Is an EV tax deductible?

Can you write off 100% electric car

Used EVs or plug-in hybrids can be eligible for a tax credit of up to $4,000 provided they meet certain requirements. There are now significant eligibility limits on both the price of the vehicle and the income of the buyer; if either figure is too high, you will not qualify for the tax credit.

CachedSimilar

How do I claim $7500 EV tax credit

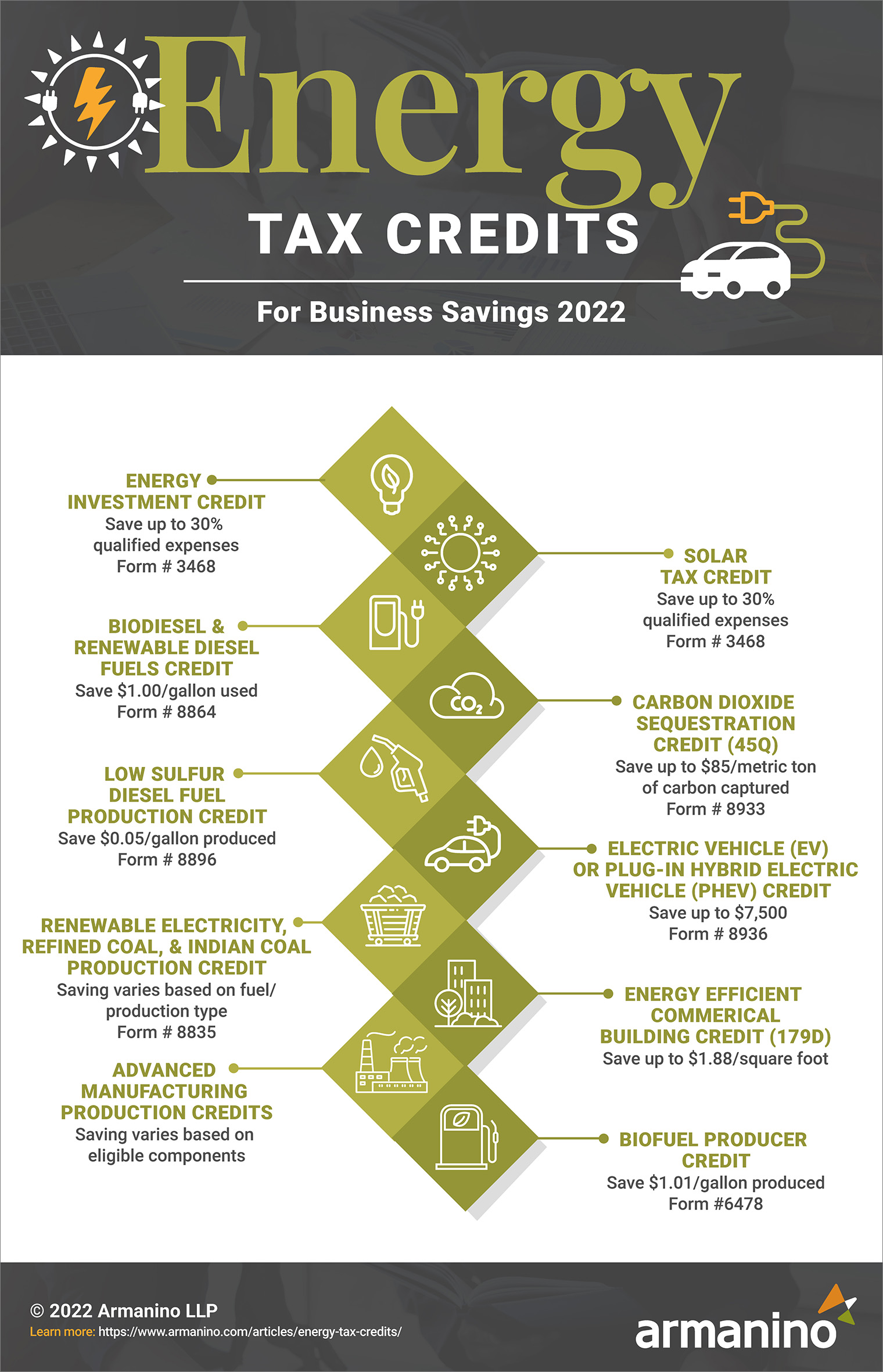

How do I claim the EV tax credit To claim the tax break, known as the Qualified Plug-In Electric Drive Motor Vehicle Credit, you will need to file IRS Form 8936 with your tax return. (You will need to provide the VIN for your vehicle.) You can only claim the credit once, when you purchase the vehicle.

Cached

What EV is eligible for tax credit

Starting January 1, 2023 qualifying used EVs priced below $25,000 can qualify for up to $4,000 in federal tax credits. There are some terms to note however: – Used vehicle qualifies for tax credit only once in its lifetime. – Purchaser must be an individual (no businesses) to qualify for the used vehicle credit.

Cached

Are Teslas tax deductible

As part of the 2023 Inflation Reduction Act, eligible businesses and tax-exempt organizations can claim up to a $7,500 credit when purchasing new Tesla vehicles with a gross vehicle weight rating (GVWR) of up to 14,000 pounds. All Tesla passenger vehicles qualify for this incentive: Model S.

CachedSimilar

What is the income limit for the $7500 EV tax credit

EV Tax Credit Income Limits 2023

The EV tax credit income limit for married couples who are filing jointly is $300,000. And, if you file as head of household and make more than $225,000, you also won't be able to claim the electric vehicle tax credit.

Can you write off 100 of a car over 6000 pounds

Vehicles weighing more than 6,000 pounds but less than 14,000 receive a maximum first-year deduction of up to $27,000 in 2023 ($28,900 in 2023). After that, you follow a regular depreciation schedule.

What does $7,500 tax credit mean

1, many Americans will qualify for a tax credit of up to $7,500 for buying an electric vehicle. The credit, part of changes enacted in the Inflation Reduction Act, is designed to spur EV sales and reduce greenhouse emissions. READ MORE: Over a dozen states grapple with adopting California's electric vehicle mandate.

How do I claim federal tax credit for EV charger

To claim the federal tax credit for your home EV charger, or other EV charging equipment, file Form 8911 with the IRS when you file your federal income tax return. You will need your receipts that show the purchase price of the EV charger and any fees for installation of the charger.

Are Teslas eligible for EV tax credit

Tesla's Model 3 finds itself eligible for the $7,500 U.S. tax credit on EVs.

How do I get tax write off on my Tesla

Complete Form 8936, Qualified Plug-in Electric Drive Motor Vehicle Credit (Including Qualified Two-Wheeled Plug-in Electric Vehicles and New Clean Vehicles), and file it with your tax return for the year you took possession of the vehicle to claim the used clean vehicle credit.

Why is Tesla no longer eligible for tax credit

If the IRS were to use those weight specifications for the clean vehicle tax incentive eligibility, then many cars (including Model Y) would not reach the 6,000 gross vehicle weight rating to be classed as an SUV. Tesla specifies the Model Y has a curb weight of about 4,403 pounds.

How long is EV tax credit

Federal EV Tax Credit 2023: How it Works

For EVs placed into service in 2023, the up to $7,500 EV tax credit is extended for 10 years — until December 2032. The tax credit is taken in the year that you take delivery of the EV.

What is the federal EV income limit

Is there an income limit for the EV tax credit The Inflation Reduction Act limits the electric vehicle federal tax incentives to individuals reporting adjusted gross incomes of $150,000 or less on taxes, $225,000 for those filing as head of household, and $300,000 for joint filers.

What is the tax write off for a car over 6000 pounds

Vehicles weighing more than 6,000 pounds but less than 14,000 receive a maximum first-year deduction of up to $27,000 in 2023 ($28,900 in 2023). After that, you follow a regular depreciation schedule.

What is the 6000 pound write off rule

The 6,000-pound vehicle tax deduction is a rule under the federal tax code that allows people to deduct up to $25,000 of a vehicle's purchasing price on their tax return. The vehicle purchased must weigh over 6,000 pounds, according to the gross vehicle weight rating (GVWR), but no more than 14,000 pounds.

Is the EV tax credit at the point of sale in 2024

Starting in 2024, the EV tax credit will essentially convert into a point-of-sale rebate. The tax credit applies to 30 percent of the cost of a used EV, up to $4,000, on a vehicle with a maximum MSRP of $25,000, weighing no more than 14,000 lbs.

Is EV charging station tax deductible

One of the major changes that came with the updated Inflation Reduction Act allows drivers to use the tax credit to help finance a vehicle charger. Its official name is the Alternative Fuel Vehicle Refueling Property Credit. To claim the credit, EV drivers must file Form 8911 with the IRS.

Does the federal tax credit for EV roll over

The credit is non-refundable, so you won't get a refund for the unused portion of it. In addition, you can't carry the credit over to your next year's return.

Why is Tesla not eligible for $7,500 tax credit

In order to qualify for a tax credit of up to $7,500, a new EV or eligible plug-in hybrid vehicle (PHEV) must meet certain rules: A vehicle's MSRP must not exceed certain limits, so pricey EVs, such as the GMC Hummer EV, Lucid Air, and Tesla Model S and Model X, won't qualify.

How does EV tax credit work if I don’t owe taxes

The EV tax credit is a federal credit for income taxes owed to the IRS; you must owe enough taxes to take advantage of this opportunity. If you owe no income taxes to the IRS, then you can't benefit from it.