How much money can you transfer through Navy Federal?

Does Navy Federal have transaction limits

The daily cash limit is $1,000, which includes withdrawals at NFCU proprietary ATMs, manual cash at NFCU financial institutions, and cash back with a purchase at participating merchants. Daily limits may vary for other types of transactions.

What is Navy Federal wire transfer limit

$5,000

Start the transfer by filling out the Domestic or International Wire Transfer Form and providing it to Navy Federal through one of the following methods. Third-party requests greater than $5,000 must be submitted in writing, through a secure message or by visiting a branch.

Cached

How long does Navy Federal take to transfer money to another bank

Processing Time

Transfers are generally credited within 2 to 3 business days, regardless of whether it's a one-time or recurring transfer.

Cached

How much does Navy Federal charge for bank transfers

Fee. The fee for both domestic and international outgoing transfers is $14.50.

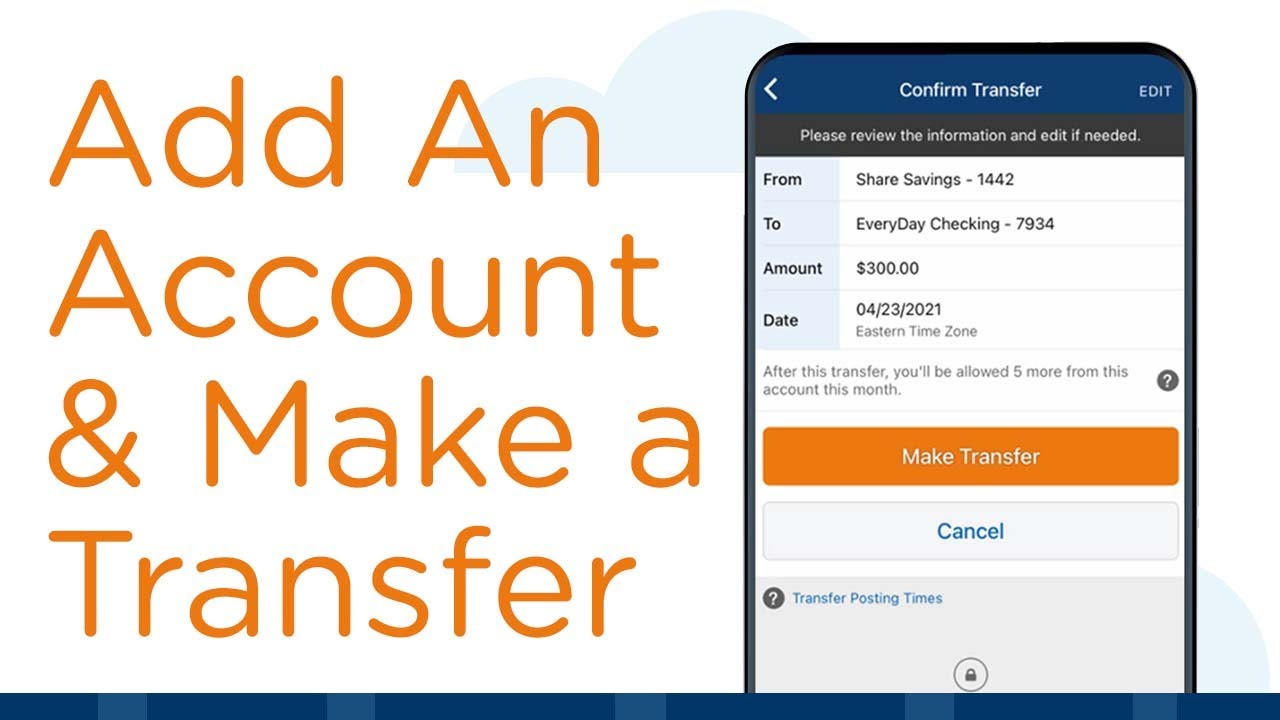

How do I transfer money from Navy Federal to another bank

First you'll need to add the transfer. Account. Information. So click transfers in the bottom navigation bar then select view add accounts. Press the plus sign in the upper right corner then choose

What is the maximum transaction limit per day in federal bank

1 Lac every 24 hours. For NEFT, the transfer limit for non-beneficiary is quick pay limit and for verified beneficiary the limit is Rs. 10 Lac per day.

What is the largest amount you can wire transfer

Is there a wire transfer limit Wire transfers are regulated under the Electronic Fund Transfer Act (EFTA), which does not put a limit on the amount of money a person can transfer. However, financial institutions often impose daily transaction limits on deposits and withdrawals from accounts.

Can I send $5000 through Zelle

If your bank or credit union offers Zelle®, please contact them directly to learn more about their sending limits through Zelle®. If your bank or credit union does not yet offer Zelle®, your weekly send limit is $500 in the Zelle® app. Please note that you cannot request to increase or decrease your send limit.

How to transfer money from Navy Federal to another bank account

First you'll need to add the transfer. Account. Information. So click transfers in the bottom navigation bar then select view add accounts.

Is there a limit on wire transfers

Is there a wire transfer limit Wire transfers are regulated under the Electronic Fund Transfer Act (EFTA), which does not put a limit on the amount of money a person can transfer.

What is a high limit for money transfer

2 lakhs. The maximum amount that can be transferred under this system can vary across banks. There is no upper limit set by the RBI for RTGS transactions.

What is the daily limit for money transfer

Previously, a user could send up to Rs. 2,00,000; however, due to its growing popularity and status as one of the most widely used payment methods, the government increased the daily transaction limit. The daily transaction limit for instant domestic IMPS funds transfer has been increased to Rs. 500,000.

What happens if you transfer more than $10 000

If transactions involve more than $10,000, you are responsible for reporting the transfers to the Internal Revenue Service (IRS). Failing to do so could lead to fines and other legal repercussions.

How to transfer more than $5,000

Here are the best ways to send money:Cash. Max transfer amount: No limit.Bank transfer. Max transfer amount: No limit, although there may be internal transfer limits.PayPal. Max transfer amount: $10,000 per transaction.Google Wallet.Venmo.Xoom.USForex.

How can I send large amounts of money

Best for sending $10,000 or more within the U.S.: Bank wire transfer. Cheapest for international bank-to-bank transfers: MoneyGram. Fastest for international transfers: Xoom. Best for transferring large amounts internationally: OFX.

Can I send $5000 through Venmo

There's a $5,000 per transfer limit. If you want to transfer more than $5,000, you'll need to initiate multiple transfers. If you are using instant transfer, you'll need to make a transfer of at least $0.26 – you can't transfer less than $0.25 using instant transfer.

What happens if you wire transfer more than 10000

If transactions involve more than $10,000, you are responsible for reporting the transfers to the Internal Revenue Service (IRS). Failing to do so could lead to fines and other legal repercussions.

What happens if you transfer more than $10000

Who must file. Generally, any person in a trade or business who receives more than $10,000 in cash in a single transaction or in related transactions must file a Form 8300.

How can I transfer a large sum of money

A bank, money transfer app or currency broker can transfer large sums of money internationally. Currency brokers can be a good option for a large money transfer because they offer personal guidance, no size limits and can be a lot cheaper than the banks.

How do I legally transfer large amounts of money

Wire Transfers

You can send large sums of money from one bank account to another with a wire transfer. These types of transfers are initiated through a bank officer at the delivering bank who fills out the necessary forms. Wire transfers, for the most part, must be done in person.