How much is Chase credit card late fee?

Does Chase report 1 day late payments

Missing a payment by a few days

The usual time period is 30 days for a credit report to reflect a late payment. This late payment could hurt your score and lead to higher annual percentage rates (APRs) as a consequence, depending on your card's terms and conditions.

What happens if my Chase payment is late

If your payment is over 60 days late then you could be charged a penalty APR which will cause your interest rate to go higher than your regular APR. In addition, the longer your payment is overdue, the more damage your credit score may incur. How to avoid the fee: Make sure to pay your bill on time each month.

Cached

Does Chase credit card have a grace period

You may get a grace period of around 21 days to pay off your balance. The due date on your statement is the end of your grace period, which is when interest starts accruing if you have not paid off the full balance. Cash advances have a separate APR and begin accruing interest immediately.

Does Chase have a late payment grace period

Chase's grace period for credit card payments is at least 21 days, from the end of the monthly billing cycle until your payment due date. If you always pay your balance in full during the Chase credit card grace period, you will not owe any interest.

Will Chase forgive one late payment

I missed a payment. Can you make a goodwill or courtesy adjustment and remove it from my credit report The information we report is required to be complete and accurate. Because of this, we don't make goodwill or courtesy adjustments.

What happens if I make a payment 1 day late

Even a single late or missed payment may impact credit reports and credit scores. But the short answer is: late payments generally won't end up on your credit reports for at least 30 days after the date you miss the payment, although you may still incur late fees.

Does 1 late payment affect credit

Even a single late or missed payment may impact credit reports and credit scores. But the short answer is: late payments generally won't end up on your credit reports for at least 30 days after the date you miss the payment, although you may still incur late fees.

What happens if I pay my credit card 3 days late

The Bottom Line

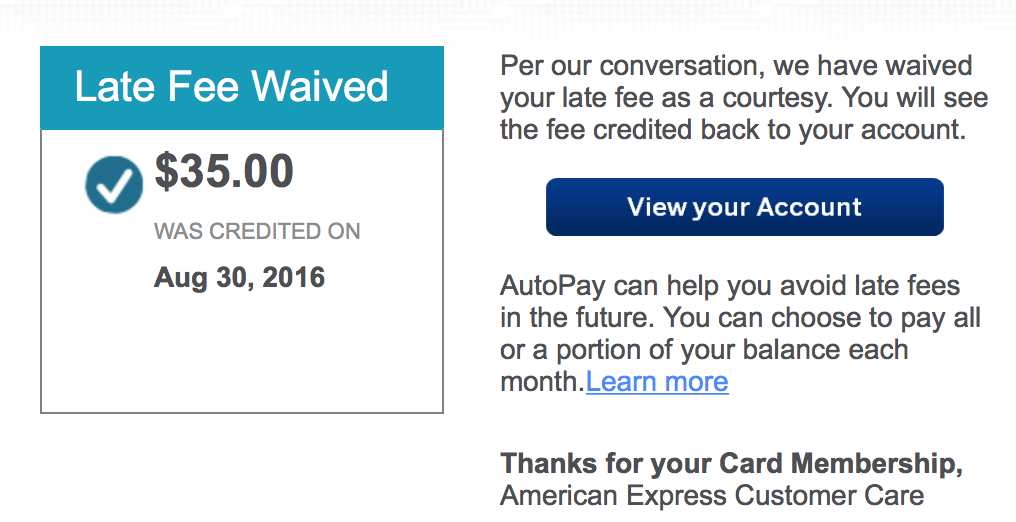

Late card payments won't show up on your credit report as long as you pay within 30 days of the due date. Your credit card issuer may also offer a one-time late fee waiver and could remove the penalty APR upon request. If not, you could transfer your balance to a new card with a lower interest rate.

How many days can you be late on a payment

Creditors don't report a late payment to the credit bureaus until it's 30 days past due. However, you may still incur a late fee. Payments 30 or more days late: Once a late payment is 30 days overdue, it will appear on your credit report.

Will a 2 day late payment affect credit score

Even a single late or missed payment may impact credit reports and credit scores. But the short answer is: late payments generally won't end up on your credit reports for at least 30 days after the date you miss the payment, although you may still incur late fees.

How much does 1 late payment affect credit score

Your credit score can drop by as much as 100+ points if one late payment appears on your credit report, but the impact will vary depending on the scoring model and your overall financial profile.

Does a 3 day late payment affect credit score

Even a single late or missed payment may impact credit reports and credit scores. But the short answer is: late payments generally won't end up on your credit reports for at least 30 days after the date you miss the payment, although you may still incur late fees.

Can 2 days late payment affect credit

By federal law, a late payment cannot be reported to the credit reporting bureaus until it is at least 30 days past due. An overlooked bill won't hurt your credit as long as you pay before the 30-day mark, although you may have to pay a late fee.

What happens if I am 3 days late on my credit card payment

Even a single late or missed payment may impact credit reports and credit scores. Late payments generally won't end up on your credit reports for at least 30 days after you miss the payment. Late fees may quickly be applied after the payment due date.

How much does 1 30 day late affect your credit

Paying 30 days or more past due could drop your score as much as 100 points. Try these strategies to manage payments. Bev O'Shea is a former NerdWallet authority on consumer credit, scams and identity theft.

What happens if I pay credit card 2 days late

Late card payments won't show up on your credit report as long as you pay within 30 days of the due date. Your credit card issuer may also offer a one-time late fee waiver and could remove the penalty APR upon request. If not, you could transfer your balance to a new card with a lower interest rate.

How bad will 1 late payment affect credit

Once a late payment hits your credit reports, your credit score can drop as much as 180 points. Consumers with high credit scores may see a bigger drop than those with low scores. Some lenders don't report a payment late until it's 60 days past due, but you shouldn't count on this when planning your payment.

How long does it take for credit to recover from 1 late payment

Even if you repay overdue bills, the late payment won't fall off your credit report until after seven years. And no matter how late your payment is, say 30 days versus 60 days, it will still take seven years to drop off.

What happens if I pay my credit card bill 2 days late

Even a single late or missed payment may impact credit reports and credit scores. But the short answer is: late payments generally won't end up on your credit reports for at least 30 days after the date you miss the payment, although you may still incur late fees.

How much does a 2 day late payment affect credit score

By federal law, a late payment cannot be reported to the credit reporting bureaus until it is at least 30 days past due. An overlooked bill won't hurt your credit as long as you pay before the 30-day mark, although you may have to pay a late fee.