Is a 600 credit score low?

What will a 600 credit score get you

What Does a 600 Credit Score Get You

| Type of Credit | Do You Qualify |

|---|---|

| Secured Credit Card | YES |

| Unsecured Credit Card | YES |

| Home Loan | YES (FHA Loan) |

| Personal Loan | MAYBE |

Cached

Can you buy anything with a 600 credit score

Although 600 is considered “fair” by most standards, it doesn't mean you can't buy a home. However, lenders like higher credit ratings. It shows you're more likely to make loan payments and less likely to default on your loan. If you're buying a house, your first step is to check your credit score.

Cached

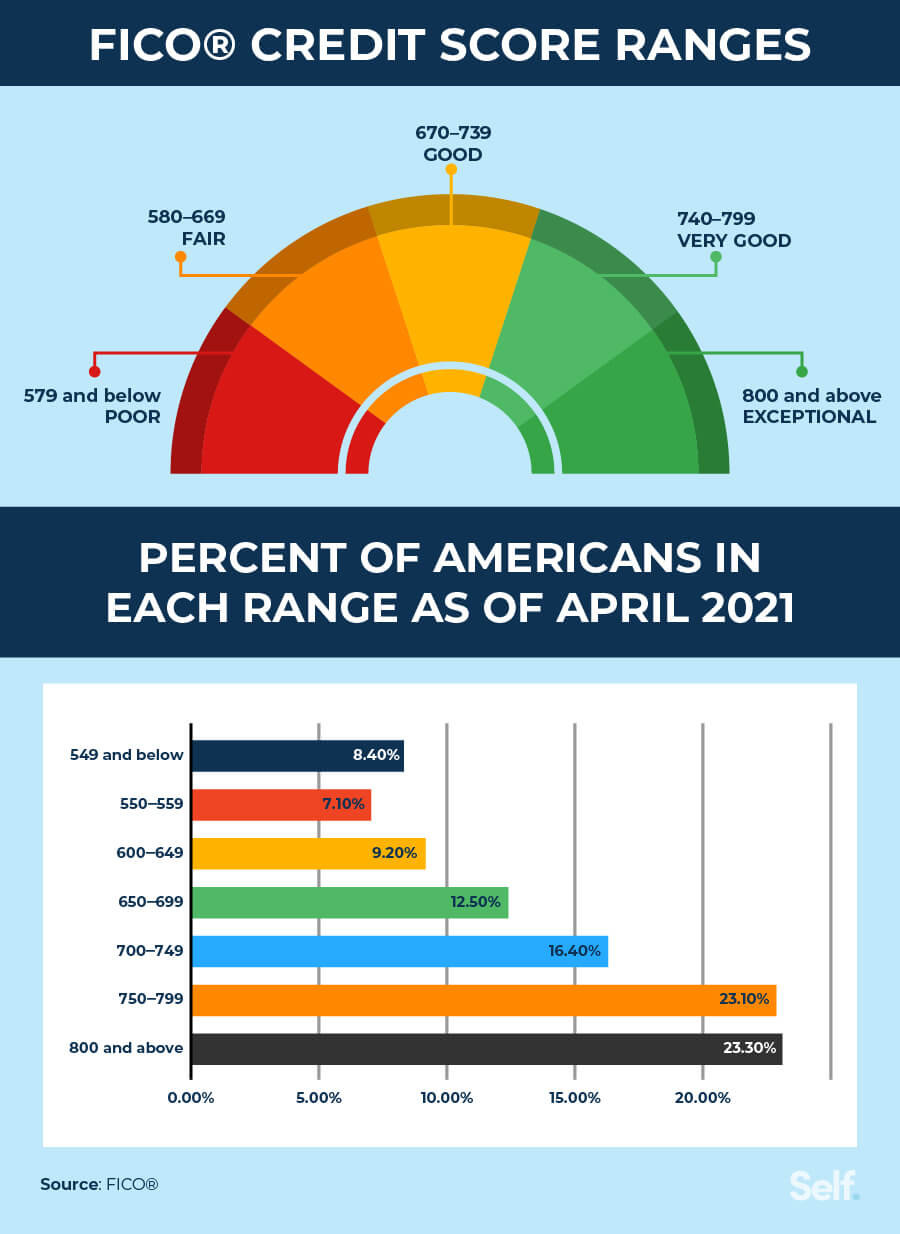

What percentage of the population has a credit score of 600

What does having a 600 credit score mean According to FICO® Score, 15.5% of the population has a credit score below 600, while the average credit score sits at 716.

Is 600 a good credit score to buy a house

A 600 credit score is high enough to get a home loan. In fact, there are several mortgage programs designed specifically to help people with lower credit scores. However, you'll need to meet other lending requirements too.

Cached

How long does it take to go from 600 to 800 credit score

Depending on where you're starting from, It can take several years or more to build an 800 credit score. You need to have a few years of only positive payment history and a good mix of credit accounts showing you have experience managing different types of credit cards and loans.

How to go from 600 to 700 credit score

How To Get A 700 Credit ScoreLower Your Credit Utilization.Limit New Credit Applications.Diversify Your Credit Mix.Keep Old Credit Cards Open.Make On-Time Payments.

How to go from 600 to 750 credit score

6 easy tips to help raise your credit scoreMake your payments on time.Set up autopay or calendar reminders.Don't open too many accounts at once.Get credit for paying monthly utility and cell phone bills on time.Request a credit report and dispute any credit report errors.Pay attention to your credit utilization rate.

What credit score do you start with

zero

Some people wonder whether the starting credit score is zero, for example, or whether we all start with a credit score of 300 (the lowest possible FICO score). The truth is that there's no such thing as a “starting credit score.” We each build our own unique credit score based on the way we use credit.

How big of a loan can you get with a 600 credit score

The amount you can borrow will vary by lender, but you can typically take out a loan between $1,000 and $50,000 with a 600 credit score. Keep in mind that the more you borrow, the more you'll pay in interest.

Will a bank give you a loan with 600 credit score

Yes, you can get a personal loan with a 600 credit score — there are even lenders that specialize in offering fair credit personal loans. But keep in mind that if you have a credit score between 580 and 669, you'll generally be considered a “subprime” borrower — meaning lenders might see you as a more risky investment.

How hard is it to get a 750 credit score

To get a 750 credit score, you need to pay all bills on time, have an open credit card account that's in good standing, and maintain low credit utilization for months or years, depending on the starting point. The key to reaching a 750 credit score is adding lots of positive information to your credit reports.

How to get 800 credit score in 45 days

Here are 10 ways to increase your credit score by 100 points – most often this can be done within 45 days.Check your credit report.Pay your bills on time.Pay off any collections.Get caught up on past-due bills.Keep balances low on your credit cards.Pay off debt rather than continually transferring it.

What is the lowest credit score possible

300

FICO & Vantage both set the lowest possible credit score at 300. However, almost nobody has this low of a score. In fact, according to FICO, the average credit score in America is 704. A bad FICO credit score ranges from 300-579, while a bad Vantage score ranges 300-499.

What credit score does an 18 year old start with

The credit history you start with at 18 is a blank slate. Your credit score doesn't exist until you start building credit. To begin your credit-building journey, consider opening a secured credit card or ask a family member to add you as an authorized user on their account.

How fast can you build credit from 600

For instance, going from a poor credit score of around 500 to a fair credit score (in the 580-669 range) takes around 12 to 18 months of responsible credit use.

Is A 900 credit score good

Although ranges vary depending on the credit scoring model, generally credit scores from 580 to 669 are considered fair; 670 to 739 are considered good; 740 to 799 are considered very good; and 800 and up are considered excellent.

How long does it take to go from 550 to 750 credit score

How Long Does It Take to Fix Credit The good news is that when your score is low, each positive change you make is likely to have a significant impact. For instance, going from a poor credit score of around 500 to a fair credit score (in the 580-669 range) takes around 12 to 18 months of responsible credit use.

What is a very poor to poor credit score

What is classed as a bad credit score When it comes to your Experian Credit Score, 561–720 is classed as Poor and 0–560 is considered Very Poor. Though remember, your credit score isn't fixed.

Which of the 3 credit scores is usually the lowest

Your Equifax score is lower than the other credit scores because there is a slight difference in what is reported to each credit agency and each one uses a slightly different method to score your data. Your Experian, Equifax and TransUnion credit reports should be fairly similiar.

How long does it take to get a 700 credit score from 500

6-18 months

The credit-building journey is different for each person, but prudent money management can get you from a 500 credit score to 700 within 6-18 months. It can take multiple years to go from a 500 credit score to an excellent score, but most loans become available before you reach a 700 credit score.