How much stimulus do non filers get?

Do non-filers get a stimulus check

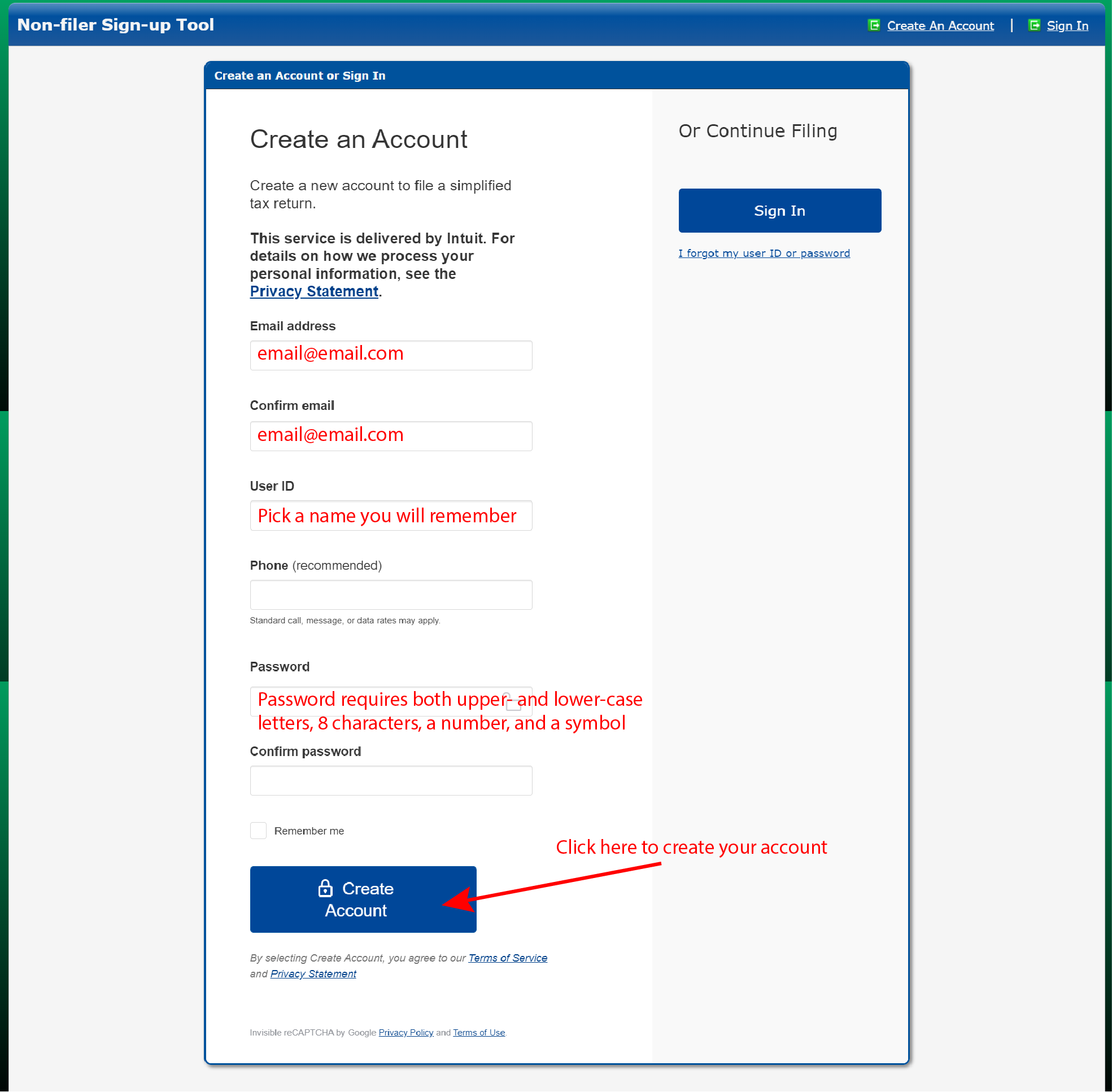

You will get half of this money in 2023 as an advance payment and half in 2023. Even if you don't owe taxes or have no income, you can still get this full tax credit. Fill out the IRS Non-filer tool to get the advance CTC or missed stimulus checks if you are don't need to file a 2023 tax return .

Cached

How much does a single person get for stimulus

U.S. citizens, permanent residents or qualifying resident aliens may qualify for the maximum amount of $1,200 for an individual or $2,400 for married individuals filing a joint return.

Do non tax filers get a 3rd stimulus check

The IRS continues to issue the third Economic Impact Payment to eligible individuals. This includes Social Security recipients and other federal beneficiaries who do not normally file a tax return. Most of these payments will be sent electronically and received on April 7.

Are people on SSI getting a stimulus check in 2023

Although the federal government has not authorized stimulus payments, if you receive an SSI check 2023, you may be entitled to money from the state where you live.

Is it too late to claim stimulus money

It's not too late to claim any stimulus checks you might have missed! You will need to file a 2023 tax return to get the first and second stimulus checks and a 2023 tax return to get the third one.

How do non-filers check payment status

People who aren't required to file a tax return and used the Non-Filers: Enter Payment Info Here tool to register for a payment can check the status of their payment using the Get My Payment tool. These individuals should wait two weeks after submitting their information.

How much is the 1st and 2nd stimulus check per person

The U.S. government has sent out three rounds of stimulus checks — for up to $1,200, $600 and $1,400 — over the past year in response to the coronavirus pandemic.

How much was first and second stimulus

the first Economic Impact Payment was $1,200 ($2,400 if married filing jointly) plus $500 for each qualifying child you had in 2023; and. the second Economic Impact Payment was $600 ($1,200 if married filing jointly) plus $600 for each qualifying child you had in 2023.

Who is eligible for the $1,400 stimulus check

Stimulus payments can total up to $1,400 per person for those with adjusted gross incomes of $75,000 or less as single filers, or $160,000 or less for joint filers.

How much is the 1st 2nd and 3rd stimulus check

The U.S. government has sent out three rounds of stimulus checks — for up to $1,200, $600 and $1,400 — over the past year in response to the coronavirus pandemic.

How much will SSI checks be in 2023 for one person

$914

Generally, the maximum Federal SSI benefit amount changes yearly. SSI benefits increased in 2023 because there was an increase in the Consumer Price Index from the third quarter of 2023 to the third quarter of 2023. Effective January 1, 2023 the Federal benefit rate is $914 for an individual and $1,371 for a couple.

How much money will people on SSI get in 2023

SSI amounts for 2023

| Recipient | Unrounded annual amounts for— | Monthly amounts for 2023 |

|---|---|---|

| 2023 | ||

| Eligible individual | $10,092.40 | $914 |

| Eligible couple | 15,136.93 | 1,371 |

| Essential person | 5,057.77 | 458 |

Can you still file for stimulus money

If you missed the October 2023 filing deadline, you can still file your tax return to get your first and second stimulus checks. If you don't owe taxes, there is no penalty for filing late. To learn more about your options, read the IRS page Filing Past Due Tax Returns.

Is there a time limit to claim stimulus check

If you will be filing a full tax return, you have until the IRS closes their tax filing software on November 20, 2023. After this date, you can still claim the third stimulus check in 2023 by filing your taxes for Tax Year 2023. If you're not required to file taxes, the deadline to use GetCTC.org is November 15, 2023.

How long does it take for the IRS to process a non filers form

Mail or fax the completed IRS Form 4506-T to the address (or FAX number) provided on page 2 of Form 4506-T. If the 4506-T information is successfully validated, tax filers can expect to receive a paper IRS Verification of Non-filing Letter at the address provided on their request within 5 to 10 days.

How much were the 3 stimulus checks

In March 2023, President Biden signed the American Rescue Plan Act, which authorized a third round of federal stimulus checks worth up to $1,400 for each eligible person ($2,800 for couples), plus an additional amount of up to $1,400 for each dependent.

How much was the 3rd stimulus check

$1,400

Third round of stimulus checks: March 2023

The third payment provided eligible individual taxpayers for a check of up to $1,400, while couples filing jointly could receive a maximum of $2,800.

Who qualifies for the $3,000 stimulus check

Families with children between 6 and 17 years old will get $3,000. As for extending the tax credit into 2023, President Joe Biden wants the child tax credit to continue into 2023. It was part of the president's Build Back Better plan.

How do I know if I have the $1400 stimulus check

You can check on the status of your third stimulus check by visiting the IRS Get My Payment tool, available in English and Spanish. If you are missing your third stimulus check, file your 2023 tax return or use GetCTC.org (available until November 15, 2023) if you don't have a filing requirement.

How much was the 1st and 2nd stimulus check

the first Economic Impact Payment was $1,200 ($2,400 if married filing jointly) plus $500 for each qualifying child you had in 2023; and. the second Economic Impact Payment was $600 ($1,200 if married filing jointly) plus $600 for each qualifying child you had in 2023.