Is a 635 Equifax score good?

Is 635 Equifax good

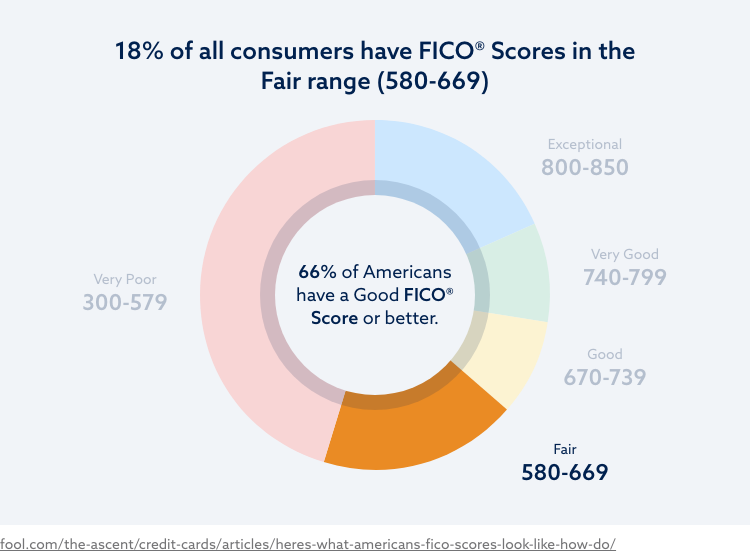

Although ranges vary depending on the credit scoring model, generally credit scores from 580 to 669 are considered fair; 670 to 739 are considered good; 740 to 799 are considered very good; and 800 and up are considered excellent.

Cached

How bad is a 635 credit score

Your score falls within the range of scores, from 580 to 669, considered Fair. A 635 FICO® Score is below the average credit score. Some lenders see consumers with scores in the Fair range as having unfavorable credit, and may decline their credit applications.

Cached

What can you get with a 635 credit score

What Does a 635 Credit Score Get You

| Type of Credit | Do You Qualify |

|---|---|

| Unsecured Credit Card | YES |

| Home Loan | YES (FHA Loan) |

| Personal Loan | MAYBE |

| Auto Loan | MAYBE |

Cached

Can I buy a car with 635 credit score

Can I get an auto loan with an 635 credit score The short answer is yes, but you're likely to get a significantly higher-than-average interest rate. To put it into perspective, as of November 2023, the typical borrower with prime credit (720 or higher FICO score) got an APR of 5.34% on a 60-month new auto loan.

Cached

Is Equifax usually higher

Your Equifax credit score is more likely to appear lower than your TransUnion one because of the reporting differences, but a “fair” score from TransUnion is typically “fair” across the board.

What is the average Equifax

Equifax scores range from 0-700. 380-419 is considered a fair score. A score of 420-465 is considered good.

What is the lowest credit score to buy a house

Generally speaking, you'll need a credit score of at least 620 in order to secure a loan to buy a house. That's the minimum credit score requirement most lenders have for a conventional loan. With that said, it's still possible to get a loan with a lower credit score, including a score in the 500s.

How to raise a 635 credit score

Steps to Improve Your Credit ScoresBuild Your Credit File.Don't Miss Payments.Catch Up On Past-Due Accounts.Pay Down Revolving Account Balances.Limit How Often You Apply for New Accounts.

How to go from 600 to 700 credit score

How To Get A 700 Credit ScoreLower Your Credit Utilization.Limit New Credit Applications.Diversify Your Credit Mix.Keep Old Credit Cards Open.Make On-Time Payments.

How accurate is Equifax on Credit Karma

Here's the short answer: The credit scores and reports you see on Credit Karma come directly from TransUnion and Equifax, two of the three major consumer credit bureaus. The credit scores and reports you see on Credit Karma should accurately reflect your credit information as reported by those bureaus.

Do car dealerships use Equifax or TransUnion

Do car dealerships use Equifax or TransUnion Car dealerships use a VantageScore or FICO score. The three credit bureaus — Equifax, TransUnion, and Experian — all provide both scores to auto dealerships.

Which is more important Equifax or TransUnion

TransUnion vs. Equifax: Which is most accurate No credit score from any one of the credit bureaus is more valuable or more accurate than another. It's possible that a lender may gravitate toward one score over another, but that doesn't necessarily mean that score is better.

Which one counts more TransUnion or Equifax

Neither score is more or less accurate than the other; they're only being calculated from slightly differing sources. Your Equifax credit score is more likely to appear lower than your TransUnion one because of the reporting differences, but a “fair” score from TransUnion is typically “fair” across the board.

Is Equifax your real credit score

The Equifax credit score is an educational credit score developed by Equifax. Equifax credit scores are provided to consumers for their own use to help them estimate their general credit position. Equifax credit scores are not used by lenders and creditors to assess consumers' creditworthiness.

Is Equifax usually the lowest score

Neither score is more or less accurate than the other; they're only being calculated from slightly differing sources. Your Equifax credit score is more likely to appear lower than your TransUnion one because of the reporting differences, but a “fair” score from TransUnion is typically “fair” across the board.

What credit score is needed to buy a 300k house

620-660

Additionally, you'll need to maintain an “acceptable” credit history. Some mortgage lenders are happy with a credit score of 580, but many prefer 620-660 or higher.

How to raise credit score 100 points in 30 days

Quick checklist: how to raise your credit score in 30 daysMake sure your credit report is accurate.Sign up for Credit Karma.Pay bills on time.Use credit cards responsibly.Pay down a credit card or loan.Increase your credit limit on current cards.Make payments two times a month.Consolidate your debt.

How long does it take to go from 600 to 800 credit score

Depending on where you're starting from, It can take several years or more to build an 800 credit score. You need to have a few years of only positive payment history and a good mix of credit accounts showing you have experience managing different types of credit cards and loans.

How to get 800 credit score in 45 days

Here are 10 ways to increase your credit score by 100 points – most often this can be done within 45 days.Check your credit report.Pay your bills on time.Pay off any collections.Get caught up on past-due bills.Keep balances low on your credit cards.Pay off debt rather than continually transferring it.

Is Equifax your actual score

The Equifax credit score is an educational credit score developed by Equifax. Equifax credit scores are provided to consumers for their own use to help them estimate their general credit position. Equifax credit scores are not used by lenders and creditors to assess consumers' creditworthiness.