How much is a 3.5% processing fee?

How do I calculate a processing fee

How to Calculate Processing Fees. The formula for calculating processing fees is: (order amount * percentage fee) + (transaction fee * number of transactions).

How to calculate a 3% credit card processing fee

Question: How to calculate 3% processing fee Answer: To calculate a 3% processing fee, multiply the total transaction amount by 0.03. For example, if the transaction amount is $100, the processing fee would be $3 (100 x 0.03 = 3). The total amount charged to the customer would be $103.

Cached

What is a 3 percent transaction fee

A foreign transaction fee is one of the most common types of fees you could face if you use your credit card at a non-U.S. retailer. Foreign transaction fees are assessed by your credit card issuer and tend to be charged as a percentage of the purchase that you're making, usually around 3%.

How much are processing fees usually

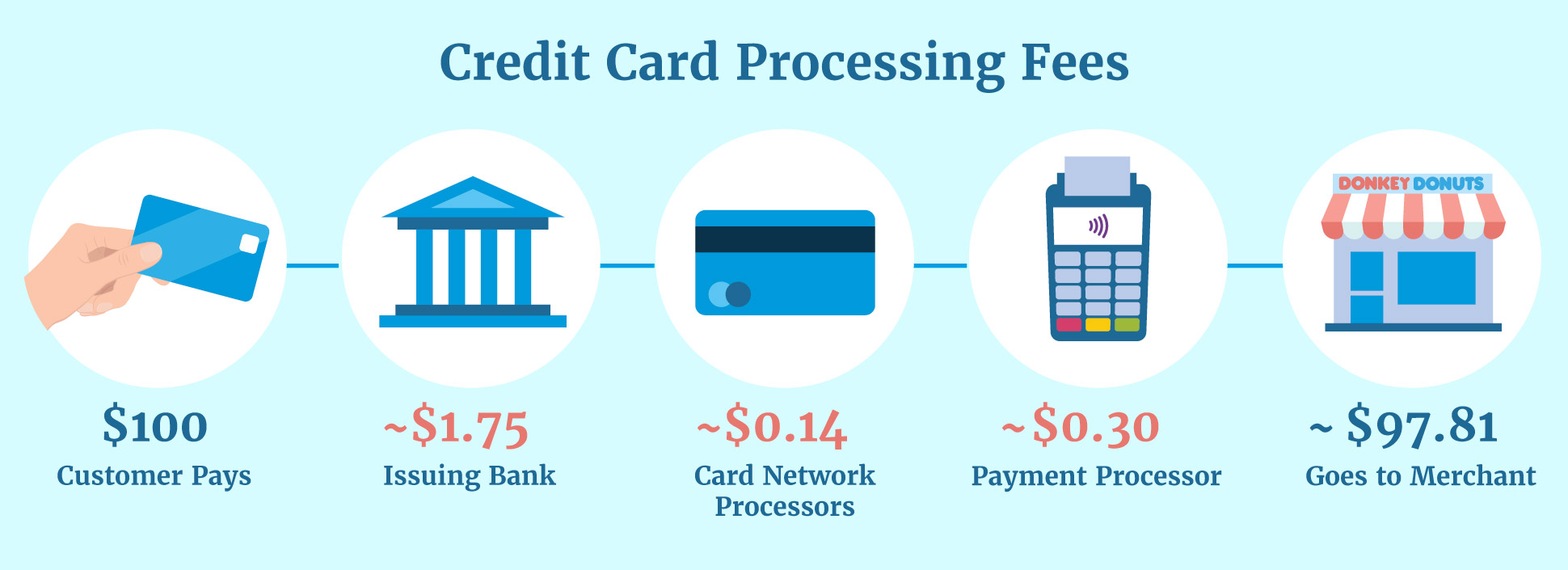

between 1.5% and 3.5%

The average credit card processing fee ranges between 1.5% and 3.5%. Just where do all these fees come from, and what can a merchant do to minimize them

Cached

Can you charge clients a processing fee

Surcharges are legal unless restricted by state law. Businesses that choose to add surcharges are required to follow protocols to ensure full transparency. The surcharge regulations outlined below only apply within the U.S.

Is processing fee negotiable

Markups (Negotiable)

It's the only area of credit card processing expense that you can negotiate. The processing markup includes the processor's rates, credit card transaction fees, monthly fees, and any fees associated with software, gateways or processing equipment. That is, any fees that the processor can control.

What is the 3% fee of 1000

We can now easily see that 3% of 1000 is 30.

Is it illegal to charge 3% credit card fee

Are Credit Card Surcharges Legal If you're wondering if it is legal to charge credit card fees, the short answer is yes. The practice of surcharging was outlawed for several decades until 2013 when a class action lawsuit permitted merchants in several U.S. states to implement surcharges in their businesses.

Is 3% transfer fee a lot

In almost all cases, a 3% balance transfer fee is worth paying, and sometimes even a 5% fee. Credit cards have extremely high interest rates, and because of that, credit card debt can be very difficult to get out of.

Is a 3% transaction fee bad

You might be thinking that 3% doesn't sound too bad, but these fees can quickly add up if you're making a lot of small purchases or you're making large purchases. For example, if you spend $100 and your fee is 3%, you'll spend an extra $3, but if you spend $1,000, you'll be paying an extra $30 in fees.

Why are card processing fees so high

Merchant fees are so high because credit card processing companies often inflate their charges. Processors also charge extra fees and unnecessary fees, adding to the total cost of a merchant's monthly statement. For example, let's say a customer buys food at a restaurant using a Visa rewards card.

How do you pass processing fees to customers

4 Methods to Pass Credit Card Merchant Fees to CustomersConvenience Fees. A convenience fee allows businesses to add fees to some transactions but not others.Cash Discounts.Minimum Purchase Requirements.Follow Laws and Requirements.Be Transparent.Provide Multiple Payment Options.

Is it legal for a company to charge a credit card processing fee

If you're wondering if it is legal to charge credit card fees, the short answer is yes. The practice of surcharging was outlawed for several decades until 2013 when a class action lawsuit permitted merchants in several U.S. states to implement surcharges in their businesses.

How do I avoid payment processing fees

Implementing a surcharge program is an effective way to eliminate processing fees. Surcharge programs pass the cost of these fees onto the consumer. They can avoid these fees by paying with cash or debit instead. The best way to implement a surcharge program is through Nadapayments.

How do I avoid refund processing fees

“Tell them upfront you don't want the extra fee.” If you are adamant about doing it yourself, try the IRS' Free File program. Qualifying taxpayers with an adjusted gross income of $66K or less can file their federal returns for free via the program. There are also some free state return services, as well.

What is 3% of $100

Answer: 3% of 100 is 3.

What is 3% out of 900

Answer and Explanation: 27 is 3 percent of 900.

Why are businesses charging 3 credit card fees

The main reason merchants add credit card surcharges is to compensate for high credit card processing costs. Consumers generally frown upon extra fees, especially if you're one of the only businesses in your local area to charge fees.

Why do credit cards have 3% charge

Credit card swipe fees, also known as interchange fees, are a per-use fee charged by banks to merchants using credit or debit cards. These fees average around 2-2.5% of the cost of the transaction. Credit card companies claim these fees are used to allay the credit risk from cardholders late payments or defaults.

How much will it cost in fees to transfer a $1000 balance to this card

It costs $30 to $50 in fees to transfer a $1,000 balance to a credit card, in most cases, as balance transfer fees on credit cards usually equal 3% to 5% of the amount transferred.