Is a credit note a receipt?

What is a credit note also known as

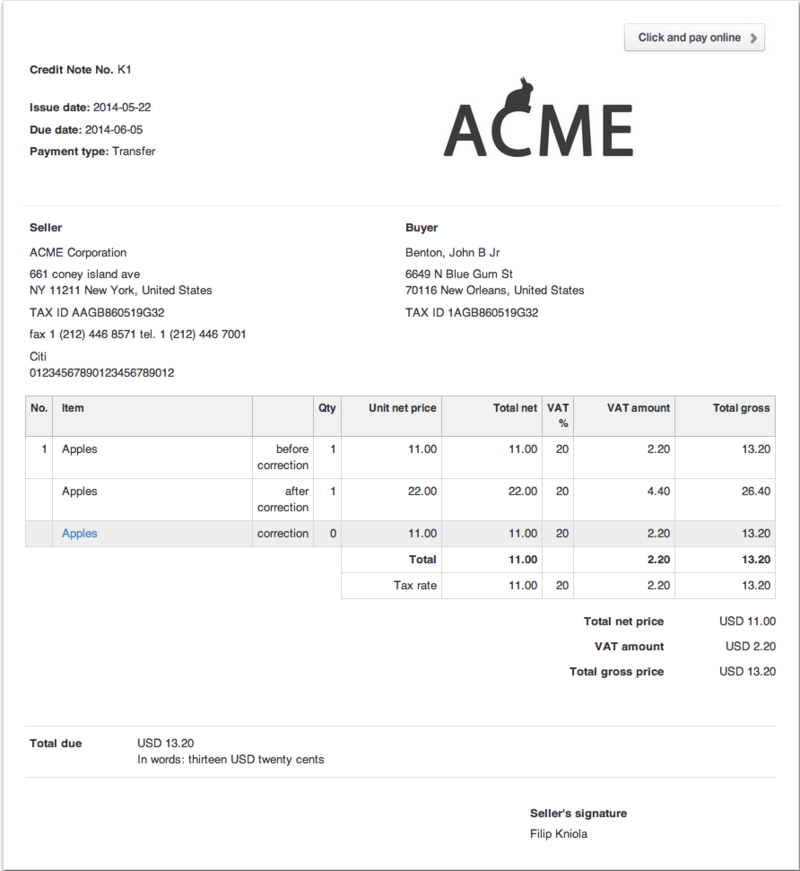

A credit note is a document issued by a seller to a buyer to notify them that credit is being applied to their account. You might notice these are referred to as credit memos.

What is the difference between a credit note and a refund receipt

A credit memo is a posting transaction that can be applied to a customer's invoice as a payment or reduction. A delayed credit is a non-posting transaction that you can include later on a customer's invoice. A refund is a posting transaction that is used when reimbursing a customer's money.

What type of transaction is a credit note

What Is a Credit Note A credit note, also known as a credit memo, is a commercial document issued by the seller and sent to the buyer when there is a reduction in the amount payable to the seller. By issuing a credit note, the seller promises to pay back the reduced amount or adjust it in a subsequent transaction.

What is the purpose of a credit note

A credit note is a financial document issued by supplier companies to reduce the amount owed to them by the buyers. It helps firms maintain a proper paper trail and is issued when the goods are returned, the price is under dispute, or when there are invoicing errors.

Is credit note a refund

A credit note is a paper or electronic note issued by a business to a customer in place of a refund. A credit note acts like a voucher that can only be used for the particular shop, chain of shops or business that issued the credit note.

What is the difference between a credit note and an invoice

A credit note is effectively a negative invoice – it's a way of showing a customer that they don't have to pay the full amount of an invoice. A credit note might either cancel an invoice out completely if it's for the same amount as the invoice, or it might be for less than the invoice.

Does a credit note mean refund

A credit note is a paper or electronic note issued by a business to a customer in place of a refund. A credit note acts like a voucher that can only be used for the particular shop, chain of shops or business that issued the credit note.

Does credit note mean purchase return

In a supplier and buyer transaction, the supplier issues a "credit note" as a sales return. By doing so, the supplier informs the buyer that the purchase returns are accepted. A credit note, also called a "sales return credit note", is given by the supplier in exchange for a debit note.

Is a credit note a refund

A credit note is a paper or electronic note issued by a business to a customer in place of a refund. A credit note acts like a voucher that can only be used for the particular shop, chain of shops or business that issued the credit note.

What happens when a credit note is issued

Credit notes are legal documents, just like invoices, that give you the important ability to cancel out an already issued invoice, either in full or in part. Issuing a credit note essentially allows you to delete the amount of the invoice from your financial records, without actually deleting the invoice itself.

Why is a credit note better than a refund

A credit note is generated by a business to be offset against a previous invoice raised (whether in part or full). No physical monetary exchanges arise at this stage, but often a credit note will precede a refund whereby money does change hands.

Does a credit note cancel out an invoice

Credit notes and invoices are legal documents that go hand-in-hand in business accounting. Invoices are issued to show that payment is owed, whereas credit notes are issued to cancel the invoice or show a return of money.

Do I have to accept a credit note instead of a refund

If I return goods do I have to accept a "credit note" No. You can insist on the full repayment of your money.

What is the disadvantage of credit note

Disadvantages of a credit note include missing out on revenue due to having to credit mistakes and returns. It also may contribute to lower profits when returns and credits exceed sales.

Can you get a refund on a credit note

In general, you do not have to accept a credit note if your complaint is covered by consumer law (except in very limited cases for package holidays – see below). Instead, you can insist on a repair, a replacement or a refund. If you accept a credit note you may not be able to ask for a refund afterwards.

What are the disadvantages of a credit note

Disadvantages of a credit note include missing out on revenue due to having to credit mistakes and returns. It also may contribute to lower profits when returns and credits exceed sales.

What impact does a credit note have on an invoice

Credit notes are legal documents, just like invoices, that give you the important ability to cancel out an already issued invoice, either in full or in part. Issuing a credit note essentially allows you to delete the amount of the invoice from your financial records, without actually deleting the invoice itself.

What to do when you receive a credit note

In double-entry bookkeeping systems, the credit note would be entered as debit under revenues, and credit under accounts receivable. Each credit note should be recorded and updated in the appropriate accounts to match the balance (such as stock, in the case of returned products).

Can I convert credit note to cash

A credit note preserves your right to a cash refund, and you have until the expiry date on the face of it to swap it for a full refund.

Why would a seller send a credit note

Credit notes are typically used when there has been an error in an already-issued invoice, such as an incorrect amount, or when a customer wishes to change their original order.