How to increase 813 credit score?

What can I do with a credit score of 813

With an 813 credit score, you are well-positioned to qualify for any financial product, from the best credit cards and personal loans to the best auto loans and mortgages. An 813 credit score doesn't guarantee you approval, however, because your income and existing debt obligations matter, too.

Cached

How many people have a credit score of 813

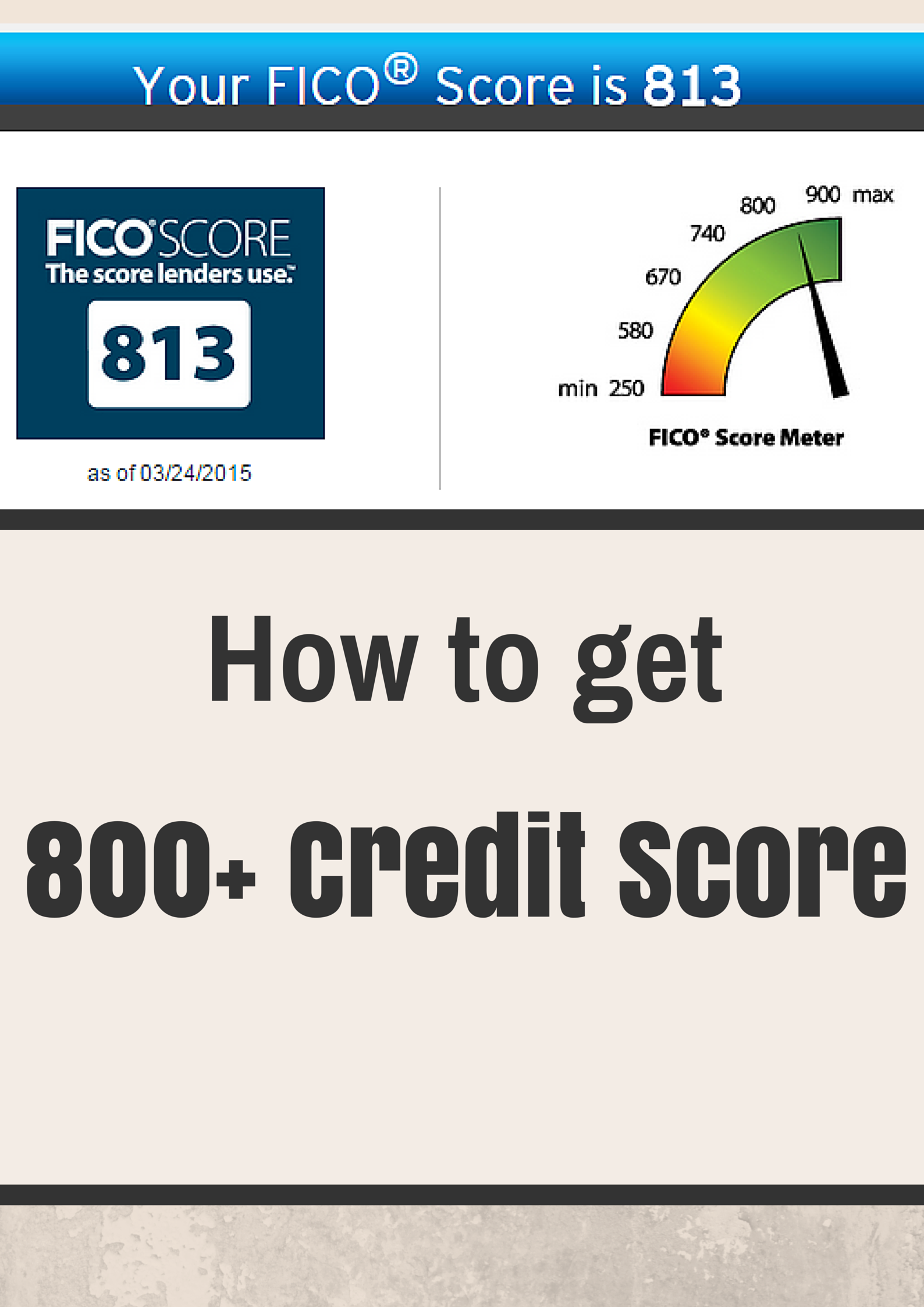

In short, an 813 credit score puts you in the top tier of U.S. consumers in the eyes of lenders. In the widely used FICO credit scoring model, scores range from 300 to 850. The average credit score was 714 in 2023. Fewer than one-fourth of U.S. adults have credit scores of 800 or higher.

Cached

How to increase credit score from 810 to 850

Tips to Perfect Your Credit ScorePay your credit card bills often.Keep a solid payment history.Consider your credit mix.Increase your credit limit.Don't close old accounts.Regularly monitor your credit report.Only apply for credit when you really need it.

Cached

How to go from 800 to 900 credit score

7 ways to achieve a perfect credit scoreMaintain a consistent payment history.Monitor your credit score regularly.Keep old accounts open and use them sporadically.Report your on-time rent and utility payments.Increase your credit limit when possible.Avoid maxing out your credit cards.Balance your credit utilization.

How rare is a 810 credit score

An 810 credit score is considered very good. In fact, just 21% of consumers in the U.S. have a credit score of 800 or higher. By comparison, the national average credit score is 714, according to Experian.

Is 800 credit score rare

According to a report by FICO, only 23% of the scorable population has a credit score of 800 or above.

How rare is 800 credit score

According to a report by FICO, only 23% of the scorable population has a credit score of 800 or above.

How rare is a 850 credit score

While achieving a perfect 850 credit score is rare, it's not impossible. About 1.3% of consumers have one, according to Experian's latest data. FICO scores can range anywhere from 300 to 850. The average score was 714, as of 2023.

Why is it so hard to get a 800 credit score

Since the length of your credit history accounts for 15% of your credit score, negative, minimal or no credit history can stop you from reaching an 800 credit score. To solve this problem, focus on building your credit. You can do this by taking out a credit-builder loan or applying for your first credit card.

Why is it so hard to get a credit score of 850

According to FICO, about 98% of “FICO High Achievers” have zero missed payments. And for the small 2% who do, the missed payment happened, on average, approximately four years ago. So while missing a credit card payment can be easy to do, staying on top of your payments is the only way you will one day reach 850.

How rare is an 800 credit score

23%

According to a report by FICO, only 23% of the scorable population has a credit score of 800 or above.

Does anyone have an 850 credit score

While achieving a perfect 850 credit score is rare, it's not impossible. About 1.3% of consumers have one, according to Experian's latest data. FICO scores can range anywhere from 300 to 850. The average score was 714, as of 2023.

Does anyone have an 840 credit score

Your 840 FICO® Score falls in the range of scores, from 800 to 850, that is categorized as Exceptional. Your FICO® Score is well above the average credit score, and you are likely to receive easy approvals when applying for new credit. 21% of all consumers have FICO® Scores in the Exceptional range.

Does anyone have a 850 credit score

While achieving a perfect 850 credit score is rare, it's not impossible. About 1.3% of consumers have one, according to Experian's latest data. FICO scores can range anywhere from 300 to 850. The average score was 714, as of 2023.

Is A 900 credit score good

Although ranges vary depending on the credit scoring model, generally credit scores from 580 to 669 are considered fair; 670 to 739 are considered good; 740 to 799 are considered very good; and 800 and up are considered excellent.

Does anyone have 900 credit score

Your credit score ranges from 300 to 900, with no credit score or 300 being the lowest and 900 being the highest credit score. Higher the credit score; lower the risk of getting loan applications rejected by lenders.

Is it rare to have an 800 credit score

According to a report by FICO, only 23% of the scorable population has a credit score of 800 or above.

Can my credit score go up 200 points in a month

There are several actions you may take that can provide you a quick boost to your credit score in a short length of time, even though there are no short cuts to developing a strong credit history and score. In fact, some individuals' credit scores may increase by as much as 200 points in just 30 days.

Is it rare to have an 850 credit score

While achieving a perfect 850 credit score is rare, it's not impossible. About 1.3% of consumers have one, according to Experian's latest data. FICO scores can range anywhere from 300 to 850. The average score was 714, as of 2023.

How rare is 830 credit score

Your score falls in the range of scores, from 800 to 850, that is considered Exceptional. Your FICO® Score and is well above the average credit score. Consumers with scores in this range may expect easy approvals when applying for new credit. 21% of all consumers have FICO® Scores in the Exceptional range.