Is 811a good credit score?

What can I do with an 811 credit score

With an 811 credit score, you are well-positioned to qualify for any financial product, from the best credit cards and personal loans to the best auto loans and mortgages. An 811 credit score doesn't guarantee you approval, however, because your income and existing debt obligations matter, too.

Cached

Can I buy a house with 811 credit score

Buying a home with an 811 credit score

To be perfectly clear, you don't need a top-tier credit history to qualify for a mortgage. Even the most restrictive mortgage products have credit score requirements in the mid-700s. A credit score of 811 will generally qualify you for a lender's best interest rates.

Cached

How rare is an 800 credit score

23%

According to a report by FICO, only 23% of the scorable population has a credit score of 800 or above.

Is it possible to get a 850 credit score

While achieving a perfect 850 credit score is rare, it's not impossible. About 1.3% of consumers have one, according to Experian's latest data. FICO scores can range anywhere from 300 to 850.

How rare is an 811 credit score

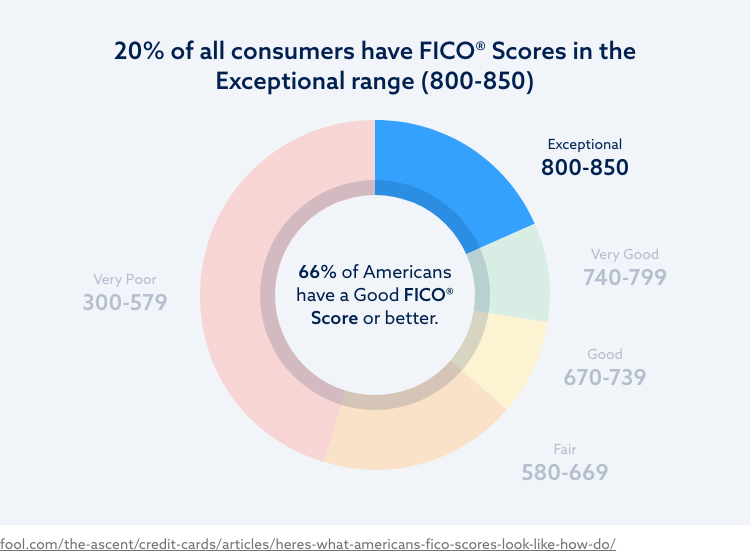

Your 811 FICO® Score falls in the range of scores, from 800 to 850, that is categorized as Exceptional. Your FICO® Score is well above the average credit score, and you are likely to receive easy approvals when applying for new credit. 21% of all consumers have FICO® Scores in the Exceptional range.

What is lowest good credit score

What is a good credit score range800 and above: excellent.740 to 799: very good.670 to 739: good.580 to 669: fair.579 and below: poor.

What is the credit limit in 811 credit card

Kotak 811 #Dream Different Credit Card offers you the range of credit card services, add-on cards, interest free cash withdrawals and credit limit of 90% of fixed deposit. The minimum credit limit is Rs 5,000 for 811 saving account customers and Rs 9,000 for others.

Can you get a 900 credit score

FICO® score ranges vary — either from 300 to 850 or 250 to 900, depending on the scoring model. The higher the score, the better your credit.

Why is it so hard to get a 800 credit score

Since the length of your credit history accounts for 15% of your credit score, negative, minimal or no credit history can stop you from reaching an 800 credit score. To solve this problem, focus on building your credit. You can do this by taking out a credit-builder loan or applying for your first credit card.

Does anyone have a 900 credit score

Depending on the type of scoring model, a 900 credit score is possible. While the most common FICO and VantageScore models only go up to 850, the FICO Auto Score and FICO Bankcard Score models range from 250 to 900.

Is A 900 credit score good

Although ranges vary depending on the credit scoring model, generally credit scores from 580 to 669 are considered fair; 670 to 739 are considered good; 740 to 799 are considered very good; and 800 and up are considered excellent.

What is everyone’s first credit score

Since everyone's credit journey is different, there's no one standard score everyone starts out with. And you can have different credit scores depending on the credit-scoring model—either FICO or VantageScore. You won't start with a score of zero, though. You simply won't have a score at all.

Can you have a 900 credit score

FICO® score ranges vary — either from 300 to 850 or 250 to 900, depending on the scoring model. The higher the score, the better your credit.

What is a very poor to poor credit score

What is classed as a bad credit score When it comes to your Experian Credit Score, 561–720 is classed as Poor and 0–560 is considered Very Poor. Though remember, your credit score isn't fixed.

What is a normal credit line limit

What is considered a “normal” credit limit among most Americans The average American had access to $30,233 in credit across all of their credit cards in 2023, according to Experian. But the average credit card balance was $5,221 — well below the average credit limit.

Who has a credit score of 1000

A credit score of 1,000 is not possible because credit scoring models simply do not go that high. According to Experian, some credit scoring models reach upwards of 900 or 950, but those are industry-specific scores that are only used by certain institutions.

How powerful is a 800 credit score

Your 800 FICO® Score falls in the range of scores, from 800 to 850, that is categorized as Exceptional. Your FICO® Score is well above the average credit score, and you are likely to receive easy approvals when applying for new credit. 21% of all consumers have FICO® Scores in the Exceptional range.

How much is a 800 credit score worth

A FICO® Score of 800 is well above the average credit score of 714. It's nearly as good as credit scores can get, but you still may be able to improve it a bit. More importantly, your score is on the low end of the Exceptional range and fairly close to the Very Good credit score range (740-799).

How much of the population has 800 credit score

How rare is an 800 credit score

| Credit Score Range | Percentage of Adults |

|---|---|

| 800 – 850 | 23.3% |

| 750 – 799 | 23.1% |

| 700 – 749 | 16.4% |

| 650 – 699 | 12.5% |

What does an 850 credit score do for you

Your 850 FICO® Score is nearly perfect and will be seen as a sign of near-flawless credit management. Your likelihood of defaulting on your bills will be considered extremely low, and you can expect lenders to offer you their best deals, including the lowest-available interest rates.