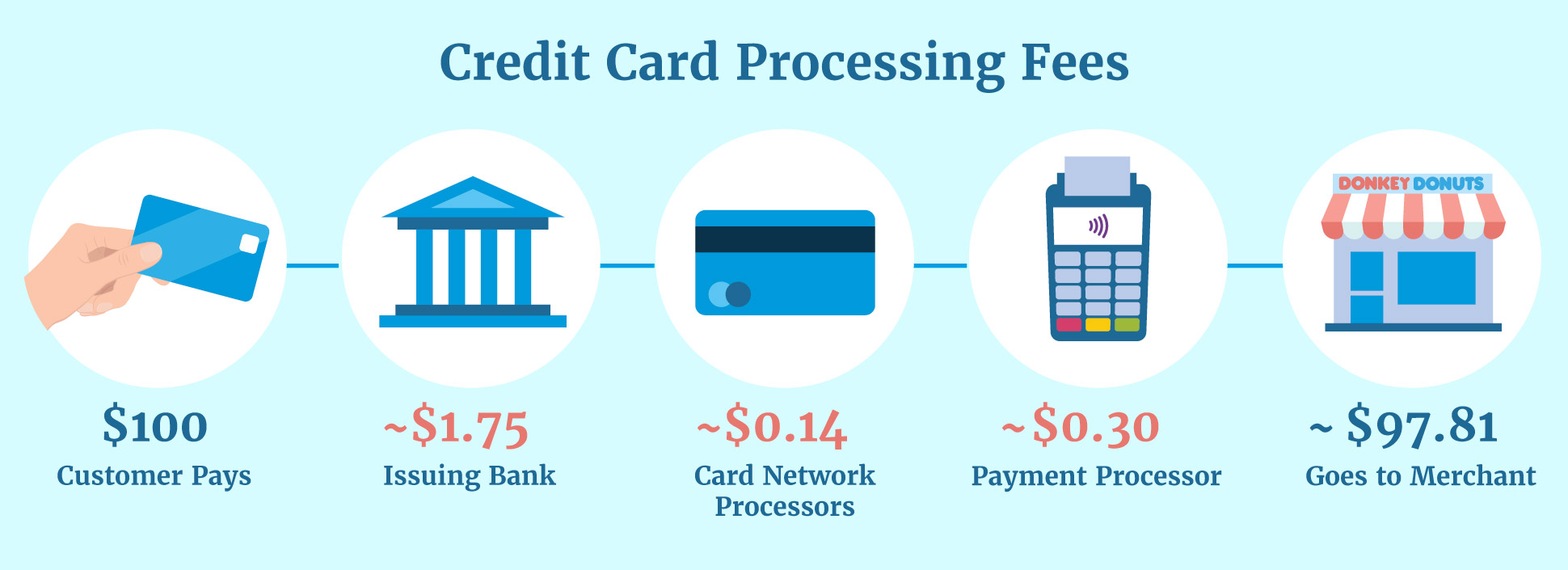

Credit card processing fees for merchants equal approximately 1.3% to 3.5% of each credit card transaction. The exact amount depends on the payment network (e.g., Visa, Mastercard, Discover, or American Express), the type of credit card, and the merchant category code (MCC) of the business.

Cached

How much do credit card companies charge merchants

The average credit card processing fee ranges between 1.5% and 3.5%. Just where do all these fees come from, and what can a merchant do to minimize them

Cached

What is the transaction fee for Visa credit card

1.3% to 3.5%

The average credit card processing fee per transaction is 1.3% to 3.5%.

Cached

Does Visa allow merchants to charge a fee

Starting on April 15th, 2023, merchants in the United States will be restricted to surcharge customers to a 3% cap for those who pay with Visa credit cards.

Does Visa make money on every transaction

Visa makes its profits by selling services as a middleman between financial institutions and merchants. The company does not profit from the interest charged on Visa-branded card payments, which instead goes to the card-issuing financial institution.

How much do credit card companies make from a transaction

Interchange. Every time you use a credit card, the merchant pays a processing fee equal to a percentage of the transaction. The portion of that fee sent to the issuer via the payment network is called “interchange,” and is usually about 1% to 3% of the transaction.

What percentage does Amex charge merchants

Credit and charge cards – 3.03% + $0.10 per transaction. Prepaid cards – 1.68% + $0.15 per transaction. Corporate purchasing cards – 3.01% + $0.10 per transaction.

Why are credit card fees so high for merchants

Merchant fees are so high because credit card processing companies often inflate their charges. Processors also charge extra fees and unnecessary fees, adding to the total cost of a merchant's monthly statement. For example, let's say a customer buys food at a restaurant using a Visa rewards card.

Do you get charged per transaction on a credit card

The fee is usually a percentage of the transaction value. Interest will apply from the date of the withdrawal or transaction. Some retailers and service providers may charge a fee for using a credit card to purchase things like postal orders, or to enter competitions.

Do all Visa cards have a purchase fee

Getting a Visa card costs as little as $0, depending on the type of Visa card you get. Visa gift cards often have a one-time fee of $2.95 to $6.95 at the time of purchase, based on the gift card's value, whereas most Visa debit cards and credit cards cost nothing to get.

Can you pass on credit card fees to customers

With surcharging, merchants are able to automatically pass credit card fees to their customers when a credit card is used at checkout. Credit card surcharging allows businesses to pass on the financial burden of credit card processing fees by attaching an extra fee to each customer's credit card transaction.

What are the new Visa surcharge rules

Merchants who intend to surcharge are no longer required to register with Visa. Instead, the merchant must notify their merchant acquirer 30 days in advance of commencing surcharging. The maximum allowed surcharge in the US will be reduced to 3% from the current 4% maximum.

Do credit card companies make money if you pay full

Yes, credit card issuers can make money from your card account even if you pay in full every month. Every time you use your card, the merchant is charged a fee by the issuer to process the transaction. This is called an interchange fee. Interchange fees typically range from 1% to 3% of the transaction amount.

Does Visa make money from interchange

Get the latest information. Visa uses interchange reimbursement fees as transfer fees between acquiring banks and issuing banks for each Visa card transaction. Visa uses these fees to balance and grow the payment system for the benefit of all participants.

How do credit card companies make money if you pay full

Do Credit Card Companies Make Money if You Pay in Full While credit card interest and fees are where the money really is for credit card issuers, credit card companies still earn revenue from transaction fees, annual fees, and other fees even if you pay your bill in full each month.

What is the margin on a credit card

The number of percentage points that credit card lenders add to the prime rate (or other index) to calculate the variable interest rate. For example, if the prime rate is 3.25 percent and the variable rate is 17.24 percent, the margin is 13.99 percent.

Does Amex charge higher fees than Visa

Visa and Mastercard tend to charge merchants processing fees between 1.5 percent and 2.5 percent to accept their credit cards, whereas American Express charges 2.5 percent to 3.5 percent.

How much does square charge per transaction

What are your fees The Square standard processing fee is 2.6% + 10¢ for contactless payments, swiped or inserted chip cards, and swiped magstripe cards. Payments that are manually keyed-in, processed using Card on File, or manually entered using Virtual Terminal have a 3.5% + 15¢ fee.

Can I pass on credit card fees to customers

With surcharging, merchants are able to automatically pass credit card fees to their customers when a credit card is used at checkout. Credit card surcharging allows businesses to pass on the financial burden of credit card processing fees by attaching an extra fee to each customer's credit card transaction.

How do you avoid merchant fees

7 Ways to Avoid Merchant FeesLearn How to Read Your Merchant Statements.Choose the Right Pricing Structure for Your Merchant Account.Reduce Fraud and Chargebacks.Avoid Equipment Leases.Monitor and Audit Your Statements Every Month.Negotiate Merchant Fees Directly With Your Processor.Don't Switch Processors.