Is 750 a good credit score for an 18 year old?

What is a good credit score for an 18 year old

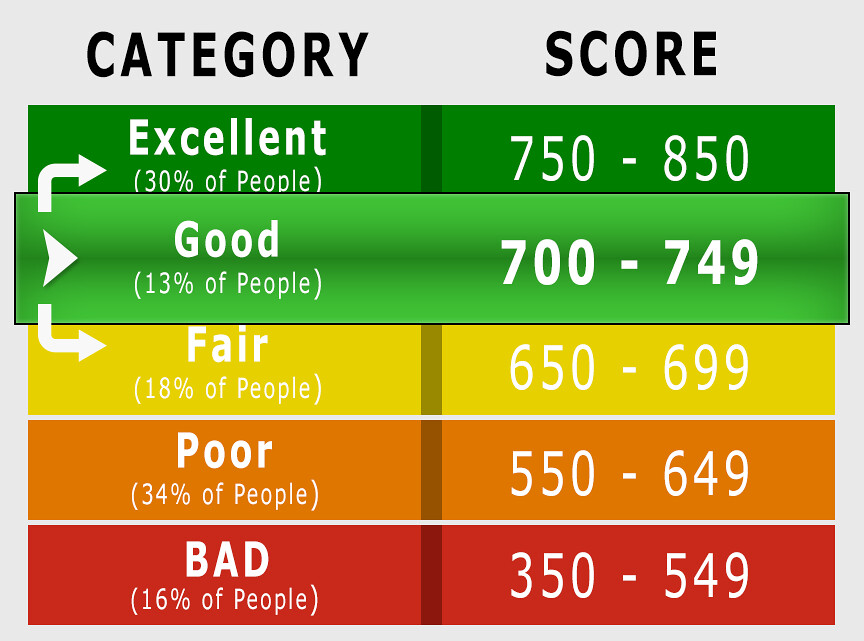

Like anyone, a score of 670 or above is considered 'good. ' At 18, it might be a good time to start applying for a student credit card, look into becoming an authorized user on a parent's card, and consider getting a part-time or work-study job to pay off loans while you're in school.

Cached

How to get 750 credit score at 18

It will take some time, but it will happen with intentional steps.Check Your Credit Report.Make On-Time Payments.Pay Off Your Debts.Lower Your Credit Utilization Rate.Consolidate Your Debt.Become An Authorized User.Leave Old Accounts Open.Open New Account Types.

Cached

How much credit does the average 18 year old have

Average Credit Score by Age

| Age | Average FICO Score |

|---|---|

| 18-24 | 679 |

| 25-40 | 686 |

| 41-56 | 705 |

| 57-75 | 740 |

Cached

How to get 800 credit score at 18

4 key factors of an excellent credit scoreOn-time payments. The best way to get your credit score over 800 comes down to paying your bills on time every month, even if it is making the minimum payment due.Amounts owed.Credit history.Types of accounts and credit activity.

Can a 18 year old have a 700 credit score

Regardless of your age, those who are initially building their credit score can start from 500 to 700, with those in their 20s having an average score of 660.

How long does it take to get a 800 credit score at 18

Depending on where you're starting from, It can take several years or more to build an 800 credit score. You need to have a few years of only positive payment history and a good mix of credit accounts showing you have experience managing different types of credit cards and loans.

Is 720 a good credit score for 18 year old

A fair credit rating is anywhere between 601 and 660. Scores between 661 and 780 are considered good credit scores. Anything over 780 is excellent.

How hard is it to get a loan at 18 with no credit

It's possible to get a personal loan if you're 18 years old and have no credit history — everyone's gotta start somewhere! Yes, your options are more limited compared to older borrowers, but there are lenders with more lenient credit score requirements and loans geared specifically for new borrowers.

How to get an 850 credit score at 18

I achieved a perfect 850 credit score, says finance coach: How I got there in 5 stepsPay all your bills on time. One of the easiest ways to boost your credit is to simply never miss a payment.Avoid excessive credit inquiries.Minimize how much debt you carry.Have a long credit history.Have a good mix of credit.

What is the easiest loan to get at 18

Student loans

Students are one of the only loans an 18-year-old borrower can likely qualify for without a cosigner. You may even be able to take out student loans as a 17-year-old with a cosigner. Many people consider student loans just to pay tuition, but they can also be used to cover some living expenses.

Can I build credit at 18

Eighteen is the earliest age you can apply for credit in your own name, so it's helpful to learn the best ways to build credit. Building credit at 18 may help you get loans, credit cards, and better interest rates in the future.

How does an 18 year old with no credit build credit

Apply for a student loan

The good news is, getting a student loan can help you start building credit at 18. Not only are you establishing your credit history, but you can also use your student loan to help your credit score by making on-time payments when your loan comes due or even during your grace period.

Can a 18-year-old with no credit get a loan

Yes, it's possible for an 18-year-old with no credit to get a loan, but the selection is limited. With no credit history, your most viable options are no credit check loans, credit builder loans, loans with a cosigner, and student loans.

Is it hard to get approved for a loan at 18

For young people, it can be difficult getting approved for a loan without a parent's co-signature, but it's not impossible. A bank's goal is to make money on a loan's interest payments and to determine whether or not loan applicants will be able to pay back their debt.

Should an 18 year old get a credit card to build credit

While understanding personal finance might seem a little intimidating for the uninitiated, the basics are fairly straightforward. And a good place to start is by opening a credit card at 18, so you can start building credit at an early age and developing good money habits.

What are 2 ways to build credit at 18 years old

Ways you can start building credit:Become an authorized user on a credit card.Consider a job.Get your own credit card.Keep track of your credit score.Make on time payments.Pay more than the minimum payment.

How does an 18 year old start building credit

How to start building credit at age 18Understand the basics of credit.Become an authorized user on a parent's credit card.Get a starter credit card.Build credit by making payments on time.Keep your credit utilization ratio low.Take out a student loan.Keep tabs on your credit report and score.

How hard is it to get a loan at 18

It is possible for an 18-year-old to get a personal loan. To increase your chances, find a creditworthy cosigner if you can. Having a cosigner may make it easier to get your loan approved. Plus, you'll also likely get a higher loan amount and a lower interest rate.

Can a 18-year-old get a 15k loan

Most lenders that offer personal loans of $15,000 or more require fair credit or better for approval, along with enough income to afford the monthly payments. Other common loan requirements include being at least 18 years old; being a U.S. citizen, permanent resident or visa holder; and having a valid bank account.

How long does it take to build credit at 18

It usually takes a minimum of six months to generate your first credit score. Establishing good or excellent credit takes longer. If you follow the tips above for building good credit and avoid the potential pitfalls, your score should continue to improve.