Is 021000322 an ACH routing number?

What routing number is 021000322

Bank of America

The routing number for Bank of America in New York, United States is 021000322 for checking and savings accounts.

Cached

Can routing number 021000021 be used for ACH

The ACH routing number for Chase is also 021000021. The domestic and international wire transfer routing number for Chase is 21000021. If you're sending an international transfer to Chase, you'll also need a SWIFT code. Click here to see routing number for Chase in other states.

How do I know if my routing number is ACH or wire

Unlike ABA routing numbers, ACH routing numbers are used for electronic transactions between financial institutions. The first two digits of ACH routing numbers often range from 61 to 72, another way to distinguish them from ABA routing numbers.

What is ABA 021000322 Bank of America

021000322. Wire Transfer: 026009593. Bank of America ABA Routing Number: North Carolina Change state layer.

Cached

Why does Bank of America have 2 routing numbers

Bank of America has branches throughout the United States and uses different routing numbers for different states and regions. Bank of America savings accounts use the same routing numbers as checking accounts.

What Bank is routing number 021000021

JPMorgan Chase, NA

Bank Name: JPMorgan Chase, NA. Routing number: 021000021.

Is ACH considered a wire transfer

Both ACH and wire transfers work in a similar way, but with different timelines and rules. Wire transfers are direct, generally immediate transfers between two financial institutions. ACH transfers, meanwhile, pass through the Automated Clearing House, and can take up to a few business days.

Do all banks have an ACH routing number

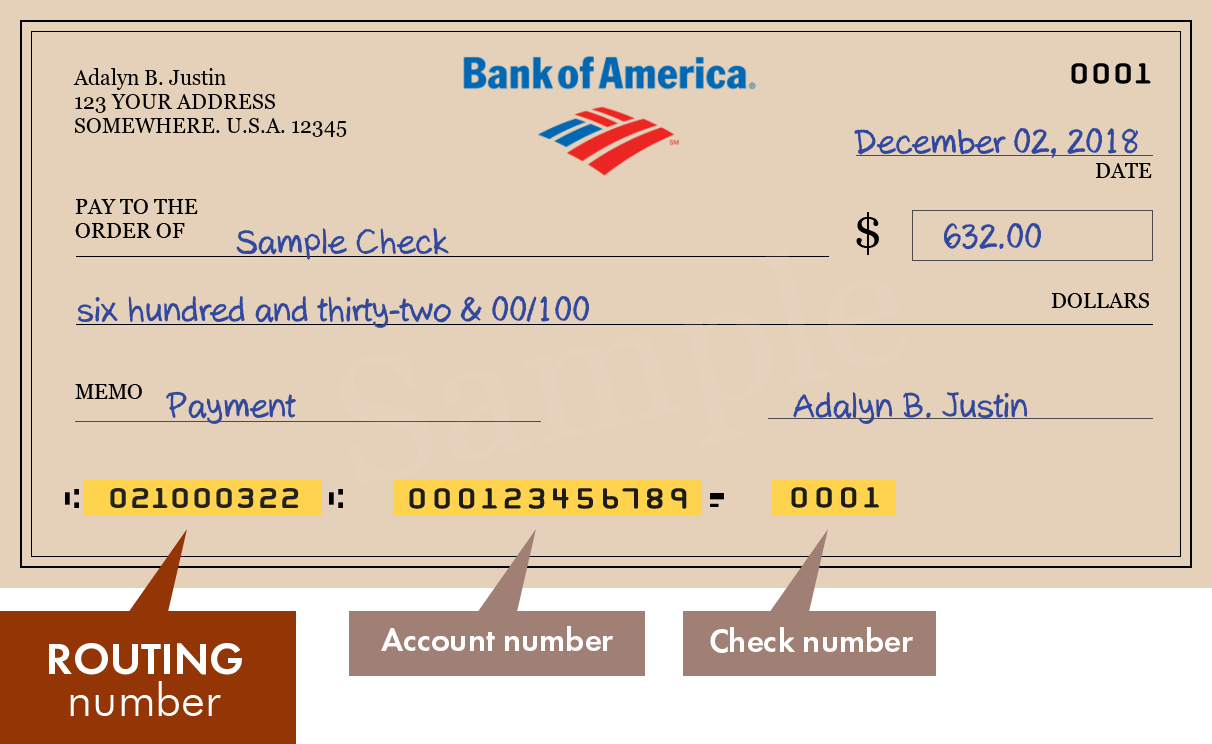

An ACH routing number is a 9-digit, unique numeric ID assigned to each banking institution in the US. It's needed for banks to identify where payments should be taken from and sent to. The routing number is used in conjunction with an account number to send or receive an ACH payment.

Which routing number do I use for wire transfer

Instead, a wire transfer uses the recipient's bank account number and ABA routing number. This is a unique 9-digit number that identifies each banking institution. If you don't know your bank's routing number, you can find it using a quick internet search.

What is an ACH routing number for Bank of America

026009593

The ACH routing number for Bank of America is 026009593. Short for Automatic Clearing House, ACH numbers are unique to each bank in the US. The ACH number and your bank account number are used by banks and transfer apps like Zelle or Cash App to identify the exact account payments should be taken from and sent to.

What is the ACH code for Bank of America

The ACH routing number for Bank of America is 026009593. Short for Automatic Clearing House, ACH numbers are unique to each bank in the US.

Why are ACH and wire routing numbers different

ACH routing numbers are different from ABA routing numbers since they're used specifically for electronic transactions. The first two digits of ACH routing numbers typically range from 61 to 72, whereas the first two digits of ABA routing numbers range between 00 and 12.

What is the ACH routing number for JPMorgan Chase

Chase Bank ACH transfer routing number

The ACH routing number for Chase Bank is 022300173. Short for Automatic Clearing House, ACH numbers are unique to each bank in the US.

Is 021000021 a wire routing number

021000021 is a routing number provided by Chase for domestic and international wire transfers only.

What format is ACH transfer

An ACH file always begins with a single "File Header Record," which will always begin with “101” followed by the routing number of the originating (sending) bank. It also includes a date time stamp, as well as the name of the originating bank and company name.

What is considered an ACH

An ACH is an electronic fund transfer made between banks and credit unions across what is called the Automated Clearing House network. ACH is used for all kinds of fund transfer transactions, including direct deposit of paychecks and monthly debits for routine payments.

Is routing number different for ACH and wire transfer

Not necessarily. Both transactions require a 9-digit number, but you will have to verify with the financial institution where you are sending the funds, if the ABA number for ACH or wires are the same, or which routing number should be used for a wire transfer and for the ACH.

What are ACH routing codes

An ACH routing number is a 9-digit, unique numeric ID assigned to each banking institution in the US. It's needed for banks to identify where payments should be taken from and sent to.

What is a wire transfer vs ACH

Wire transfers are direct, generally immediate transfers between two financial institutions. ACH transfers, meanwhile, pass through the Automated Clearing House, and can take up to a few business days.

Is ACH and wire the same thing

An ACH transfer goes through an interbank system for verification before it's completed. A wire transfer goes directly and electronically from one bank account to another without an intermediary system. ACH transfers typically have lower fees than wire transfers have.