How much loan can I get for land?

What is the longest loan you can get for land

Land loans are often short-term, two- to five-year loans followed by a balloon payment, compared to the typical 15- and 30-year terms offered on a home mortgage. There are longer terms available in special cases, particularly if you are going to use the land to build a home.

Can you borrow money off of land

A land equity loan is based on your equity in real property (land) and allows you to borrow money with the land securing the loan. If you own land, you may qualify for a land equity loan.

How much is a downpayment on land in Texas

around 20 percent

How much of a down payment should I expect with a land loan Your down payment will be dependent on a variety of factors, but a good rule of thumb is somewhere around 20 percent of the total loan amount.

Cached

Can you finance land in California

Cal-Lending offers a number of loan products to meet the needs of people looking to purchase land, build, or remodel most property types in California. Some of the products that they offer are lot and land loans for metro, urban, and suburban residences and agricultural and rural land loans.

Which bank is best for property loan

Top Home Loan BanksSBI Home Loan. 8.05%-8.55%HDFC Home Loan. 8.60% – 9.50%Axis Bank Home Loan. 7.60% – 8.05%ICICI Home Loan. 8.40% – 9.45%Bank of Baroda Home Loan. 7.45% – 8.80%PNB Home Loan. 8.25% – 11.20%LIC Housing Finance Home Loan. 8.00% – 9.25%Aditya Birla Home Loan. 8.00% – 13.00%

Can land be a long term investment

Land ownership can be a great investment as long as you enter the deal with an awareness of all of the risks and pitfalls involved. By conducting careful research, investors can take advantage of low property prices and purchase land that will be worth much more down the road.

Do banks give loans with land as collateral

Depending on your needs and your lender, you can use land as collateral for a few different types of loans. The most common use of land collateral is for a land equity loan. Land can also be used as collateral for a personal loan, which can be used for almost anything.

What is a mortgage on land

A mortgage is a temporary transfer of property in order to secure a loan of money. The person who owns the land is the 'mortgagor'. The person lending the money is the 'mortgagee'.

Do you have to put 20% down on land in Texas

The down payment for land financing typically begins at a minimum of 20%. The interest rate can be locked in for anywhere from 1 to 20 years. Interest rates on raw land will differ from conventional mortgage rates.

What credit score do you need to buy land in Texas

Loan Qualifications

Because there are different types of land loans, each has its own qualifications for borrowers to meet. However, there are still general guidelines that are taken into consideration when a borrower applies for a land loan: Have an excellent credit score (720 or higher)

Is buying land in California a good investment

Land in California is an investment! Property taxes are relatively minimal, and maintenance is low.

Do you own the land when you buy a house in California

So, basically, with the purchase of a single family home, you are buying the land and the property, the house that it's being built on top of, as well.

What is the best credit score to buy property

620 or higher

It's recommended you have a credit score of 620 or higher when you apply for a conventional loan. If your score is below 620, lenders either won't be able to approve your loan or may be required to offer you a higher interest rate, which can result in higher monthly payments.

Which loan has lowest interest rate

Top Secured Loans in IndiaApply Home Loan @ 8.65%* Rate.Apply For Gold Loan Online.Apply Car Loan @ 7.45%* Rate.

Is it smart to buy land and build later

Perhaps there's a perfect property that comes up for sale and you don't want to lose it, so buying the land now and building later makes sense. From a financial perspective, it may be much more feasible to split up the investments and have time to rebuild your savings before being ready to build.

Is buying an acre of land a good investment

Is it a good investment Yes. Land is a tangible investment that will continue to go up in value over time. So, if a buyer purchases land today for $250,000, then in a few years, its value can increase to $400,000.

How do you use land as collateral for a loan

Using Land Equity for a Mortgage

Land equity sometimes can be used as collateral to qualify for a mortgage. In this case, you would need to own the land on which you are building a new home. If you use land equity as down payment, the lender may require you fully own the land and not have outstanding debt on it.

What does using land as collateral mean

Using land as collateral allows you to take out a loan without risking other important. assets like your home, car, or savings. Land equity loans usually result in lower interest rates. Land loan amounts can be used for any purpose; it acts like a personal loan.

Does buying land count as a mortgage

In general, a land loan works similarly to a standard mortgage. If you are approved for this type of loan, your lender will provide you with funds to buy your chosen lot of land. You will then pay them back, with interest, over the next years or decades.

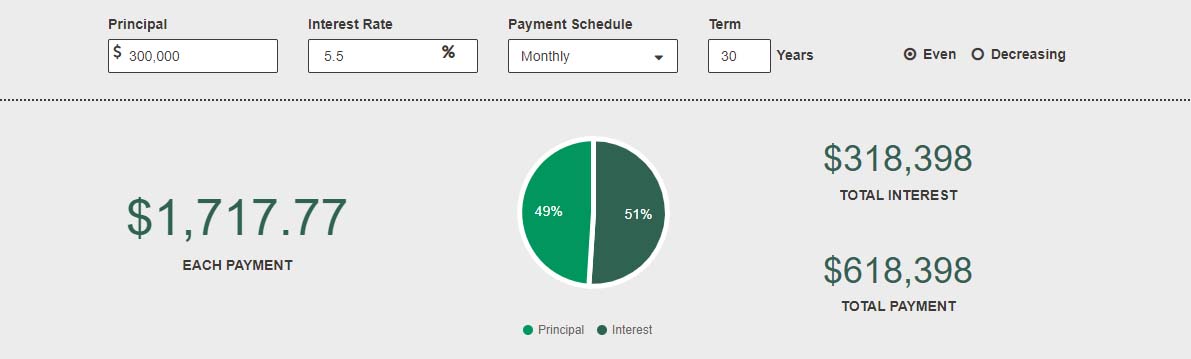

What would the payment be on a 50000 home equity loan

Loan payment example: on a $50,000 loan for 120 months at 7.50% interest rate, monthly payments would be $593.51. Payment example does not include amounts for taxes and insurance premiums.