Is a receivable an expense?

Is receivable an asset or expense

Accounts receivable are considered an asset in the business's accounting ledger because they can be converted to cash in the near term. Instead, the business has extended credit to the customer and expects to receive payment for the transaction at some point in the future.

What are receivables considered

Receivables are unpaid customer debt for products or services delivered. It is a current asset that affects a business's liquidity and working capital management. Receivables are shown as current assets on the balance sheet, and the general ledger shows a debit balance.

Is account payable an expense

Is Accounts Payable a Liability or an Expense Accounts payable is a liability since it is money owed to one or many creditors. Accounts payable is shown on a businesses balance sheet, while expenses are shown on an income statement.

Is receivable always an asset

Is accounts receivable an asset Yes, accounts receivable is an asset, because it's defined as money owed to a company by a customer.

Are liabilities an expense

Expenses and liabilities should not be confused with each other. One is listed on a company's balance sheet, and the other is listed on the company's income statement. Expenses are the costs of a company's operation, while liabilities are the obligations and debts a company owes.

Are receivables on an income statement

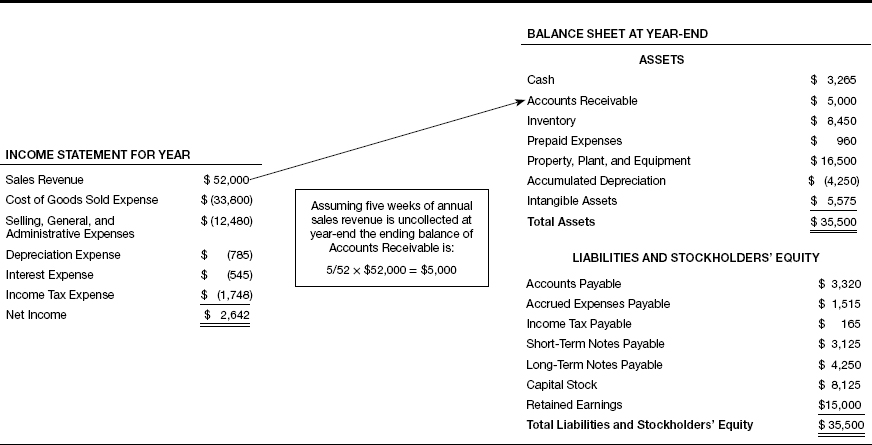

Accounts receivable isn't reported on your income statement, but you will record it in your trial balance and balance sheet – a helpful financial statement for year-end reporting and getting a full picture of your business's net worth.

Is accounts receivable a liability

For instance, a company's property, cash, accounts receivable, and inventory are examples of assets. Salaries, money to be paid to suppliers, and interest owed on debt are examples of liabilities.

Is account payable an asset or expense

Accounts payable is considered a current liability, not an asset, on the balance sheet.

Is a receivable always a liability

So, is Accounts Receivable an Asset or Liability Accounts receivable is an asset. It's a current asset that can easily be turned into cash. Liabilities are something that you owe somebody in terms of cash or products, while assets are something you own.

Is liabilities a revenue or expense

While expenses and liabilities may seem as though they're interchangeable terms, they aren't. Expenses are what your company pays on a monthly basis to fund operations. Liabilities, on the other hand, are the obligations and debts owed to other parties.

What are examples of expenses

Examples of expenses include rent, utilities, wages, salaries, maintenance, depreciation, insurance, and the cost of goods sold. Expenses are usually recurring payments needed to operate a business.

Is a receivable an asset

Accounts receivable or AR is the money a company is owed by its customers for goods and services rendered. Accounts receivable is a current asset and shows up in that section of a company's balance sheet.

Where do receivables go on a balance sheet

assets section

An account receivable is recorded as a debit in the assets section of a balance sheet. It is typically a short-term asset—short-term because normally it's going to be realized within a year.”

Is bills receivable an asset or liability in balance sheet

assets

Bills receivable are assets to the company. Bills payable are liabilities to the company.

Is accounts receivable an asset liability or owner’s equity

Accounts receivable are considered a current asset because they usually convert into cash within one year. When a receivable takes longer than one year to convert, it will be recorded as a long-term asset. In addition to accounts receivable, there are other current assets found on the balance sheet.

Which of the following is not an expense

Answer and Explanation: The answer is b. Dividends.

What are the 4 types of expenses

If the money's going out, it's an expense. But here at Fiscal Fitness, we like to think of your expenses in four distinct ways: fixed, recurring, non-recurring, and whammies (the worst kind of expense, by far).

What type of assets are receivables

Accounts receivable are considered a current asset because they usually convert into cash within one year. When a receivable takes longer than one year to convert, it will be recorded as a long-term asset. In addition to accounts receivable, there are other current assets found on the balance sheet.

Do receivables go on income statement

Accounts receivable isn't reported on your income statement, but you will record it in your trial balance and balance sheet – a helpful financial statement for year-end reporting and getting a full picture of your business's net worth.

What type of expense is bills receivable

In a way the entity has given those debtors a benefit i.e. credit so as per the rule Bills Receivable A/c is debited. Hence, bills receivable is a personal a/c.