How to use Citi credit card internationally?

Can I use my Citi Visa card internationally

Yes, you can.

Do I need to notify Citi card of international travel

You need to set a Citi travel notification any time you're taking a trip. This will prevent your account from being suspended due to suspected fraud when you're in an unusual area. You're never required add a travel notice to your Citibank account, but it is recommended for both foreign and domestic travel.

Can I use my Citibank card abroad

Free cash withdrawals overseas

With over 13,000 ATMs in 20 countries, you can be assured there's a Citibank® ATM near you. Enjoy free cash withdrawals from Citibank® ATMs overseas. Plus, you can even withdraw in the local currency of the country you're in.

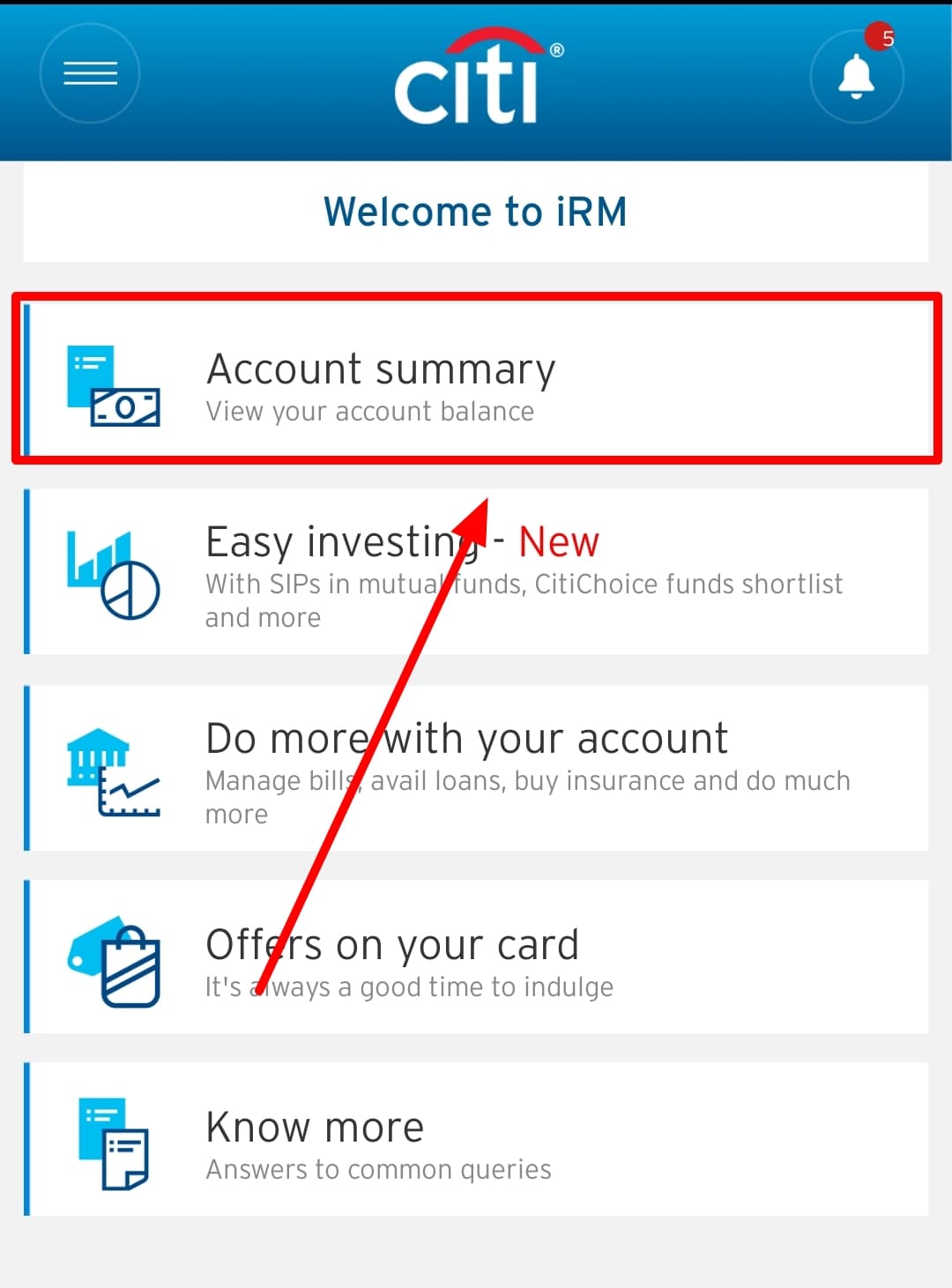

How do I activate my Citibank international transaction

If PAN is updated on your account,Step 1: Click here to fill and print the consent form.Step 2: Click here to login to your account.Step 3: Select “Account” and “Purpose of Upload” as “Enable international transactions”Step 4: Upload the scanned copy of the signed consent form and submit.

How do I tell Citibank I’m traveling

Travel Notice are easy to set up. Simply click Set Up/Manage below, follow the steps to submit a new Travel Notice and you're ready to go. You can create or cancel a travel notice at any time.

How much is Citi foreign transaction fee

The Citibank foreign transaction fee is 0% or 3% of transactions processed internationally, depending on the card.

Does Citi card charge an international fee

The Citibank foreign transaction fee is 0% or 3% of transactions processed internationally, depending on the card.

Do I need to activate credit card for overseas use

Card services

As a security measure, you will be required to activate your card before usage.

Does Citibank charge for international purchases

The Citibank foreign transaction fee is 0% or 3% of transactions processed internationally, depending on the card.

Does Citibank charge international transaction fees

Pay $0 Citibank fees for any overseas ATM or in-store transactions. Fee-free international money transfers to any bank, anywhere.

Do I need to put a travel notice on credit card

You're not required to notify your credit card company when you're going away on vacation, but it is highly recommended. By letting your credit card company know where you're going and for how long, your company will know that any card transactions from that location were likely authorized by you.

Does Citibank charge a foreign transaction fee

The Citibank foreign transaction fee is 0% or 3% of transactions processed internationally, depending on the card.

Is it better to exchange money or use credit card

Credit cards typically provide better exchange rates than what you'll get from ATM machines and currency stands. Depending on your card issuer, your purchases might automatically qualify for insurance. This coverage doesn't simply apply to consumer goods — it also covers travel delays and lost luggage.

How much does Citibank charge for international ATM

Debit Card charges on Overseas cash withdrawals at non-Citi ATMs. The withdrawal amount will first be converted to US Dollars by the relevant card scheme and a 2.75% transaction fee applied.

What happens if you use your credit card abroad

Most credit card providers charge you a fee for currency conversion when you're abroad – and for withdrawing cash abroad you may also be charged a cash withdrawal fee. Your exchange rate will be set by your payment scheme provider – either Visa, Mastercard or American Express.

Why my credit card is not working internationally

The main reason your credit card may not be working is that your credit card issuer suspects fraud. You're spending outside of your habits, whether in what you're purchasing or where you're purchasing it. However, sometimes it might not even be anything that you've done.

What is Citi card foreign transaction fee

Other Fees and Charges

| Fee Type | Fee Amount |

|---|---|

| International Transaction Fee | 3.4% of transaction amount |

| Over-the-Counter Transaction Fee | $2.50 |

| Citi PayAll Fee | 2% of the Citi PayAll payment amount. For Citi PayAll payments set up between April 2023 to October 2023 (the Period), the Citi PayAll fee is reduced to 0%. |

How much does Citibank charge for foreign currency withdrawal

Debit Card charges on Overseas cash withdrawals at non-Citi ATMs. The withdrawal amount will first be converted to US Dollars by the relevant card scheme and a 2.75% transaction fee applied.

How can international transaction fees be avoided

How to avoid international transaction feesLook for banks with no- and low-fee options.Find banks with international networks.Get a prepaid travel card.Use payment cards like credit and debit cards.Skip foreign cash exchanges.Work with your bank.Avoid freezes.

Do I need to activate my credit card for overseas use

Card services

As a security measure, you will be required to activate your card before usage.