Is a credit card liabilities or assets?

Is personal credit card debt a liability

Common types of reportable liabilities include: boat loans, capital commitments, credit card debt, exercised lines of credit, margin accounts, mortgage debt, student loans, loans from non-commercial sources (e.g., loan from a friend), and liabilities for which you co-signed and have a current legal obligation to repay.

CachedSimilar

Is credit considered an asset

No, a credit line is not an asset. If you owe money on your line then it would show up as a liability on your balance sheet. When you list the line of credit, you only have to record the portion you have actually withdrawn, not the whole amount.

Cached

What is credit card in accounting

Definition: A credit card allows its owner to withdraw money through the financial firm that has issed the card. A credit card is a wallet-size plastic card containing electronic data that can be interpreted by a reading device for credit cards.

What are 5 examples of liabilities

Examples of liabilities are -Bank debt.Mortgage debt.Money owed to suppliers (accounts payable)Wages owed.Taxes owed.

Why are credit cards liabilities

In contrast, credit card debts are liabilities. Each credit card transaction creates a new loan from the credit card issuer. Eventually the loan needs to be repaid with a financial asset—money.

Is a credit card payment a liability or expense

Liabilities

Credit Cards as Liabilities

The balance owed on a credit card can be treated either as a negative asset, known as a “contra” asset, or as a liability.

Why are credit cards a liability

In contrast, credit card debts are liabilities. Each credit card transaction creates a new loan from the credit card issuer. Eventually the loan needs to be repaid with a financial asset—money.

Why is a credit card considered a liability

Credit cards are a liability and not an asset, as the money on the card is not yours and this credit line does not increase your net worth.

How do you record credit cards in accounting

Credit Card Expense accounts are expense accounts, so they are also increased by debits and decreased by credits. Because the Sales Revenue account is a revenue account, it is increased by credits and decreased by debits.

What type of account is a credit card

A credit card generally operates as a substitute for cash or a check and most often provides an unsecured revolving line of credit. The borrower is required to pay at least part of the card's outstanding balance each billing cycle, depending on the terms as set forth in the cardholder agreement.

What are 10 examples of assets

What are the Main Types of AssetsCash and cash equivalents.Accounts Receivable.Inventory.Investments.PPE (Property, Plant, and Equipment)Vehicles.Furniture.Patents (intangible asset)

What are 6 examples of liabilities

Recorded on the right side of the balance sheet, liabilities include loans, accounts payable, mortgages, deferred revenues, bonds, warranties, and accrued expenses.

What type of account is a credit card account

A credit card is a type of revolving credit account that involves borrowing money—generally up to a predetermined credit limit—and paying it back over and over again while the account is open.

How is credit a liability

A credit entry increases liability, revenue or equity accounts — or it decreases an asset or expense account. Thus, a credit indicates money leaving an account. You can record all credits on the right side, as a negative number to reflect outgoing money.

Is a credit account a liability

A liability account reflects the amount a company owes. Examples include credit card accounts/balances, accounts payable, notes payable, taxes and loans. An equity account reflects the shareholders' interests in the company's assets.

How do you categorize credit card payments in accounting

A payment against a Card Balance is paying against that credit card type of liability account in your file, the same as ane debt payment is not expense but Liability payment. In other words, paying VISA or AMEX is a debt payment, it isn't the purchase of something.

How do I record a credit card in QuickBooks

This is the main way to record your credit card payments in QuickBooks.Select + New.Under Money Out (if you're in Business view), or Other (if you're in Accountant view), select Pay down credit card.Select the credit card you made the payment to.Enter the payment amount.Enter the date of the payment.

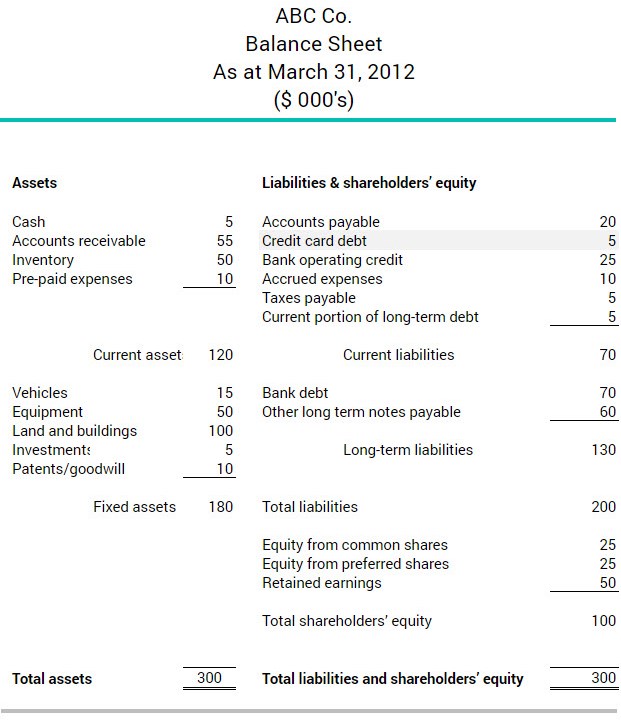

Where does credit card go on balance sheet

It appears under liabilities on the balance sheet. Credit card debt is a current liability, which means businesses must pay it within a normal operating cycle, (typically less than 12 months).

Are credit cards considered accounts payable

Accounts payable is a record of your company's short-term debts that have not yet been paid. This includes things like credit card bills and pending invoices from vendors and suppliers, as opposed to mortgages and loan repayments that are longer term.

What are the 5 main assets

There are five crucial asset categories: derivatives, fixed income, real estate, cash & cash equivalents, and equity.