Is a 10 6 ARM a good idea?

Are 10 6 ARMs good

Often, he says, people will find that the 10/6 ARM is “the best of both worlds,” giving them a lower interest rate than fixed rate loans such as a 30-year fixed but with more stability than a 5/6 ARM. Safis also recommends that people ask a few questions to help them decide if a 10/6 ARM is right for them.

Cached

How long does a 10 6 ARM last

10 years

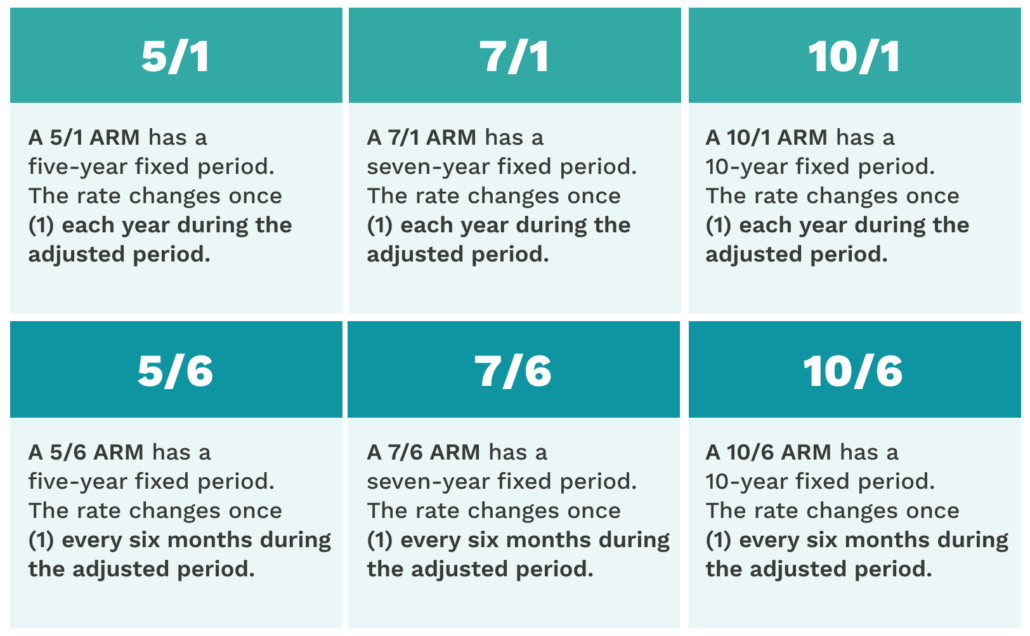

10/6 ARM: A 10/6 ARM loan has a fixed rate of interest for the first 10 years of the loan. After that, the interest rate will adjust once every 6 months for the remaining 20 years.

Cached

Is a 10 year ARM a good idea

Pros. Relatively long fixed-rate period: A 10/1 ARM has a relatively long fixed-rate period, which can be attractive, especially considering the average homeowner tends to move before then. Could potentially pay less in interest: With a 10/1 ARM, you could save on interest as long as rates remain low.

Cached

How often does a 10 6 ARM adjust

every six months

A 10/6 ARM Mortgage has an interest rate that is fixed for 10 years, and then the interest rate will be adjusted every six months after that for the duration of your loan.

Cached

Can I pay off an ARM early

Some ARMs, including interest-only and payment-option ARMs, may require you to pay special fees or penalties if you refinance or pay off the ARM early (usually within the first 3 to 5 years of the loan).

Is it a good idea to get an ARM mortgage

Adjustable-rate mortgages may be the better option over fixed-rate mortgages for borrowers who expect to move out before the fixed-rate period of their ARM ends. ARMs are also often good in housing markets where interest rates are high, as your interest rate can adjust if rates drop.

Can I refinance out of an ARM

Refinancing can be done for many reasons, but switching from an adjustable-rate mortgage (or ARM) to a fixed-rate mortgage is one of the most common. The general rule of thumb is that refinancing to a fixed-rate loan makes the most sense when interest rates are low.

What is the downside to getting an ARM

The big disadvantage of an ARM is the likelihood of your rate going up. If rates have risen since you took out the loan, your repayments will increase. Often, there's a cap on the annual/total rate increase, but it can still sting.

What is the biggest mistake on a variable rate mortgage

One of the biggest mistakes you can make is converting your variable rate mortgage into a fixed. I'm not saying that this is never a good idea, as there are times when it can be beneficial for some. But in most cases, converting your variable into a fixed can be a costly move.

Why is an ARM not a good idea when financing a home

ARMs require borrowers to plan for when the interest rate starts changing and monthly payments grow. Even with careful planning, though, you might be unable to sell or refinance when you want to. If you can't make the payments after the fixed-rate phase of the loan, you could lose the home.

Do ARM mortgages always go up

Adjustable-rate mortgages come with interest rates that change over time. This makes them different from fixed-rate mortgages, which come with the same interest rate throughout the lifetime of the loan. ARMs typically begin with very low introductory rates, after which the rate increases.

Is an ARM a good idea in 2023

Is an ARM a good idea in 2023 ARMs are generally only a good idea if rates are likely to drop by the time your rate would adjust, or if you're confident you'll be able to sell or refinance before it does. Most major forecasts expect mortgage rates to trend down over the next couple of years.

What is the downfall of an ARM mortgage

The big disadvantage of an ARM is the likelihood of your rate going up. If rates have risen since you took out the loan, your repayments will increase. Often, there's a cap on the annual/total rate increase, but it can still sting.

What are bad things about ARM loans

Cons of an adjustable-rate mortgageRates and monthly payments may rise. The big disadvantage of an ARM is the likelihood of your rate going up.You could buy too much house. The lower initial payments could make it easier to qualify for a more expensive home.Difficulty with refinancing.

Is it hard to live with one ARM

If you only have the use of one hand or arm, doing your day-to-day activities can be hard. If you have lost your dominant hand you will need to use your other hand for most tasks like feeding or writing, at least in the beginning.

What is the biggest downside to variable-rate loans

unpredictability

The biggest downside of variable-rate loans is the unpredictability. It is almost impossible to know what the future holds in terms of interest rates.

What is one danger of taking a variable rate loan

What Is the Danger of Taking a Variable Rate Loan Your lender can change your interest rate at any time. While this does present opportunities for lower interest rates, you may also be assessed interest at higher rates that are increasingly growing.

Why do lenders prefer ARMs

ARMs are also attractive because their low initial payments often enable the borrower to qualify for a larger loan and, in a falling-interest-rate environment, allow the borrower to enjoy lower interest rates (and lower payments) without the need to refinance the mortgage.

What are the disadvantages of ARM

The big disadvantage of an ARM is the likelihood of your rate going up. If rates have risen since you took out the loan, your repayments will increase. Often, there's a cap on the annual/total rate increase, but it can still sting.

What may be a concern if you have an adjustable-rate mortgage ARM

An adjustable-rate mortgage (ARM) is a loan with an interest rate that changes. ARMs may start with lower monthly payments than fixed-rate mortgages, but keep in mind the following: Your monthly payments could change. They could go up — sometimes by a lot—even if interest rates don't go up.