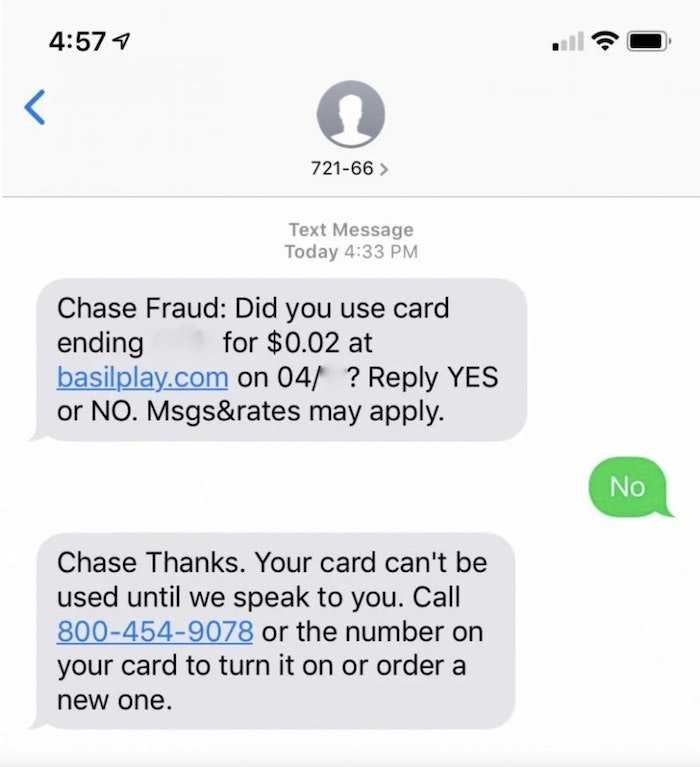

Is 721 66 a Chase number?

How do I know if a Chase text is real

If you have any doubts about whether an email, phone call or text message is actually from us, please call the toll-free number on the back of your credit/debit card or the toll-free number on your statement. We'll help figure out if you're dealing with a scam.

CachedSimilar

Does Chase text from a phone number

Chase will never ask you to provide your personal information via email or text message. Don't respond to any text messages or give your information to anyone over the phone if you can't verify they are indeed a Chase representative.

Cached

Does Chase ever send text messages

You can receive alerts via email, text message and push notification when there is a charge, refund or other transaction on your account, when a balance transfer or payment has posted, to get balance and available credit limit amounts, when a payment is due, or when a payment has posted.

How does Chase notify you of suspicious activity

Suspicious activity

We monitor your chase.com profile to help us detect fraud as early as possible. We might call you if we notice a change in your online activity, but we'll never ask you for personal information over the phone, such as your mother's maiden name or Social Security Number.

How do I receive text messages from Chase

Sign up for Chase Mobile

Sign in to Chase OnlineSM and select “Text banking” in the profile & settings menu. Enter and verify your mobile phone number to receive a text message with an 8-digit verification code.

What are Chase Secure messages

What is Chase secure message A secure message is a message which you send after logging into to your Chase account. This is more secure than regular email and is sent from the Chase Secure Message Center – hence the name “secure message.”

What is the number for Chase Bank verification

If you have any questions regarding enrollment, you may contact Billing Solutions direct by phone at (888) 801-0091 or by email at [email protected].

What is the phone number for Chase bank alert

If you suspect a charge on your account may be fraudulent, please call us immediately at 1-800-955-9060.

What is the number for Chase bank verification

If you have any questions regarding enrollment, you may contact Billing Solutions direct by phone at (888) 801-0091 or by email at [email protected].

How do you identify a suspicious transaction in banking

Unexpected movements in transactions and account management.Transactions showing significant fluctuation in terms of the volume or frequency of the customer's business.Small deposits and transfers that are immediately allocated to accounts in other countries or regions.

How do you identify suspicious transactions

An assessment of suspicion should be based on a reasonable evaluation of relevant factors, including the knowledge of the customer's business, whether the transactions are in keeping with normal industry practices, financial history, background and behaviour.

What is the phone number for Chase alert

If you suspect a charge on your account may be fraudulent, please call us immediately at 1-800-955-9060.

Does Chase send security alerts

We monitor for fraud 24/7 and can text, email or call you if there are unusual purchases on your credit card. To assist us, please update your phone number in case we need to contact you quickly. We may contact you for account servicing, such as payment questions, or if we suspect fraud on your account.

How do I check my Chase secure message

How do I access my secure messages To see your secure messages, just sign in to chase.com. From your accounts page, go to the side menu (the three-line icon in the top left corner) and choose "Secure messages."

What is JP Morgan Chase phone number

(800) 935-9935JPMorgan Chase & Co / Customer service

What is the code for bank verification

*565*1# Validate your Bank Verification Number (BVN):

What is Chase bank Alert

Account Alerts are notifications about your account sent as an email, text message, or push notification. Alerts can remind you when your payment is due, notify you when your balance reaches a set amount, and much more. You can choose the alerts that are right for you, click Account Alerts to get started.

How do I get Chase text notifications

Here's how:After signing in, choose the "Account management" tab.Choose "Profile & settings," then choose "Alerts"Select "Choose alerts" and pick the accounts you want.Under "Delivery methods" customize options and choose "Save"You're now enrolled.

Which of the following is an example of red flag for suspicious transaction

Unusual transactions

Firms should look out for activity that is inconsistent with their expected behavior, such as large cash payments, unexplained payments from a third party, or use of multiple or foreign accounts. These are all AML red flags.

How do you identify a transaction

Six-Step of Accounting Transaction AnalysisIdentify If the Event is an Accounting Transaction.Identify what Accounts it Affects.Identify what Accounts it Affects.Identify which Accounts are Going up or Down.Apply the rules of Debits and Credits to the Accounts.Find the Transaction Amounts to be Entered.