Is 708 considered a good credit score?

Can I buy a house with a 708 credit score

A 708 credit score is a good credit score. The good-credit range includes scores of 700 to 749, while an excellent credit score is 750 to 850, and people with scores this high are in a good position to qualify for the best possible mortgages, auto loans and credit cards, among other things.

Cached

What can you do with a credit score of 708

As 708 is a good credit score, you should not be limited in your loan options. You'll likely easily qualify for most credit cards, personal loans, auto loans, lines of credit and more. Since you're not in the top range of credit scores, you'll still always want to review your loan terms.

Cached

Can I get a car with a credit score of 708

A 708 FICO® Score is considered “Good”. Mortgage, auto, and personal loans are relatively easy to get with a 708 Credit Score. Lenders like to do business with borrowers that have Good credit because it's less risky.

Cached

What does a credit score of 708 mean

According to Experian, the average American consumer has a FICO Score of 714 as of 2023, and anything in the range of 670 to 739 is generally considered to be a good credit score. Most lenders consider an 708 credit score to be an average credit score that shows you generally pay your bills on time.

Cached

What credit score is needed to buy a 300k house

620-660

Additionally, you'll need to maintain an “acceptable” credit history. Some mortgage lenders are happy with a credit score of 580, but many prefer 620-660 or higher.

What is a very good credit score

740 to 799

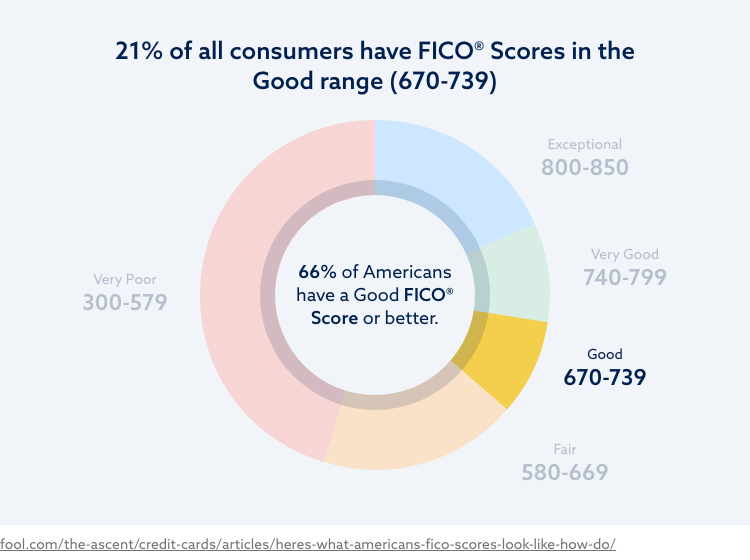

Although ranges vary depending on the credit scoring model, generally credit scores from 580 to 669 are considered fair; 670 to 739 are considered good; 740 to 799 are considered very good; and 800 and up are considered excellent.

What is a 800 credit score worth

A FICO® Score of 800 is well above the average credit score of 714. It's nearly as good as credit scores can get, but you still may be able to improve it a bit. More importantly, your score is on the low end of the Exceptional range and fairly close to the Very Good credit score range (740-799).

What is the average credit score by age

Average FICO Score Nearly Unchanged Among All Generations

| Average FICO® Score by Generation | ||

|---|---|---|

| Generation | 2023 | 2023 |

| Silent Generation (77+) | 760 | 760 |

| Baby boomers (58-76) | 740 | 742 |

| Generation X (42-57) | 705 | 706 |

What credit score do I need to buy a $30 000 car

There's no set minimum credit score required to get an auto loan. It's possible to get approved for an auto loan with just about any credit score, but the better your credit history, the bigger your chances of getting approved with favorable terms.

What credit score do you need for a $60000 car loan

In general, lenders look for borrowers in the prime range or better, so you will need a score of 661 or higher to qualify for most conventional car loans.

How rare is a 720 credit score

46% of consumers have FICO® Scores lower than 720. The best way to determine how to improve your credit score is to check your FICO® Score.

How much do you have to make a year to afford a $400000 house

$105,864 each year

Assuming a 30-year fixed conventional mortgage and a 20 percent down payment of $80,000, with a high 6.88 percent interest rate, borrowers must earn a minimum of $105,864 each year to afford a home priced at $400,000. Based on these numbers, your monthly mortgage payment would be around $2,470.

How big of a loan can I get with a 720 credit score

$50,000 – $100,000+

You can borrow $50,000 – $100,000+ with a 720 credit score. The exact amount of money you will get depends on other factors besides your credit score, such as your income, your employment status, the type of loan you get, and even the lender.

How accurate is Credit Karma

Here's the short answer: The credit scores and reports you see on Credit Karma come directly from TransUnion and Equifax, two of the three major consumer credit bureaus. The credit scores and reports you see on Credit Karma should accurately reflect your credit information as reported by those bureaus.

How many people have 800 credit score

Your 800 FICO® Score falls in the range of scores, from 800 to 850, that is categorized as Exceptional. Your FICO® Score is well above the average credit score, and you are likely to receive easy approvals when applying for new credit. 21% of all consumers have FICO® Scores in the Exceptional range.

Is A 900 credit score good

Although ranges vary depending on the credit scoring model, generally credit scores from 580 to 669 are considered fair; 670 to 739 are considered good; 740 to 799 are considered very good; and 800 and up are considered excellent.

Does anyone have a 900 credit score

Depending on the type of scoring model, a 900 credit score is possible. While the most common FICO and VantageScore models only go up to 850, the FICO Auto Score and FICO Bankcard Score models range from 250 to 900.

How many people have an 800 credit score

Your 800 FICO® Score falls in the range of scores, from 800 to 850, that is categorized as Exceptional. Your FICO® Score is well above the average credit score, and you are likely to receive easy approvals when applying for new credit. 21% of all consumers have FICO® Scores in the Exceptional range.

What is a perfect credit score

850

An 850 FICO® Score isn't as uncommon as you might think. Statistically, there's a good chance you've attended a wedding, conference, church service or other large gathering with someone who has a perfect score. As of the third quarter (Q3) of 2023, 1.31% of all FICO® Scores in the U.S. stood at 850.

What credit score do I need to buy a $70000 car

To get an auto loan without a high interest rate, our research shows you'll want a credit score of 700 or above on the 300- to 850-point scale. That's considered prime credit, and lenders don't have to price much risk into their rates.