How much money can you have in the bank with Social Security Disability?

Does it matter how much money you have in the bank for Social Security disability

The value of your resources is one of the factors that determines whether you are eligible for SSI benefits. However, not all resources count for SSI. If the value of your resources that we count is over the allowable limit at the beginning of the month, you cannot receive SSI for that month.

CachedSimilar

What can cause you to lose your Social Security disability benefits

Two things can cause us to decide that you no longer have a disability and stop or suspend your benefits:If, after completing a 9-month Trial Work Period (TWP), you work at a level we consider substantial.If we decide that your medical condition has improved and you no longer have a disability.

Does disability go into your bank account

Federal law mandates that all Federal benefit payments – including Social Security and Supplemental Security Income benefits – must be made electronically. There are two ways you can receive your benefits: Into an existing bank account via Direct Deposit or. Onto a Direct Express® Debit Mastercard®

Can you lose disability benefits if you inherit money

Because SSDI is based on how long someone paid into the Social Security system rather than income limits, SSDI is not affected by any inheritance they may receive.

Cached

Can I have a savings account while on Social Security disability

Can you have a savings account if you receive Social Security disability benefits Yes, you can have a savings account if you receive disability benefits. However, your account balance may impact your eligibility depending on which benefits you're applying for. SSDI does not have any savings account limits.

How do I get the $16728 Social Security bonus

To acquire the full amount, you need to maximize your working life and begin collecting your check until age 70. Another way to maximize your check is by asking for a raise every two or three years. Moving companies throughout your career is another way to prove your worth, and generate more money.

What is the downside of Social Security disability

If you do not have a private disability insurance policy and you get disabled, there is a high chance that you remain without any income for several months. SSDI therefore may not be a reliable insurance policy to compensate for the lost income after getting disabled.

What happens to my Social Security disability when I turn 62

Social Security disability benefits automatically change to retirement benefits when disability beneficiaries become full retirement age. The law does not allow a person to receive both retirement and disability benefits on one earnings record at the same time.

How often does SSDI monitor your bank account

There isn't a set schedule or a guaranteed timeline as to how frequently your accounts might be monitored. It could be once a year, twice a year, or only once every few years. Often, it will depend upon circumstances, and the schedule set forth by the SSA.

Can you have savings account Social Security disability

Yes. Beneficiaries who receive Social Security or SSI benefits can deposit their benefits into their ABLE accounts.

What happens if you inherit money while on Social Security

SSI and Social Security Benefits

If you pay into these programs, you are eligible to receive benefits. Income from working at a job or other source could affect Social Security and SSDI benefits. However, receiving an inheritance won't affect Social Security and SSDI benefits.

What is a bank account for a person with disability

An ABLE Account is a tax-advantaged savings account that allows individuals with disabilities to save and invest money for disability-related expenses (called Qualified Disability Expenses, or QDEs) without losing eligibility for certain means-tested public benefits programs, such as Medicaid, Supplemental Nutrition …

How do you get the $16000 Social Security bonus

How to Get a Social Security BonusOption 1: Increase Your Earnings. Social Security benefits are based on your earnings.Option 2: Wait Until Age 70 to Claim Social Security Benefits.Option 3: Be Strategic With Spousal Benefits.Option 4: Make the Most of COLA Increases.

What changes are coming for Social Security in 2023

Social Security recipients will get an 8.7% raise for 2023, compared with the 5.9% increase that beneficiaries received in 2023. Maximum earnings subject to the Social Security tax also went up, from $147,000 to $160,200.

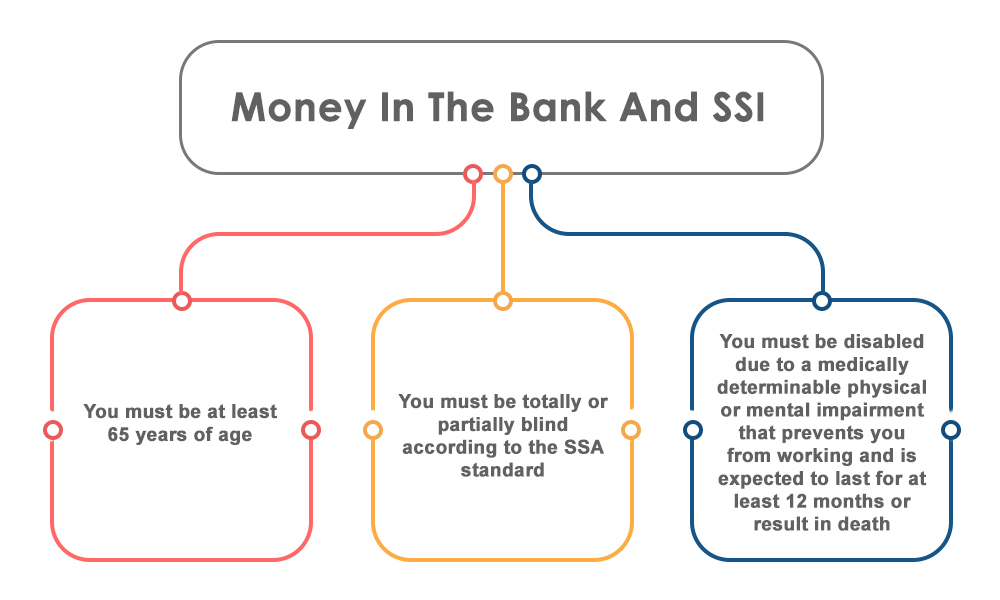

Is there a difference between disability and Social Security disability

The major difference is that SSI determination is based on age/disability and limited income and resources, whereas SSDI determination is based on disability and work credits. In addition, in most states, an SSI recipient will automatically qualify for health care coverage through Medicaid.

Why is Social Security disability higher than regular Social Security

The reason here is that your Social Security benefits will be determined by your PIA for the year you turn 62, while your disability benefits would be calculated with your PIA for the next year. Provided your AIME is the same or higher, then your PIA for the later year will be higher.

Can you collect Social Security disability while collecting Social Security

Many individuals are eligible for benefits under both the Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI) programs at the same time. We use the term “concurrent” when individuals are eligible for benefits under both programs.

Does SSDI watch your bank account

For anyone receiving Social Security Disability Insurance (SSDI) or Social Security retirement benefits, the Disability Law Office stated that the SSA cannot easily check your bank account because “there is no limit to the assets one has in order to be eligible for benefits,” and permission may not be assumed.

Can I have a savings account while on SSDI

Yes. If you receive Social Security Disability Insurance (SSDI) or Supplemental Security Income (SSI) you can have a savings account. However, there could be limits on how much you can have in it, depending on which type of disability benefit you collect.

Does SSI monitor your bank account

The SSI keeps your bank account in check because they need to monitor the money you carry inside of it constantly. Doing this is necessary because the money in your account can determine your eligibility. So yes, the money inside your bank account may disqualify you from Social Security disability benefits.