How often does a variable rate change?

How often does a variable rate increase

Your interest rate and payment automatically adjust every 6 months.

How often do variable rate loans adjust

With most ARMs, the interest rate and monthly payment change every month, quarter, year, 3 years, or 5 years. The period between rate changes is called the adjustment period.

Can variable rate change at any time

During the time your interest rate is fixed, both your interest rate and your required repayments won't change. A variable interest rate home loan, on the other hand, can change at any time. Lenders may increase or decrease the interest rate attached to the loan.

Does variable interest rate change every month

A variable interest rate fluctuates over time because it is based on an underlying benchmark interest rate or index that changes periodically with the market.

Cached

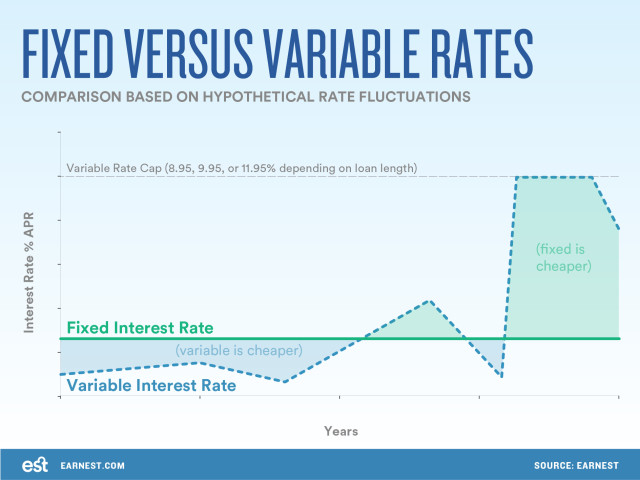

Is it better to go variable or fixed

Is a Variable or Fixed Rate Better In a period of decreasing interest rates, a variable rate is better. However, the trade off is there's a risk of eventual higher interest assessments at elevated rates should market conditions shift to rising interest rates.

How much difference does 1 percent make on a mortgage

Mortgage rates increase in increments of 0.125%, and although one percent may seem like an insignificant amount, a quick glance at the numbers would tell you otherwise. As a rough rule of thumb, every 1% increase in your interest rate lowers your purchase price you can afford for the same payment by about 10%.

What is the biggest mistake on a variable rate mortgage

One of the biggest mistakes you can make is converting your variable rate mortgage into a fixed. I'm not saying that this is never a good idea, as there are times when it can be beneficial for some. But in most cases, converting your variable into a fixed can be a costly move.

Do variable rates ever go down

Loan repayments decrease when interest rates fall. Loans typically get better upfront perks like low introductory rates for an initial loan period. The interest rate for a variable loan is generally lower than a fixed loan, especially when the loan is incurred.

How often can banks change variable interest rate

Lenders' variable rates are influenced by what's happening in the markets, what the Reserve Bank is doing with its cash rate, and many other factors. It might be a few months or even years until you see interest rates change, or it could happen a few times in a month – it's not set in stone.

How high can a variable interest rate go

Variable rates are often capped, but the caps can be as high as 25%. Rates typically start out lower than fixed rates.

Will interest rates go down in 2023

“We expect that 30-year mortgage rates will end 2023 at 5.2%,” the organization noted in its forecast commentary. It since has walked back its forecast slightly but still sees rates dipping below 6%, to 5.6%, by the end of the year.

Is it better to go for a 2 year or 5 year fixed-rate mortgage

Is it better to have a 2 or 5-year fixed mortgage 2-year fixed mortgages often benefit from a lower interest rate, but the 5-year fixed mortgage rates offer you more long-term financial stability, as you're locked into the fixed deal for longer.

Will mortgage interest rates go down in 2023

“[W]ith the rate of inflation decelerating rates should gently decline over the course of 2023.” Fannie Mae. 30-year fixed rate mortgage will average 6.4% for Q2 2023, according to the May Housing Forecast. National Association of Realtors (NAR).

What is one danger of taking a variable rate loan

What Is the Danger of Taking a Variable Rate Loan Your lender can change your interest rate at any time. While this does present opportunities for lower interest rates, you may also be assessed interest at higher rates that are increasingly growing.

What is the disadvantage of a variable mortgage

One of the biggest disadvantages of variable rate mortgages is that your payments can change over time, making it harder to budget. If you want peace of mind that your payments will remain the same for a set period of time, you may prefer to the security of a fixed rate mortgage.

What is the biggest downside to variable rate loans

unpredictability

The biggest downside of variable-rate loans is the unpredictability. It is almost impossible to know what the future holds in terms of interest rates.

Is it better to go variable or fixed right now

If you're concerned about future payments and your budget, it's likely worth it to lock in now. The benefits of knowing exactly what your monthly payments are for the next five years with a fixed-rate mortgage can trump any savings you may get from a variable one.

How high will interest rates go by the end of 2023

The Mortgage Bankers Association predicts rates will fall to 5.5 percent by the end of 2023 as the economy weakens. The group revised its forecast upward a bit — it previously expected rates to fall to 5.3 percent.

How high will interest rates go 2023

Mortgage rate predictions for 2023

| Housing Authority | 30-Year Mortgage Rate Forecast (Q2 2023) |

|---|---|

| National Association of Home Builders | 6.36% |

| Fannie Mae | 6.40% |

| Mortgage Bankers Association | 6.40% |

| Average Prediction | 6.35% |

How high will interest rates go in 2023

Since the start of 2023, the Fed has hiked rates 10 times to combat rising inflation. As of May 2023, the federal funds rate ranges from 5.00% to 5.25%. If this prediction is correct, it won't be surprising to see some of the best high-yield savings accounts offering rates exceeding 4%.