How much is the tax credit per child per month?

Why did I get $250 from IRS today

If you had a tax liability last year, you will receive up to $250 if you filed individually, and up to $500 if you filed jointly.

Do you have to pay back Child Tax Credit

Excess Advance Child Tax Credit Payment Amount: If your advance Child Tax Credit payments exceeded the amount of Child Tax Credit you can properly claim on your 2023 tax return, you may need to repay to the IRS some or all of that excess payment.

What is the tax deduction for a child

For 2023, the Child Tax Credit is $3,600 for each qualifying child under the age of 6 and to $3,000 for qualifying children ages 6 through 17.

How to get a $10,000 tax refund

CAEITCBe 18 or older or have a qualifying child.Have earned income of at least $1.00 and not more than $30,000.Have a valid Social Security Number or Individual Taxpayer Identification Number (ITIN) for yourself, your spouse, and any qualifying children.Living in California for more than half of the tax year.

Why did I get $2800 from the IRS

The third Economic Impact Payment will be larger for most eligible people. Eligible individuals who filed a joint tax return will receive up to $2,800, and all other eligible individuals will receive up to $1,400. Those with qualifying dependents on their tax return will receive up to $1,400 per qualifying dependent.

Who gets the 250.00 stimulus check

Individual filers who make between $75,000 and $125,000 a year — and couples who earn between $150,000 and $250,000 — were to receive $250 per taxpayer, plus another $250 if they have any dependents. A family with children could therefore receive a total of $750.

Do we have to pay back Biden Child Tax Credit

The budget also calls for permanently making the child tax credit fully refundable, which means people would still be eligible even if their tax liability was less than the credit amount.

Can both parents claim Child Tax Credit

Yes. You will be able to claim the full amount of the Child Tax Credit for your child on your 2023 tax return even if the other parent received advance Child Tax Credit payments.

What is the total credit for dependents

The maximum credit amount is $500 for each dependent who meets certain conditions. This credit can be claimed for: Dependents of any age, including those who are age 18 or older. Dependents who have Social Security numbers or Individual Taxpayer Identification numbers.

How many kids can you claim on your taxes

Does the Earned Income Credit (EIC) increase with each dependent child, or is there a maximum number of dependents I can claim Share: The Earned Income Credit (EIC) increases with the first three children you claim. The maximum number of dependents you can claim for earned income credit purposes is three.

How do I get the biggest tax refund this year

6 Ways to Get a Bigger Tax RefundTry itemizing your deductions.Double check your filing status.Make a retirement contribution.Claim tax credits.Contribute to your health savings account.Work with a tax professional.

Will tax refunds be bigger in 2023

According to early IRS data, the average tax refund will be about 11% smaller in 2023 versus 2023, largely due to the end of pandemic-related tax credits and deductions.

Who gets a $2800 stimulus check

Under the terms, individuals could receive up to $1,400 through the third stimulus checks. Couples who file jointly could get up to $2,800. Additionally, eligible dependents could also receive $1,400. To qualify, you had to be either a U.S. citizen or resident alien in 2023.

Why did I get $1,800 from the IRS

If you and your family meet the income eligibility requirements and you received each advance payment between July and December 2023, you can expect to receive up to $1,800 for each child age 5 and younger, or up to $1,500 for each child between the ages of 6 and 17, when you file your 2023 taxes.

What is the $450 per child

First Lady Casey DeSantis announced last week that $35.5 million in DeSantis' budget will "support nearly 59,000 Florida families with a one-time payment of $450 per child, which includes foster families."The American Rescue Plan Act created a $1 billion fund to assist needy families affected by the pandemic within the …

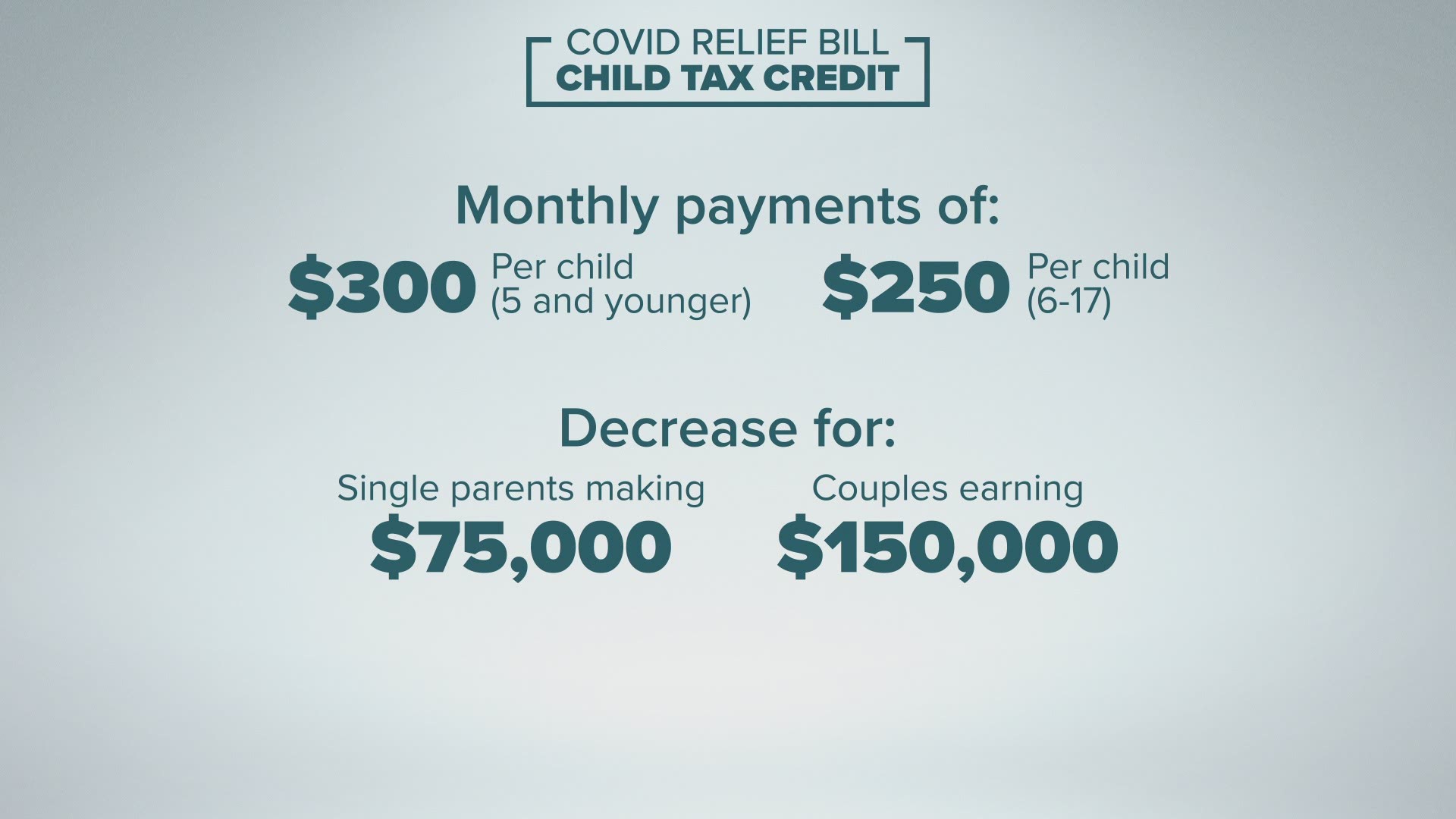

Who gets the $300 child stimulus

For every child 6-17 years old, families will get a monthly payment of $250, and for children under 6 years old, families will get $300 each month.

What is the new Child Tax Credit for 2023

The Child Tax Credit is worth a maximum of $2,000 per qualifying child. Up to $1,500 is refundable. To be eligible for the CTC, you must have earned more than $2,500.

What is the tax refund for 2023

The IRS has announced it will start accepting tax returns on January 23, 2023 (as we predicted as far back as October 2023). So, early tax filers who are a due a refund can often see the refund as early as mid- or late February. That's without an expensive “tax refund loan” or other similar product.

Can a stay at home mom claim child on taxes

A stay-at-home mom can claim her child as a dependent even if she has no income. To do so, both spouses must agree that they can claim the child before filing. In most cases, it would be more advantageous for the spouse with income to claim the child.

Who gets to claim child on taxes if never married

Only one parent can claim the children as dependents on their taxes if the parents are unmarried. Either unmarried parent is entitled to the exemption so long as they support the child. Typically, the best way to decide which parent should claim the child is to determine which parent has the higher income.