How much is the Child Tax Credit for 2016?

What was the child tax credit amount in 2016

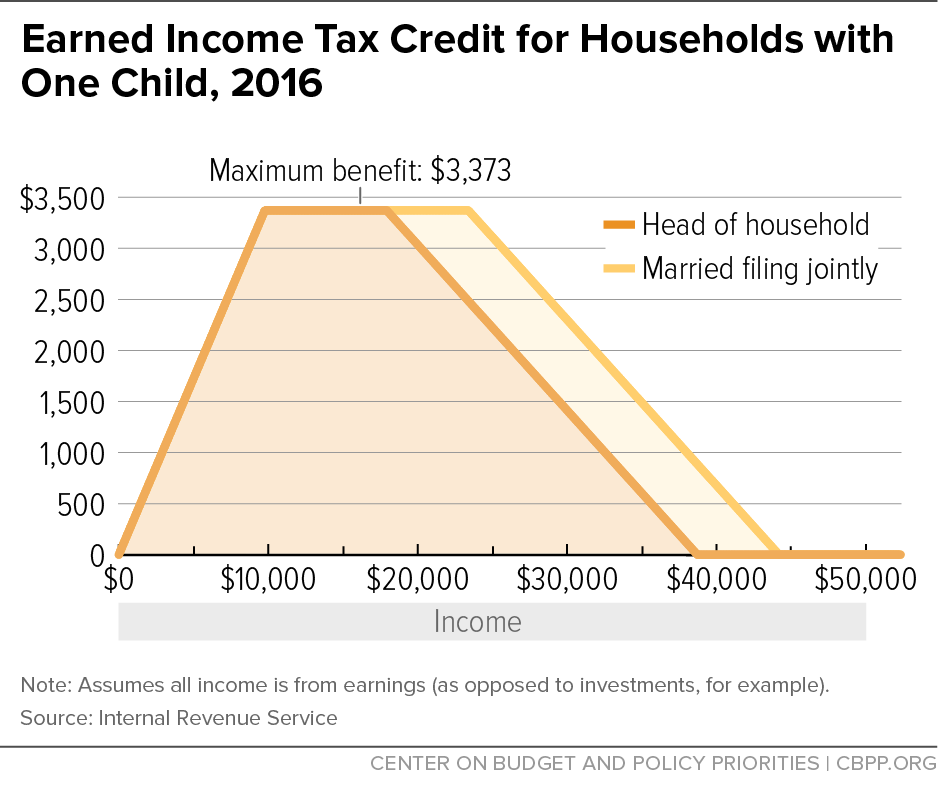

Once you determine if you are eligible for the EITC, here are the maximum credit amounts that you might qualifiy for in 2016: $506 with no Qualifying Children. $3,373 with 1 Qualifying Child. $5,572 with 2 Qualifying Children.

Cached

How much was child tax credit in 2023

The Tax Cuts and Jobs Act of 2023 doubled the tax credit to $2,000 and made limits to the refundable amount of up to $1,400 per child. It also introduced phase out thresholds and rates for higher-income taxpayers. The act is temporary and will expire on Dec. 31, 2025.

What was the child tax credit pre 2023

Before the 2023 tax law, the CTC was a maximum tax credit of $1,000 per eligible child under age 17.

What is the child tax credit for 2014

The maximum amount of credit for Tax Year 2014 is: $6,143 with three or more qualifying children. $5,460 with two qualifying children. $3,305 with one qualifying child.

What are the federal tax rates for 2016

The Federal income tax has 7 brackets: 10%, 15%, 25%, 28%, 33%, 35%, and 39.6%. The amount of tax you owe depends on your income level and filing status. It's important to understand that moving into a higher tax bracket does not mean that all of your income will be taxed at a higher rate.

How much was each child tax credit payment

For tax year 2023, the Child Tax Credit increased from $2,000 per qualifying child to: $3,600 for children ages 5 and under at the end of 2023; and. $3,000 for children ages 6 through 17 at the end of 2023.

What is the child tax credit for 2015

Child Tax Credit

The maximum amount you can claim for the credit is $1,000 for each qualifying child.

What is the child tax credit for 2013

For families with one child, the maximum credit was $3,169 in tax year 2012, and it will increase to $3,250 in 2013. For families with two children, in tax year 2012 the maximum was $5,236, and it will increase to $5,372 in 2013. The American Recovery and Reinvestment Act of 2009 (ARRA; P.L.

How much was the first Child Tax Credit

Most families will receive the full amount: $3,600 for each child under age 6 and $3,000 for each child ages 6 to 17. To get money to families sooner, the IRS is sending families half of their 2023 Child Tax Credit as monthly payments of $300 per child under age 6 and $250 per child between the ages of 6 and 17.

How much was the tax credit per child

For tax year 2023, the Child Tax Credit is increased from $2,000 per qualifying child to: $3,600 for each qualifying child who has not reached age 6 by the end of 2023, or.

What was the Child Tax Credit in 2015

Child Tax Credit

The maximum amount you can claim for the credit is $1,000 for each qualifying child.

How much was the Child Tax Credit in 2013

Revenue loss estimates of the EITC and CTC (billions of dollars), 2012–2023

| Fiscal year | Earned income tax credit | Child tax credit |

|---|---|---|

| Total | Total | |

| 2012 | $59.0 | $56.8 |

| 2013 | 60.9 | 57.3 |

| 2014 | 67.0 | 57.9 |

How is taxable income calculated 2016

Your total taxable income is your AGI minus your itemized or standard deduction, and your deduction for exemptions.

What was the maximum taxable income in 2016

$118,500

Due to the maximum taxable income limit, employees and employers will pay a maximum of $7,347 each in Social Security tax in 2016. The maximum taxable income limit has risen from $3,000 in 1937 to $118,500 in 2016.

How much was the first child tax credit payment

It is broken up into monthly payments, which means payments of up to $300 per child under age 6 and $250 per child ages 6 to 17.

How much was the first child tax credit

The regular child tax credit was $2,000 for children under the age of 17. Half of the money will be distributed as an advance on 2023 tax credits in monthly payments from July to December — the second half will be claimed when families file taxes next year.

What is the Child Tax Credit 2013

For families with one child, the maximum credit was $3,169 in tax year 2012, and it will increase to $3,250 in 2013. For families with two children, in tax year 2012 the maximum was $5,236, and it will increase to $5,372 in 2013. The American Recovery and Reinvestment Act of 2009 (ARRA; P.L.

How much was the child tax credit in 2010

$1,000

$1,000 for each qualifying child. applies. 1. The amount on Form 1040, line 46; Form 1040A, line 28; or Form 1040NR, line 44, is less than the credit.

What is the child tax credit for 2011

The federal Child Tax Credit can provide a family up to $1,000 in tax assistance for each qualifying child under age 17. 2. Who is eligible for the Child Tax Credit Have adjusted gross income (AGI) during 2011 below specified limits, depending on filing status and number of qualifying children (see Question 3).

How much was the full child tax credit

The maximum tax credit per qualifying child is $2,000 for kids 5 and younger – or $3,000 for those 6 through 17. Additionally, you can't receive a portion of the credit in advance, as was the case last year.