How to get my credit score from 770 to 800?

How to get 800 credit score from 770

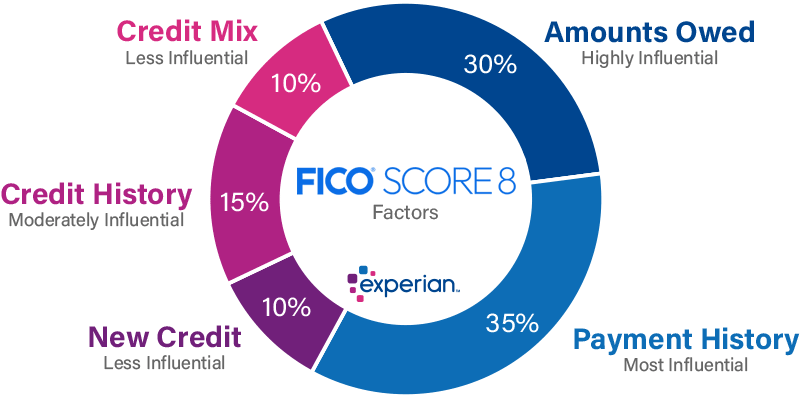

4 key factors of an excellent credit scoreOn-time payments. The best way to get your credit score over 800 comes down to paying your bills on time every month, even if it is making the minimum payment due.Amounts owed.Credit history.Types of accounts and credit activity.

How long does it take to go from 720 to 800 credit score

Depending on where you're starting from, It can take several years or more to build an 800 credit score. You need to have a few years of only positive payment history and a good mix of credit accounts showing you have experience managing different types of credit cards and loans.

Cached

How to increase credit score from 780 to 800

5 Habits To Get 800+ Credit ScorePay Your Bills on Time – All of Them. Paying your bills on time can improve your credit score and get you closer to an 800+ credit score.Don't Hit Your Credit Limit.Only Spend What You Can Afford.Don't Apply for Every Credit Card.Have a Credit History.What an 800+ Credit Score Can Mean.

Cached

How long will it take to get a 800 credit score

Most people with an 800 credit score have a long credit history, just a little under 22 years. Credit history length does not represent how long you've used credit. Rather, it represents the average age of the open accounts on your credit report. If you close an old credit card, it can shorten your credit history.

Can I buy a house with 770 credit score

Can I buy a house if my credit score is low Depending on the type of loan you are interested in borrowing, yes. Many conventional loans allow you to borrow with a ”fair” credit score of 620 or higher, though your interest rate may be higher than it would be with a higher credit score.

How many people have a 770 credit score

A 770 FICO® Score is above the average credit score. Consumers in this range may qualify for better interest rates from lenders. 25% of all consumers have FICO® Scores in the Very Good range.

Can my credit score go up 200 points in a month

There are several actions you may take that can provide you a quick boost to your credit score in a short length of time, even though there are no short cuts to developing a strong credit history and score. In fact, some individuals' credit scores may increase by as much as 200 points in just 30 days.

Is 770 a good credit score

Although ranges vary depending on the credit scoring model, generally credit scores from 580 to 669 are considered fair; 670 to 739 are considered good; 740 to 799 are considered very good; and 800 and up are considered excellent.

How rare is a 780 credit score

A 780 FICO® Score is above the average credit score. Borrowers with scores in the Very Good range typically qualify for lenders' better interest rates and product offers. 25% of all consumers have FICO® Scores in the Very Good range.

Why is it so hard to get a 800 credit score

Since the length of your credit history accounts for 15% of your credit score, negative, minimal or no credit history can stop you from reaching an 800 credit score. To solve this problem, focus on building your credit. You can do this by taking out a credit-builder loan or applying for your first credit card.

What qualifies an 800 credit score

If you have a credit score of 800, it probably means you have a long credit history, have been making payments on time and keep a low credit utilization ratio.

How many people have 770 credit score

A 770 FICO® Score is above the average credit score. Consumers in this range may qualify for better interest rates from lenders. 25% of all consumers have FICO® Scores in the Very Good range.

What credit score is needed to buy a 300k house

620-660

Additionally, you'll need to maintain an “acceptable” credit history. Some mortgage lenders are happy with a credit score of 580, but many prefer 620-660 or higher.

How rare is 900 credit score

What percentage of the population has a credit score over 900 Only about 1% of people have a credit score of 850. A 900 credit score can be thought of as fairly unrealistic.

How high can a credit score jump in a month

There are several actions you may take that can provide you a quick boost to your credit score in a short length of time, even though there are no short cuts to developing a strong credit history and score. In fact, some individuals' credit scores may increase by as much as 200 points in just 30 days.

What’s the highest your credit score can jump in one month

In fact, some consumers may even see their credit scores rise as much as 100 points in 30 days. Learn more: Lower your credit utilization rate.

Can I buy a car with 770 credit score

While there is no formal definition of what a “very good” credit score is, most experts would consider your 770 FICO Score to fall in that category. This is an above average credit score that puts you in an excellent position to get a great rate on a mortgage or auto loan.

How to increase credit score from 780 to 850

Tips to Perfect Your Credit ScorePay your credit card bills often.Keep a solid payment history.Consider your credit mix.Increase your credit limit.Don't close old accounts.Regularly monitor your credit report.Only apply for credit when you really need it.

How to get 800 credit score in 45 days

Here are 10 ways to increase your credit score by 100 points – most often this can be done within 45 days.Check your credit report.Pay your bills on time.Pay off any collections.Get caught up on past-due bills.Keep balances low on your credit cards.Pay off debt rather than continually transferring it.

How to go from 760 credit score to 800

How to Get an 800 Credit ScorePay Your Bills on Time, Every Time. Perhaps the best way to show lenders you're a responsible borrower is to pay your bills on time.Keep Your Credit Card Balances Low.Be Mindful of Your Credit History.Improve Your Credit Mix.Review Your Credit Reports.