How much of a tax break do you get for medical expenses?

How much do you get back on taxes for medical expenses

How to claim medical expense deductions

| Filing Status | 2023 Standard Deduction |

|---|---|

| Single | $12,950 |

| Married Filing Jointly | $25,900 |

| Married Filing Separately | $12,950 |

| Head of Household | $19,400 |

Apr 24, 2023

Cached

How do you calculate medical expense deduction

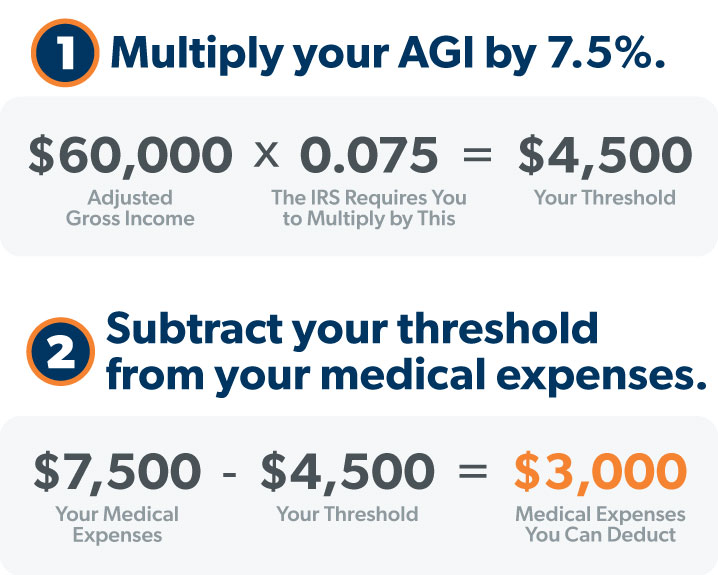

Calculating Your Medical Expense Deduction

The Consolidated Appropriations Act of 2023 made the 7.5% threshold permanent. You can get your deduction by taking your AGI and multiplying it by 7.5%. If your AGI is $50,000, only qualifying medical expenses over $3,750 can be deducted ($50,000 x 7.5% = $3,750).

Cached

Do medical benefits reduce taxable income

If you're wondering if health insurance premiums can be deducted, the answer is no. You are already receiving the tax benefit with your pre-taxed earnings, and you can only claim qualified medical expenses as a post-tax deduction if they were paid for with after-tax earnings.

What if your medical expenses exceed your income

You are allowed to deduct all qualified medical expenses if they are more than the annual adjusted gross income (AGI) limit. The IRS does not have a gross cap on medical deductions because you must itemize all medical expenses and deductible expenses on Form 1040, Schedule A.

Do medical bills affect tax return

If you're itemizing deductions, the IRS generally allows you a medical expenses deduction if you have unreimbursed expenses that are more than 10% of your Adjusted Gross Income. You can deduct the cost of care from several types of practitioners at various stages of care.

Can you write off health insurance

Health insurance premiums are deductible if you itemize your tax return. Whether you can deduct health insurance premiums from your tax return also depends on when and how you pay your premiums: If you pay for health insurance before taxes are taken out of your check, you can't deduct your health insurance premiums.

Does the IRS ask for proof of medical bills

You are not required to send the IRS information forms or other proof of health care coverage when filing your tax return. However, it's a good idea to keep these records on hand.

What qualifies as a qualified medical expense

Some Qualified Medical Expenses, like doctors' visits, lab tests, and hospital stays, are also Medicare-covered services. Services like dental and vision care are Qualified Medical Expenses, but aren't covered by Medicare.

Can I write off my health insurance premiums

Health insurance premiums are deductible if you itemize your tax return. Whether you can deduct health insurance premiums from your tax return also depends on when and how you pay your premiums: If you pay for health insurance before taxes are taken out of your check, you can't deduct your health insurance premiums.

Does health insurance affect your taxes

— If you received health insurance for all or part of the year from an employer or union, your employer or union will send you Form 1095-C. Like Form 1095-B, this form has vital information that you will need to file taxes, properly; however, it will not be included in your actual tax return.

Are medical expenses 100% deductible

You can deduct unreimbursed, qualified medical and dental expenses that exceed 7.5% of your AGI. 1 Say you have an AGI of $50,000, and your family has $10,000 in medical bills for the tax year. You could deduct any expenses over $3,750 ($50,000 × 7.5%), or $6,250 in this example ($10,000 – $3,750).

Do you get a refund if your expenses exceed your income

If your deductions exceed income earned and you had tax withheld from your paycheck, you might be entitled to a refund. You may also be able to claim a net operating loss (NOLs). A Net Operating Loss is when your deductions for the year are greater than your income in that same year.

Can I deduct my house insurance on my taxes

You may look for ways to reduce costs including turning to your tax return. Some taxpayers have asked if homeowner's insurance is tax deductible. Here's the skinny: You can only deduct homeowner's insurance premiums paid on rental properties. Homeowner's insurance is never tax deductible your main home.

Do employers get a tax write off for health insurance

Health insurance tax deductions for employers

When an employer offers a formal health benefit, the expense can generally be written off as a business expense. The Internal Revenue Service (IRS) allows employers to deduct a few different healthcare benefits.

Will I get audited if I claim medical expenses

Claiming deductions for things like charitable donations or medical expenses to lower your tax bill doesn't in itself make you prime audit material. But claiming substantial deductions in proportion to your income does.

Can I deduct health insurance premiums

Health insurance premiums are deductible if you itemize your tax return. Whether you can deduct health insurance premiums from your tax return also depends on when and how you pay your premiums: If you pay for health insurance before taxes are taken out of your check, you can't deduct your health insurance premiums.

What deductions can I claim without receipts

10 Deductions You Can Claim Without ReceiptsHome Office Expenses. This is usually the most common expense deducted without receipts.Cell Phone Expenses.Vehicle Expenses.Travel or Business Trips.Self-Employment Taxes.Self-Employment Retirement Plan Contributions.Self-Employed Health Insurance Premiums.Educator expenses.

Does health insurance affect tax return

You may be eligible to receive a premium tax credit if you obtain your health insurance from the Marketplace. This credit is to assist with monthly premium payments and is determined by the information on your tax return.

Do I have to pay back the premium tax credit

If at the end of the year you've taken more premium tax credit in advance than you're due based on your final income, you'll have to pay back the excess when you file your federal tax return. If you've taken less than you qualify for, you'll get the difference back.

Will a 1095-a lower my tax return

Yes. In some cases, the information on the corrected Form 1095-A may be in your favor – it may decrease the amount of taxes you owe or increase your refund.