How quickly does a cashier’s check clear?

Do cashiers checks clear immediately

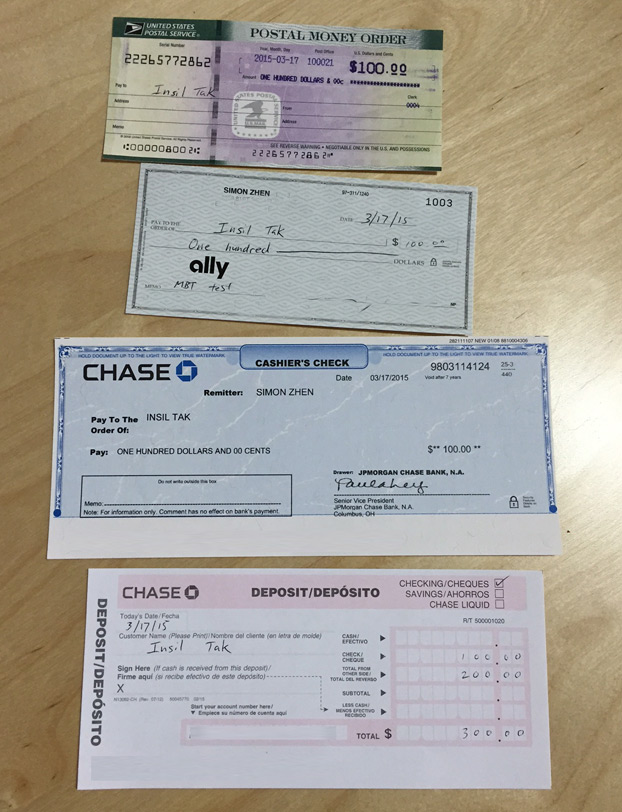

Cashier's checks are also useful in time-sensitive transactions. The funds are usually available immediately—in most cases, the next day. If you're looking to make a big money purchase, a cashier's check may be the quickest and safest way to go.

Cached

Does a cashier’s check get deposit instantly

Federal regulations require banks to make funds deposited in an account by cashier's, certified, or teller's checks available for withdrawal not later than the business day after the banking day on which the deposit takes place, the same as for cash deposits, but only if certain conditions are met.

Cached

How long does it take for a $30000 cashier’s check to clear

Time It Takes For Checks To Clear

| Type of Check | Time To Clear |

|---|---|

| Cashier's Checks | Can clear on the next business day, unless a bank suspects there might be fraud, then could be several weeks |

| Money Orders | Can clear on the next business day, unless a bank suspects there might be fraud, then could be several weeks |

CachedSimilar

Why is there a 7 day hold on a cashier’s check

Banks place holds on checks to make sure that the check payer has the bank funds necessary to clear it. In addition to protecting your bank, a hold can protect you from spending funds from a check that is later returned unpaid. That's important because it could help you avoid accidental overdrafts and related fees.

What is the maximum amount for a cashier’s check

Cashier's checks are good for large purchases.

Cashier's checks are typically used for larger purchases. Although the policy may change from bank to bank, generally there's no upper limit for a cashier's check.

What happens when you deposit over $10000 check

Depositing over $10k only results in an IRS form being filed by the bank. You often won't have to do anything to explain it unless you are suspected of fraud or money laundering.

Can a cashier’s check be deposited same day

Generally, cashier's checks must be made available by the next business day.

What happens when you deposit over $10000 cashiers check

However, for individual cashier's checks, money orders or traveler's checks that exceed $10,000, the institution that issues the check in exchange for currency is required to report the transaction to the government, so the bank where the check is being deposited doesn't need to.

What is the biggest amount for a cashier’s check

Cashier's checks are typically used for larger purchases. Although the policy may change from bank to bank, generally there's no upper limit for a cashier's check.

What is the highest amount a cashiers check can hold

Cashier's checks are typically used for larger purchases. Although the policy may change from bank to bank, generally there's no upper limit for a cashier's check.

How long does a bank have to hold a cashier’s check

There's no set or specified expiration date for cashier's checks.

Can you cash a $10000 cashier’s check

And the IRS treats cashier's checks of $10,000 or less as cash. Cashier's checks of more than $10,000 are not considered cash — so they don't need to be reported on Form 8300. Your cashier's check may also need to be reported on Form 8300 if you use it in combination with cash in a transaction of larger than $10,000.

Where can I cash a $20000 check without a bank account

Cash it at the issuing bank (this is the bank name that is pre-printed on the check) Cash a check at a retailer that cashes checks (discount department store, grocery stores, etc.) Cash the check at a check-cashing store. Deposit at an ATM onto a pre-paid card account or checkless debit card account.

How much check can I deposit without being flagged

Are Financial Institutions Required to Report Large Deposits Banks and credit unions are required to report when a customer deposits cash over $10k.

When I deposit a cashier’s check are the funds available

When you deposit a check, you might see the money in your account, but you can't withdraw all of that money until the bank "clears" the deposit. Personal checks might take several days or weeks, but cashier's checks typically make the funds available within one business day.

What is the largest amount for a cashier’s check

Cashier's checks are typically used for larger purchases. Although the policy may change from bank to bank, generally there's no upper limit for a cashier's check.

Will a bank cash a large cashier’s check

You can usually cash a cashier's check at the issuing bank, regardless of the amount it's drawn for once you endorse it, even if you don't have an account there. Alternatively, it's possible to cash a cashier's check at a check-cashing store, but there might be a fee.

Where can I cash a $30000 cashier’s check

You can cash a cashier's check at banks and credit unions. If you're not a customer of the financial institution, you'll likely have to pay a fee.

Where can I cash a $50000 check without a bank account

If you want to cash a large check without a bank account, you'll need to visit the bank or credit union that issued the check to you. If you're not an account holder, you may also be charged a fee for the service.

What happens when you deposit a check over $10000

Depositing over $10k only results in an IRS form being filed by the bank. You often won't have to do anything to explain it unless you are suspected of fraud or money laundering.