How much is the first payment with snap finance?

How long does snap finance give you to pay

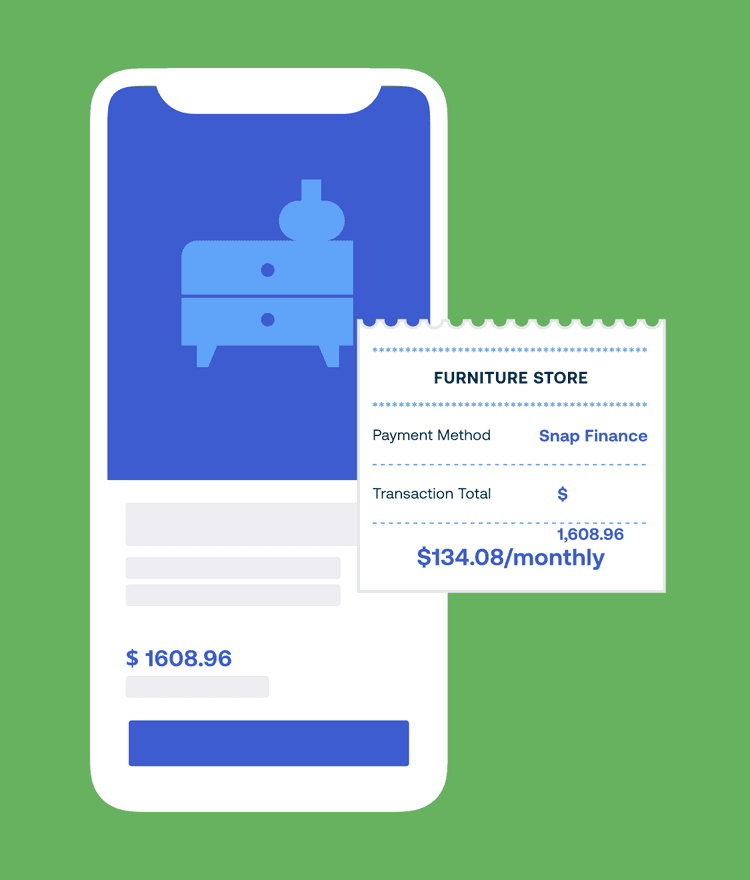

Even if you have no credit, Snap is a great way to finance the things you need. It's not a traditional loan, but a consumer lease that spreads out your purchase over 12 months of easy payments.

Cached

Are snap finance payments monthly

Pay monthly, weekly, twice a month according to your preference. No hidden fees or interest if paid in 100 days. After receiving your furniture you need to call Snap Finance to set up your account for 3 months with no interest.

Cached

How does snap finance work 100 days

You pay no interest if pay it off with 100 days (price plus the initial payment). After 100 days can buyout before the 12 months and enjoy a discount lease fee.

Cached

Does snap finance give you cash

Whether you need a little extra cash for college, groceries, an emergency car repair, or anything in between, a Snap Cash loan can help. But Snap Cash just got better! In just 6 clicks in 60 seconds, you can get money when you need it, deposited right into your account; no credit check required!

Cached

Does snap Finance mess up your credit

Applying with Snap will affect your credit score with these CRAs, but is unlikely to affect your FICO score or scores from the three major credit bureaus – Experian, Equifax, and Transunion. Note: Experian is used for Credit+ applications and as a result, credit scores may be affected.

How do I pay off snap Finance

How Do I Pay Off My AccountSign in to your account at customer.snapfinance.com.Click on the “Schedule Payment” button on the main dashboard.Continue to “Select a Payment Method.”Select a stored payment method.Select the default payoff amount displayed.Verify the information is correct and click “Submit Payment.”

How do I pay off snap finance

How Do I Pay Off My AccountSign in to your account at customer.snapfinance.com.Click on the “Schedule Payment” button on the main dashboard.Continue to “Select a Payment Method.”Select a stored payment method.Select the default payoff amount displayed.Verify the information is correct and click “Submit Payment.”

Is snap finance the same as Affirm

Retailers using Snap Finance can now seamlessly integrate Affirm's additional financing options to offer alternative payment options. Snap Finance has partnered with Affirm, an alternative to credit cards, enabling consumers to pay over time in monthly payments.

What is 100-day payment option snap

For the lowest overall cost, you may choose to pay off your lease within the first 100 days. To use the 100-Day Option, consumers must ensure the full amount is paid within 100 days by contacting Customer Care at (877) 557-3769 or by scheduling payments in the Customer Portal at customer.snapfinance.com.

Can you have 2 loans with snap Finance

Currently, you can only have one active loan at a time.

What does 3 months same as cash mean

In retailing, same as cash is a term used by retailers to offer things which you can buy without paying any interest, usually within 30, 60, or 90 days, and occasionally six months. It is a deferred payment on purchases.

How does 90 day same as cash work

Whenever the store extends a “90 days same as cash” offer, they're simply allowing you to make a purchase with no payments and without accruing interest for the next 90 days. You can think of it like a grace period on a loan, where you aren't required to make any monthly payments for a certain period of time.

Can you have 2 loans with snap finance

Currently, you can only have one active loan at a time.

What does snap finance check

Snap always checks credit, but keep in mind that Snap's application results are not based on credit alone, and customers can be approved even if they have poor credit or no credit. For our lease-to-own and installment loan products, Snap uses data from secondary credit reporting agencies (CRAs) like Clarity and DataX.

Can you pay snap finance off early

Can Snap Finance be paid off early It's actually better for you to pay Snap Finance off early because that means a lower cost, as no interest will be charged. If you pay Snap Finance off within 100 days, there is no interest charge.

Does snap finance mess up your credit

Applying with Snap will affect your credit score with these CRAs, but is unlikely to affect your FICO score or scores from the three major credit bureaus – Experian, Equifax, and Transunion. Note: Experian is used for Credit+ applications and as a result, credit scores may be affected.

What is snap Finance payment

Snap Loan provides easy financing for people with bad credit. Even if you have no credit, Snap is a great way to finance the things you need. It's not a traditional loan, but a consumer lease that spreads out your purchase over 12 months of easy payments.

Is snap Finance based on credit

Snap always checks credit, but keep in mind that Snap's application results are not based on credit alone, and customers can be approved even if they have poor credit or no credit. For our lease-to-own and installment loan products, Snap uses data from secondary credit reporting agencies (CRAs) like Clarity and DataX.

What is snap finance payment

Snap Loan provides easy financing for people with bad credit. Even if you have no credit, Snap is a great way to finance the things you need. It's not a traditional loan, but a consumer lease that spreads out your purchase over 12 months of easy payments.

Does snap do 90 days same as cash

With a “same as cash” plan, no interest is charged for a short-term period that could be: 90 days. 6 months. 12 months.