How to access PNC home equity line of credit?

How do I access my home equity line of credit

You can access it via online transfer or with a bank card at an ATM or point of sale (same as with a debit card), or you can write checks from the account if the lender issues them. Most HELOCs have adjustable interest rates.

How do I withdraw money from my home equity

Overview of options for cashing out your home equityThe most common options for tapping equity in your home are a home equity loan, HELOC or cash-out refinance.A home equity loan is an installment loan based on your home's equity.A home equity line of credit (HELOC) is a credit line based on your home equity.

How long does it take to get a HELOC from PNC Bank

How long does the funding process take

| HELOC or home equity loan | Funding time | |

|---|---|---|

| Regions Bank | Both | Funds are available 3 business days after closing. |

| PNC Bank | HELOC | Closing often occurs 7 to 10 days after final approval. PNC doesn't specify how soon funds are available. |

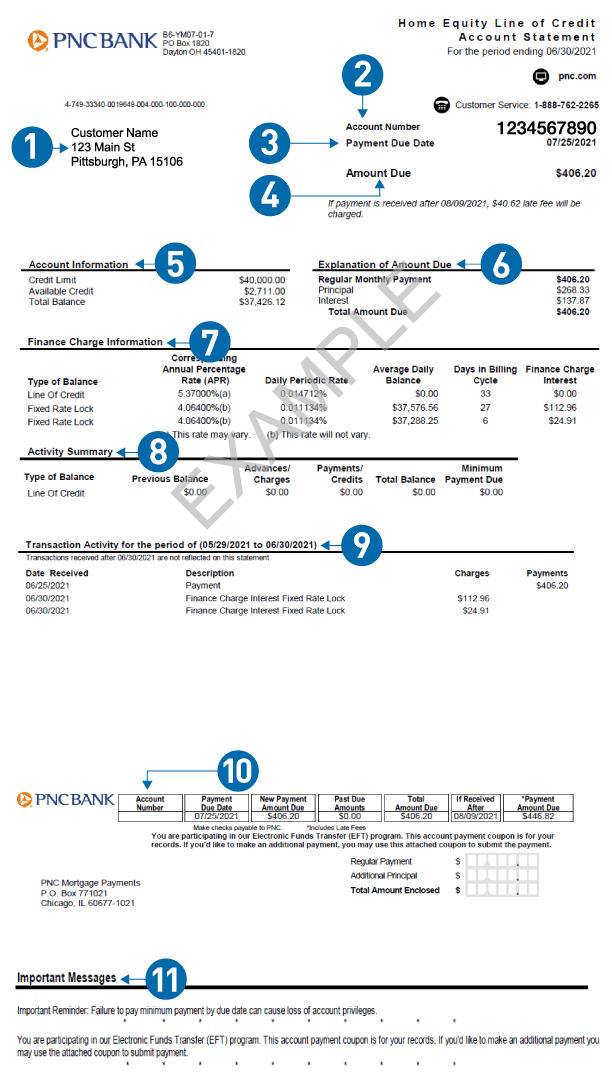

How do I pay my PNC credit line

Make a one-time, same-day payment using our Voice Banking service. Pay over the phone with Voice Banking by calling 1-888-PNC-BANK (1-888-762-2265). If paying from a non-PNC deposit account, have your account number and routing number available. Make a payment with a PNC Agent over the phone.

How do I access my line of credit

To access money from a line of credit, you may:write a cheque drawn on your line of credit.use an automated teller machine ( ATM )use telephone or online banking to pay a bill.use telephone or online banking to transfer money to your chequing account.

Can I write a check to myself from my home equity line of credit

You control how much you owe.

A HELOC has a revolving balance that works like a credit card. You can use these funds for anything you want—by making a transfer, writing a check, or using a debit card. Because you control how much of the line you use, a HELOC is a more flexible option than a loan.

Can I use money from my home equity

Although the amount of equity you can take out of your home varies from lender to lender, most allow you to borrow 80 percent to 85 percent of your home's appraised value.

When you take equity out of your home do you pay it back

When you get a home equity loan, your lender will pay out a single lump sum. Once you've received your loan, you start repaying it right away at a fixed interest rate. That means you'll pay a set amount every month for the term of the loan, whether it's five years or 30 years.

Does a HELOC get deposited into your bank account

HELOC Account Access

If you requested funds to be drawn down immediately, they will be deposited directly into your Checking or Savings account four business days after your closing.

Are HELOC funds available immediately

Once you close your loan, federal regulations require that we wait three business days after closing before we provide the loan or line of credit proceeds are available to you. During those three days, you have the right to cancel the transaction.

How do I check my PNC loan balance

Once you have signed onto Online Banking: Select your loan account from the My Accounts Summary page. You will be sent to your Account Activity page. From your Account Activity page, you should find information regarding your loan payoff.

What payment app does PNC use

With PNC Pay, quickly make purchases using the PNC Mobile app or your Android device. You may even be able to pay with rewards! Enjoy the convenience of tap and go payments, security and all the benefits your PNC Visa® card offers.

Can I access my line of credit with my debit card

A personal line of credit carries a lower interest rate than most credit cards, plus it can be accessed straight from your debit card.

Can you borrow money from your line of credit

A line of credit is a preset amount of money that a financial institution like a bank or credit union has agreed to lend you. You can draw from the line of credit when you need it, up to the maximum amount. You'll pay interest on the amount you borrow.

Can I withdraw cash from HELOC

During the term of a HELOC loan, you're able to withdraw the money as and when you need it up to the approved limit of the loan, known as the loan's drawdown period. You only pay interest on the amount you withdraw, not the total amount you've been approved for.

Can you roll your home equity line of credit into your mortgage

Yes, you can refinance a HELOC into a mortgage. You can do this by getting a cash-out refinance and using the funds to pay off the line of credit, or by consolidating the outstanding balance on a HELOC into a traditional refinance of your home's primary mortgage.

What are you allowed to use a home equity loan for

Often best suited for large, one-time expenses, home equity loans are beneficial if you need help with expenses like short-term home improvements or a new car. This type of loan typically has a fixed interest rate.

Can I take equity out of my house without refinancing

Sale-Leaseback Agreement. One of the best ways to get equity out of your home without refinancing is through what is known as a sale-leaseback agreement. In a sale-leaseback transaction, homeowners sell their home to another party in exchange for 100% of the equity they have accrued.

Is it good or bad to take equity out of your home

A home equity loan could be a good idea if you use the funds to make home improvements or consolidate debt with a lower interest rate. However, a home equity loan is a bad idea if it will overburden your finances or only serves to shift debt around.

Can HELOC be cashed out

During the term of a HELOC loan, you're able to withdraw the money as and when you need it up to the approved limit of the loan, known as the loan's drawdown period. You only pay interest on the amount you withdraw, not the total amount you've been approved for.