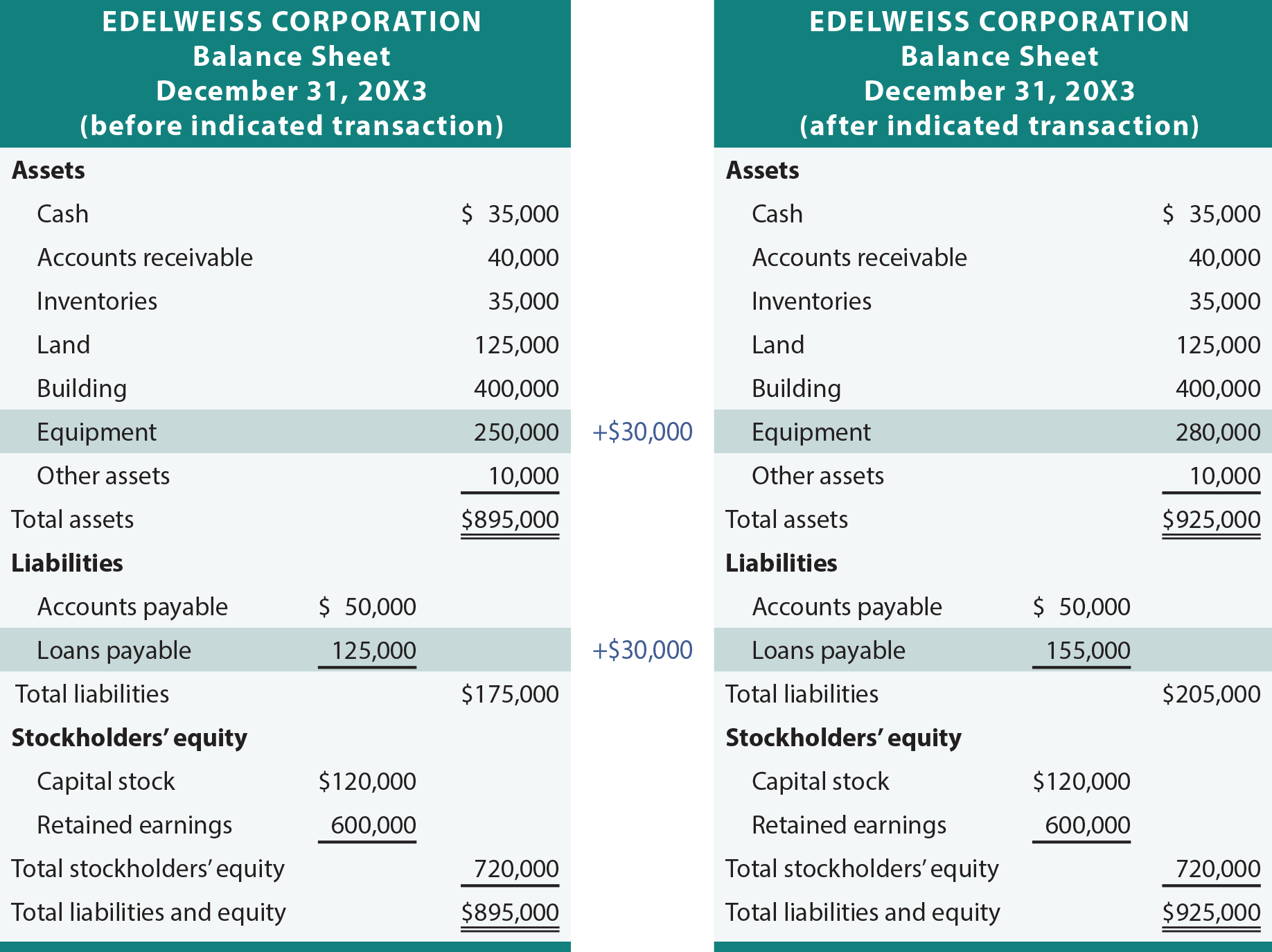

How would the purchase of equipment on credit affect a firm’s balance sheet?

How does the purchase of equipment affect the balance sheet

When equipment is purchased, it is not initially reported on the income statement. Instead, it is reported on the balance sheet as an increase in the fixed assets line item.

Cached

What happens when equipment is purchased on credit

When equipment is purchased on credit, assets are increased and liabilities are increased. These are both balance sheet accounts.

What effect does the purchase of store equipment on credit have on the balance sheet equation

Answer and Explanation: The purchase of equipment by signing a note affects the accounting equation by increasing total assets and increasing total liabilities.

How does credit affect the balance sheet

A credit increases the balance of a liability, equity, gain or revenue account and decreases the balance of an asset, loss or expense account. Credits are recorded on the right side of a journal entry. Increase asset, expense and loss accounts. Increase liability, equity, revenue and gain accounts.

Cached

How do you record purchase of equipment on credit

When you first purchase new equipment, you need to debit the specific equipment (i.e., asset) account. And, credit the account you pay for the asset from. Remember to make changes to your balance sheet to reflect the additional asset you have and your reduction in cash.

How does purchase of equipment affect accounts

The purchase of an equipment would only result to an increase in an asset (Equipment) and a decrease in another asset (Cash) in the same amount which would result to the same total amount of assets, liabilities and equity, and will not affect the basic accounting equation.

Is equipment bought on credit a liability

Equipment can be considered both a liability and an asset. For example, if you have a loan on your equipment, it is a liability.

Is acquired equipment on credit an increase or decrease

The equipment account will increase and the cash account will decrease. Equipment is increased with a debit and cash is decreased with a credit.

Does the purchase of supplies on credit increases total assets and total liabilities

Explanation: The purchase of supplies increases assets by increasing the supplies accounts. It also increases liabilities since the purchase was made on account. The liability account increased is called accounts payable.

Does a credit increase a balance sheet account

The rules for debits and credits for the balance sheet

On the asset side of the balance sheet, a debit increases the balance of an account, while a credit decreases the balance of that account.

Does credit increase assets or liabilities

A credit entry increases liability, revenue or equity accounts — or it decreases an asset or expense account. Thus, a credit indicates money leaving an account.

What are credit purchases on a balance sheet

Credit Purchases = Closing creditors + Payments made to creditors – Opening creditors.

What account is credited when equipment is purchased

Asset purchase

When you first purchase new equipment, you need to debit the specific equipment (i.e., asset) account. And, credit the account you pay for the asset from. Remember to make changes to your balance sheet to reflect the additional asset you have and your reduction in cash.

Will a purchase of equipment on account increase equity

Answer and Explanation:

The purchase of an equipment would only result to an increase in an asset (Equipment) and a decrease in another asset (Cash) in the same amount which would result to the same total amount of assets, liabilities and equity, and will not affect the basic accounting equation.

Is equipment an asset or liability on a balance sheet

Is equipment on the balance sheet Yes, it is, and it will need to be listed as a “non-current asset” and then added to any “current assets” you have so you can accurately list your company's total assets. You do not need a separate equipment balance sheet to differentiate these types of assets.

Will purchasing supplies on credit result in an increase in assets and an increase in liabilities

Explanation: The purchase of supplies increases assets by increasing the supplies accounts. It also increases liabilities since the purchase was made on account. The liability account increased is called accounts payable.

Does purchasing on credit increase liabilities

Credits increase liability, equity, and revenue accounts. Credits decrease asset and expense accounts.

Will purchasing supplies on credit increase liabilities

If you buy your supplies on credit, and it is a large enough amount that you are likely to use it over more than one accounting period, then your liabilities, in terms of accounts payable, increase, and your current assets increase as well. The result is that your accounting equation remains balanced.

Does credit increase or decrease balance

In asset accounts, a debit increases the balance and a credit decreases the balance. For liability accounts, debits decrease, and credits increase the balance. In equity accounts, a debit decreases the balance and a credit increases the balance.

Does buying on credit increase liabilities

When goods are purchased on credit, stock increases which is an asset and creditors increase, which is a liability.