Is accounts receivable liability or asset?

Is accounts receivable a liability

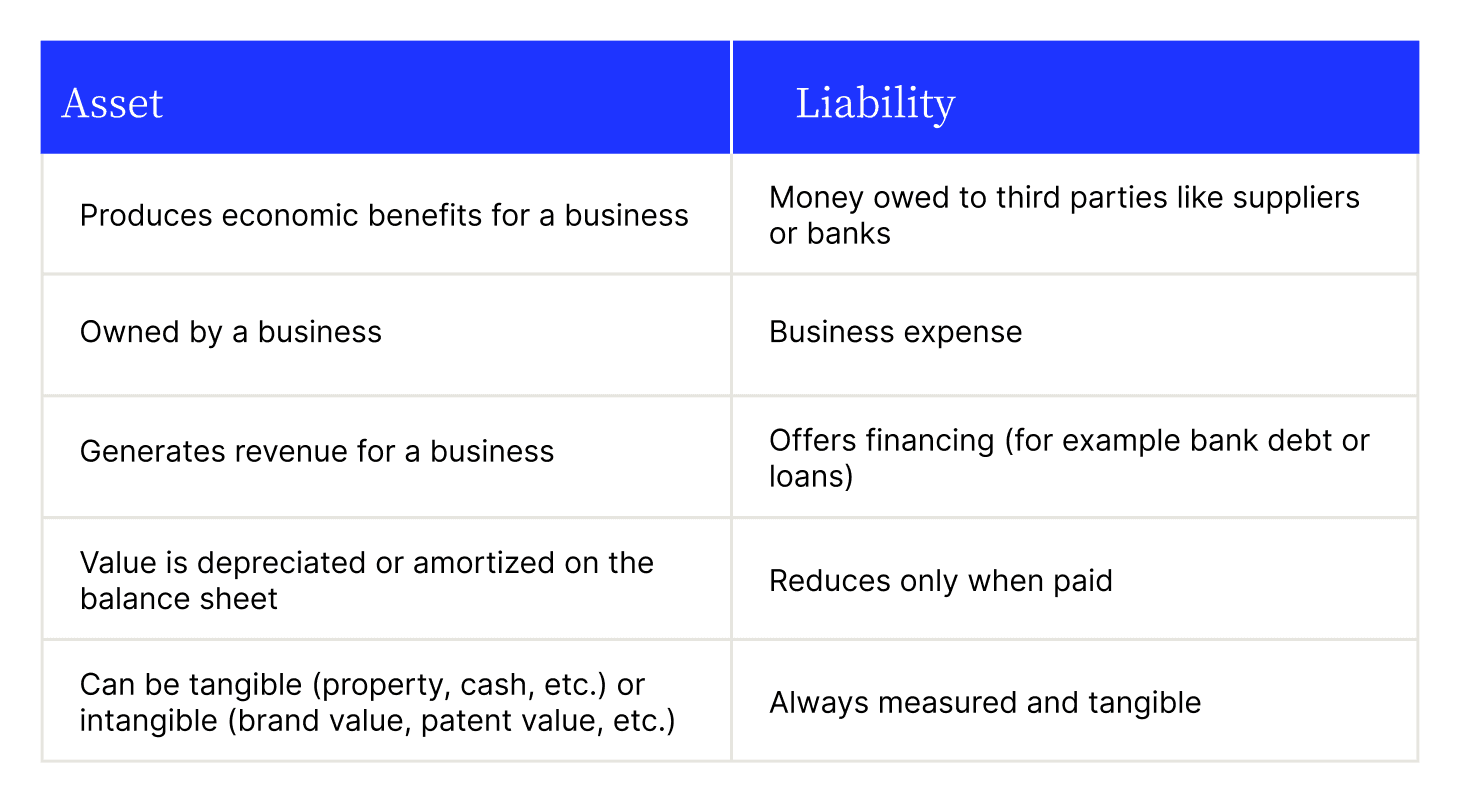

Accounts receivable are an asset, not a liability. In short, liabilities are something that you owe somebody else, while assets are things that you own. Equity is the difference between the two, so once again, accounts receivable is not considered to be equity.

Cached

Is accounts payable a liability or asset

liabilities

When a customer pays his invoice, the receivable amount is converted to cash – considered a business asset. By contrast, accounts payable are liabilities because they show money that will leave business accounts when you pay your debts. In addition to the amount owed, your accounts will also show payment terms.

Is accounts receivable a liability asset or owner’s equity

Accounts receivable are considered a current asset because they usually convert into cash within one year.

Cached

Is bills receivable an asset or liability in balance sheet

assets

Bills receivable are assets to the company. Bills payable are liabilities to the company.

What type of account is accounts receivable

asset account

Accounts receivable (AR) are an asset account on the balance sheet that represents money due to a company in the short term. Accounts receivable are created when a company lets a buyer purchase their goods or services on credit.

Are accounts payable current liabilities

Typical current liabilities include accounts payable, salaries, taxes and deferred revenues (services or products yet to be delivered but for which money has already been received).

Is receivables an asset

Accounts receivable are considered an asset in the business's accounting ledger because they can be converted to cash in the near term. Instead, the business has extended credit to the customer and expects to receive payment for the transaction at some point in the future.

What is accounts receivable classified

Also known as accounts receivable, trade receivables are classified as current assets on the balance sheet. Current assets are assets which are expected to be converted to cash in the coming year.

What is accounts receivable on a balance sheet

An account receivable is an asset recorded on the balance sheet as a result of an unpaid sales transaction, explains BDC Advisory Services Senior Business Advisor Nicolas Fontaine. “More specifically, it is a monetary asset that will realize its value once it is paid and converts into cash.

What type of balance sheet is accounts receivable

An account receivable is recorded as a debit in the assets section of a balance sheet. It is typically a short-term asset—short-term because normally it's going to be realized within a year.”

What does accounts receivable fall under

An account receivable is recorded as a debit in the assets section of a balance sheet. It is typically a short-term asset—short-term because normally it's going to be realized within a year.”

What are the 5 current liabilities

Current liabilities are the sum of Notes Payable, Accounts Payable, Short-Term Loans, Accrued Expenses, Unearned Revenue, Current Portion of Long-Term Debts, Other Short-Term Debts.

Which accounts are current liabilities

Some examples of current liabilities that appear on the balance sheet include accounts payable, payroll due, payroll taxes, accrued expenses, short-term notes payable, income taxes, interest payable, accrued interest, utilities, rental fees, and other short-term debts.

What type of account is receivables

Accounts receivable (AR) are an asset account on the balance sheet that represents money due to a company in the short term. Accounts receivable are created when a company lets a buyer purchase their goods or services on credit.

Is accounts payable a current liability

Typical current liabilities include accounts payable, salaries, taxes and deferred revenues (services or products yet to be delivered but for which money has already been received).

What side of balance sheet is receivables

current assets side

As we understood from the above example, an account receivable is an asset and would be recorded under the current assets side in the balance sheet.

What category is account receivable

asset

Accounts receivable are classified as an asset because they provide value to your company. (In this case, in the form of a future cash payment.)

What are accounts receivables classified as

current assets

Accounts Receivable are amounts due from customers from the sale of services or merchandise on credit. They are usually due in 30 – 60 days. They are classified on the Balance Sheet as current assets.

What classification is accounts receivable

asset

Accounts receivable are classified as an asset because they provide value to your company. (In this case, in the form of a future cash payment.)

What are 8 examples of current liabilities

Some examples of current liabilities that appear on the balance sheet include accounts payable, payroll due, payroll taxes, accrued expenses, short-term notes payable, income taxes, interest payable, accrued interest, utilities, rental fees, and other short-term debts.