How to contact IRS about missing Child Tax Credit?

Who to call if you didn t receive your child tax credit

the IRS 800-919-9835

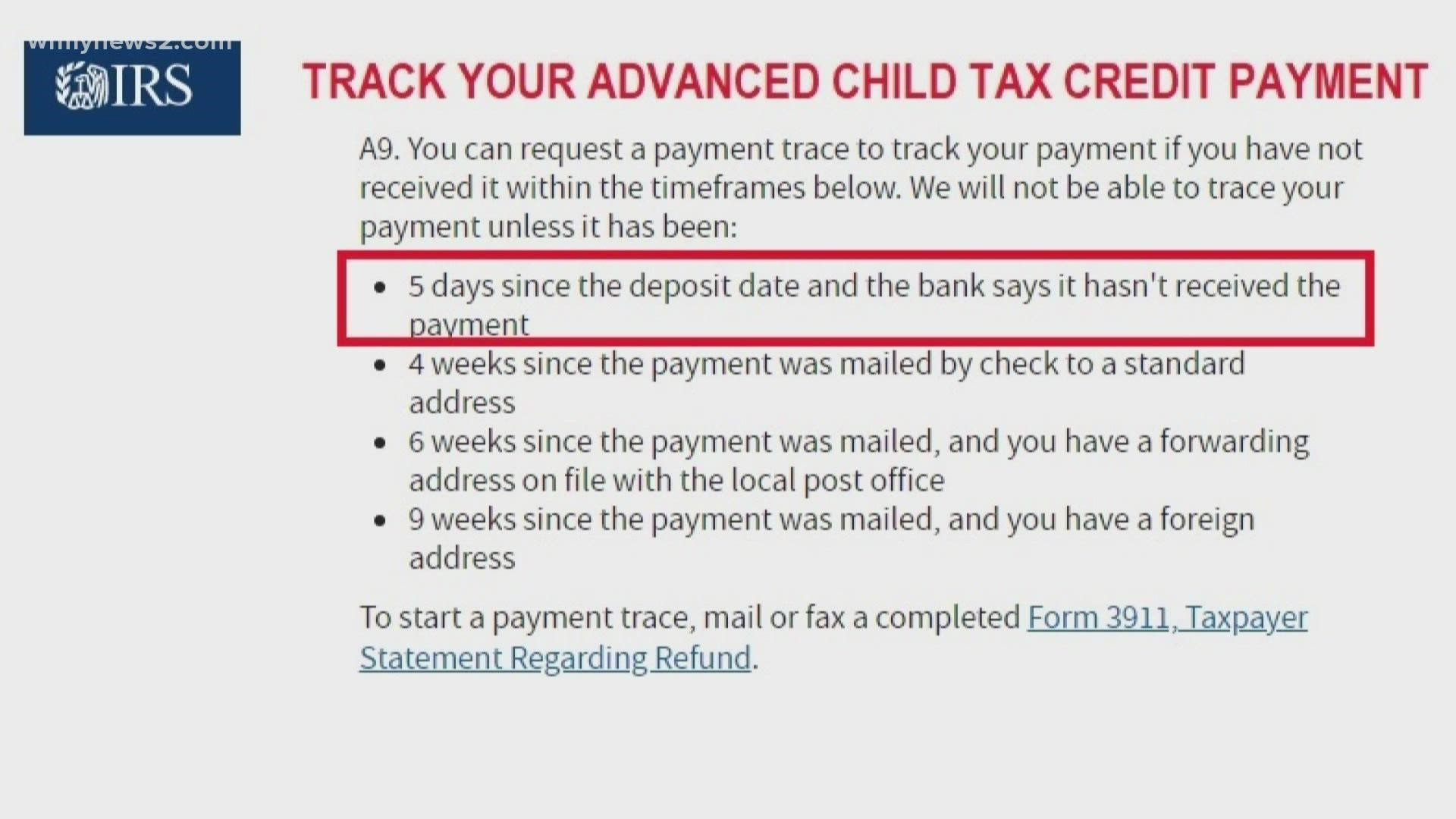

There are two ways to start the trace — by phone or by mail/fax. To make the request by phone, call the IRS 800-919-9835. If you'd rather send the request by mail or fax, send a completed Form 3911, Taxpayer Statement Regarding Refund. Note: If you file jointly, BOTH spouses must sign the form.

How do I report a missing child tax credit check to the IRS

To request a payment trace, either call the IRS at 800-919-9835, or mail or fax a completed Form 3911, Taxpayer Statement Regarding Refund to the IRS as shown in the chart further below.

Cached

How do I contact the IRS about my child tax credit letter

You can call 1-800-829-1040 to get answers to your federal tax questions 24 hours a day.

What do I do if I’m missing a child tax credit payment

If you are eligible for the Child Tax Credit, but did not receive part or all of your advance Child Tax Credit payments, you can claim the full credit amount when you file your 2023 tax return during the 2023 tax filing season.

Can I track my child tax credit check

You can check the status of your payments with the IRS: For Child Tax Credit monthly payments check the Child Tax Credit Update Portal. For stimulus payments 1 and 2 check Where's My Refund.

How long does it take the IRS to reissue a check

about six weeks

If the check hasn't been cashed, you'll get a replacement refund check in about six weeks. If your original refund check was cashed, you'll receive a claim package within six weeks to complete and return to the Bureau of the Fiscal Service to process your claim.

What do I do if I lost my 6419 form

The IRS sent Letter 6419 out from December 2023 through January 2023, so you should have received yours by now. But don't worry if you weren't sent a letter, didn't receive it or threw it out. You can also use the IRS' CTC Update Portal or create and check your IRS account for a record of your advance CTC payments.

What to do if you didn t receive letter 6419

The IRS sent Letter 6419 out from December 2023 through January 2023, so you should have received yours by now. But don't worry if you weren't sent a letter, didn't receive it or threw it out. You can also use the IRS' CTC Update Portal or create and check your IRS account for a record of your advance CTC payments.

How to get my 6419 letter online

What if I can't find my Letter 6419Click the “Sign in to Your Online Account” button.Click “ID.me Create New Account” on the next page.Follow the on-screen instructions to provide information to set up the secure ID.me account.

What number do I call to talk to someone at the IRS

800-829-1040

Contact an IRS customer service representative to correct any agency errors by calling 800-829-1040 (see telephone assistance for hours of operation).

How do I do a payment trace with the IRS

Use Where's My Refund, call us at 800-829-1954 and use the automated system, or speak with an agent by calling 800-829-1040 (see telephone assistance for hours of operation). However, if you filed a married filing jointly return, you can't initiate a trace using the automated systems.

How do you check for your child credit check

Checking the Credit of a Child Who Is 13 or Older

By visiting AnnualCreditReport.com – the only website federally authorized to provide credit reports from Experian, Equifax and TransUnion for free – your child can enter his or her personal information to receive a copy of each report.

How do I speak to a live person at the IRS

Contact an IRS customer service representative to correct any agency errors by calling 800-829-1040 (see telephone assistance for hours of operation).

Can I live chat with an IRS agent

IRS Customer Service, Online Live Chat

The IRS live chat feature can be found on many of their pages by clicking the "Start a conversation" button at the bottom of a limited number of IRS web pages. If you plan to chat with the IRS online, have your information ready for verification.

How to get my letter 6419 online

What if I can't find my Letter 6419Click the “Sign in to Your Online Account” button.Click “ID.me Create New Account” on the next page.Follow the on-screen instructions to provide information to set up the secure ID.me account.

What if i didn t get letter 6419 for child tax credit payments

What Happens if You Didn't Get Letter 6419 or Lost It The IRS sent Letter 6419 out from December 2023 through January 2023, so you should have received yours by now. But don't worry if you weren't sent a letter, didn't receive it or threw it out.

What if I did not receive letter 6419

The IRS sent Letter 6419 out from December 2023 through January 2023, so you should have received yours by now. But don't worry if you weren't sent a letter, didn't receive it or threw it out. You can also use the IRS' CTC Update Portal or create and check your IRS account for a record of your advance CTC payments.

Can I get another copy of IRS letter 6419

You can also contact the IRS via phone at 1-800-829-1040. If you did receive the letter — but lost or misplaced it — the process will be the same. Contact the IRS or access the CTC portal as soon as possible to make sure you can file accurate taxes.

How do I talk to a real person at the IRS without waiting

How to speak directly to an IRS representativeCall the IRS at 1-800-829-1040 during their support hours.Select your language, pressing 1 for English or 2 for Spanish.Press 2 for questions about your personal income taxes.Press 1 for questions about a form already filed or a payment.Press 3 for all other questions.

Can I chat with a live agent at IRS

IRS Customer Service, Online Live Chat

In March of 2023, the IRS implemented chatbots and live agents to give a quick, online means to contact an IRS representative with simple questions. The automated responses can also answer questions before connecting to a real person.