How much has consumer debt increased in 2023?

How much debt is the average American in 2023

Average consumer household debt in 2023

| DEBT TYPE | TOTAL AMOUNT, Q1 2023 |

|---|---|

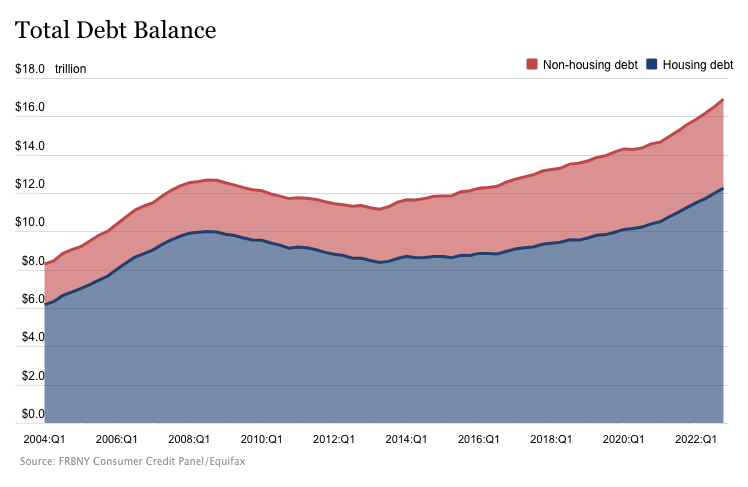

| Total consumer debt (including types not listed below) | $17 trillion |

| Average household debt, 2023 | $101,915 |

| Median household consumer debt | $67,000 |

| Total mortgage debt | $12.04 trillion |

Cached

How to get out of debt in 2023

5 Steps to Get Out of Debt in 2023Build a better budget. If you don't have a budget, now is the time to create one—and if you do have a budget already in place, make some tweaks and hold force yourself to follow it.Pay down credit cards.Save your money.Make an appointment with a credit counselor.Educate yourself.

Is credit card debt at an all time high

Credit card debt overall is at a historic high. In the last three months of 2023, credit card balances in the U.S. rose from $61 billion to nearly $990 billion according to the Federal Reserve Bank in New York. It's likely to surpass $1 trillion this year.

What is the consumer debt ratio

Your debt-to-income ratio (DTI) compares how much you owe each month to how much you earn. Specifically, it's the percentage of your gross monthly income (before taxes) that goes towards payments for rent, mortgage, credit cards, or other debt.

Is US debt at an all time high

Nearly every year, the government spends more than it collects in taxes and other revenue, resulting in a deficit. (The debt ceiling, set by Congress, caps how much the U.S. can borrow to pay for its remaining bills.) The national debt, now at a historic high, is the buildup of its deficits over time.

How fast is the US debt growing

How Did U.S. Debt Get So High

| Year | Outstanding Debt | Year-Over-Year Increase |

|---|---|---|

| 2023 | $28.4T | 6% |

| 2023 | $26.9T | 19% |

| 2023 | $22.7T | 6% |

| 2023 | $21.5T | 6% |

Is 2023 going to be bad financially

There is broad consensus that the U.S. is likely to see an economic slowdown in Q1 2023 as the impacts of the Federal rate rises from late 2023 start to feed into the economy; however, there is a significant divergence with regards to the quarters that follow.

Is it better to pay off debt or save 2023

Paying Down Debt Is Likely the Better Choice

And if you're investing the money you could use to pay down debt into a CD, money market account or high-yield savings, the amount of interest you're charged on your credit card or other debt will almost certainly mitigate any returns you manage to accrue from your deposits.

Are Americans getting into more debt

That debt load has spiked by $2.9 trillion since the end of 2023. During the first quarter, the increases in debt were seen across practically all categories, with larger (and new record) balances for mortgages, home equity lines of credit, auto loans, student loans, retail cards and other consumer loans.

What is an OK amount of credit card debt

If your total balance is more than 30% of the total credit limit, you may be in too much debt. Some experts consider it best to keep credit utilization between 1% and 10%, while anything between 11% and 30% is typically considered good.

How much debt is the consumer debt

Total Household Debt Reaches $16.90 trillion in Q4 2023; Mortgage and Auto Loan Growth Slows

| Category | Quarterly Change * (Billions $) | Total As Of Q4 2023 (Trillions $) |

|---|---|---|

| Mortgage Debt | (+) $254 | $11.92 |

| Student Debt | (+) $21 | $1.60 |

| Auto Debt | (+) $28 | $1.55 |

| Credit Card Debt | (+) $61 | $0.99 |

Is 75% a good debt ratio

This compares annual payments to service all consumer debts—excluding mortgage payments—divided by your net income. This should be 20% or less of net income. A ratio of 15% or lower is healthy, and 20% or higher is considered a warning sign.

What happens if US debt gets too high

Rising debt means fewer economic opportunities for Americans. Rising debt reduces business investment and slows economic growth. It also increases expectations of higher rates of inflation and erosion of confidence in the U.S. dollar.

What is the max debt the US can have

The debt limit extends into 2025. Previously, in December 2023, the debt ceiling was raised when it was increased by $2.5 trillion, to $31.381 trillion, which lasted until January 2023.

Is U.S. debt at an all time high

Nearly every year, the government spends more than it collects in taxes and other revenue, resulting in a deficit. (The debt ceiling, set by Congress, caps how much the U.S. can borrow to pay for its remaining bills.) The national debt, now at a historic high, is the buildup of its deficits over time.

How much is the US debt growing

How Did U.S. Debt Get So High

| Year | Outstanding Debt | Year-Over-Year Increase |

|---|---|---|

| 2023 | $28.4T | 6% |

| 2023 | $26.9T | 19% |

| 2023 | $22.7T | 6% |

| 2023 | $21.5T | 6% |

What is the finance forecast for 2023

Economic growth is expected to slow this year

GDP growth is expected to slow to around 1¼ per cent over 2023, with GDP per capita declining over the year (Graph 5.4). The weaker near-term outlook relative to three months ago reflects the softness in recent activity data.

What is the inflation outlook for 2023

After peaking at 6.2% in 2023, we expect inflation to fall to 3.5% for 2023. Over 2024 to 2027, we expect inflation to average just 1.8%—below the Fed's 2% target.

Do millionaires pay off debt or invest

They stay away from debt.

Car payments, student loans, same-as-cash financing plans—these just aren't part of their vocabulary. That's why they win with money. They don't owe anything to the bank, so every dollar they earn stays with them to spend, save and give!

What age should you be out of debt

Debt eases for those between the ages of 45-54 thanks to higher salaries. For those between the ages of 55 to 64, their assets may outweigh their debt. However, many still owe more than they have saved and must delay retirement as a result.