How should I categorize my receipts?

How do you categorize receipts

Sort by type

After receiving a receipt, separate receipts by the type of business expense. For example, place office supplies receipts in one pile and meal and entertainment receipts in another. Consider adding codes to each receipt to categorize expenses (e.g., Code 125 for meals).

Cached

What is the best way to organize expense receipts

The 6 Best Ways to Organize Receipts ElectronicallySave Receipts to Google Drive.Use Evernote.Use WellyBox.Scan or Download to Your Personal Computer.Merge Your Receipts into One Document.FreshBooks Receipt Scanning.

Cached

How do I organize my self employed receipts

Buy color-coded folders to store your receipts and documentation, so you can easily find the documentation you need later. Those folders might include: Home and office expenses: receipts; electricity, gas, and water bills; home repairs, maintenance, and renovations; internet and phone bills.

Cached

How do you organize receipts for an expense report

How to Organize Receipts for an Expense ReportClear off your desk or workstation.Round up Receipts.Sort receipts by date.Sort receipts by time.Assemble and affix receipts.Complete your expense report.Take a receipt envelope with you.Presort receipts during your trip.

What are the three types of receipts

Difference between capital receipts and revenue receipts

| Capital Receipt | Revenue Receipt |

|---|---|

| Non-Recurring nature | Recurring Nature |

| Receipts not received during normal business activities. | Receipts received during normal business activities. |

| Amount realised by sale of fixed assets. | Amount realised by sale of goods. |

What do I do with all my receipts

Do You Need to Save Your Receipts for Taxes Many people often ask if they really need to keep all of their receipts for taxes, and the short answer is yes. If you plan to deduct that expense from your gross income, you need to have proof that you made the purchase.

How do I organize my monthly bills and receipts

11 easy ways to organize your billsCreate a detailed monthly budget. A detailed monthly budget caps your expenses.Use a bill checklist.Set up automatic payments.Track your receipts.Use budgeting tools.Create a bill command center.Use a binder.Download a bill storage template.

How do you categorize receipts for taxes for small business

Make a separate label for each category on file folder labels or small pieces of paper. Attach each label to a file folder or insert the paper into a file folder label holder. As an alternative to file folders, write the receipt categories on separate envelopes.

Are pictures of receipts OK for taxes

Picture copies are fine (as long as they meet the requirements above), but they don't actually do anything for your business beyond functioning as a record. New business owners still need to copy receipt data into a spreadsheet and add everything up to manage their finances – draining your time almost as much.

What is the IRS requirement for receipts

Your supporting documents should identify the payee, the amount paid, proof of payment, the date incurred, and include a description of the item to show that the amount was for purchases.

How do you record receipts in accounting

In your journal, you will want to record:The transaction date.Notes about the transaction.Check number (if applicable)Amount.Cash receipt account types (e.g., accounts receivable)Any sales discounts.

Should I keep grocery receipts for taxes

Supporting documents include sales slips, paid bills, invoices, receipts, deposit slips, and canceled checks. These documents contain the information you need to record in your books. It is important to keep these documents because they support the entries in your books and on your tax return.

What are the different statuses for receipts

A receipt can have one of the following statuses:Approved: This receipt has been approved for automatic receipt creation.Confirmed: The customer has approved the application of this receipt and their account balances have been updated within Receivables.Remitted: This receipt has been remitted.

Why shouldn’t you throw away receipts

Is it Safe to Shred Receipts Yes, and experts state that it is safe to throw away receipts only if they contain no personal information whatsoever, such as a grocery or coffee shop receipt. However, there are exceptions to even those rules—here's what receipts you should shred: ATM receipts.

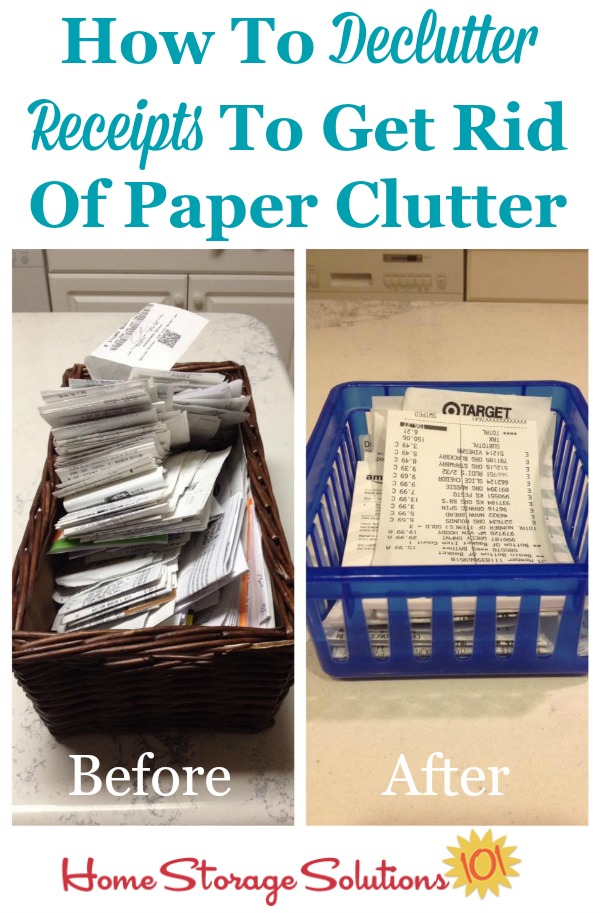

How do you declutter receipts

What I don't need anymore. And then place everything that I'm going to keep long term back into its section.

How do I make a list of monthly expenses

What monthly expenses should I include in a budgetHousing. Whether you own your own home or pay rent, the cost of housing is likely your biggest monthly expense.Utilities.Vehicles and transportation costs.Gas.Groceries, toiletries and other essential items.Internet, cable and streaming services.Cellphone.Debt payments.

How do I organize my monthly expenses

Here are six ways to organize your finances.Review Your Budget Monthly. Make it a habit to review your budget at least once a month to see if you've been spending within your means.Automate Your Savings.Create a Payday Routine.Separate Discretionary Spending.Organize and Automate Your Bills.Make a Plan to Manage Debt.

What is the IRS rule on receipts

You generally must have documentary evidence, such as receipts, canceled checks, or bills, to support your expenses. Additional evidence is required for travel, entertainment, gifts, and auto expenses.

Can I use my gas receipts for taxes

If you're claiming actual expenses, things like gas, oil, repairs, insurance, registration fees, lease payments, depreciation, bridge and tunnel tolls, and parking can all be deducted." Just make sure to keep a detailed log and all receipts, he advises, and keep track of your yearly mileage and then deduct the …

What type of receipts to save for taxes

For self-employed individuals, it is often helpful to save receipts from every purchase you make that is related to your business and to keep track of all of your utility bills, rent, and mortgage information for consideration at tax time.