Is an S Corp owner considered self-employed?

Is income from S corp self-employment

S-Corp distributions

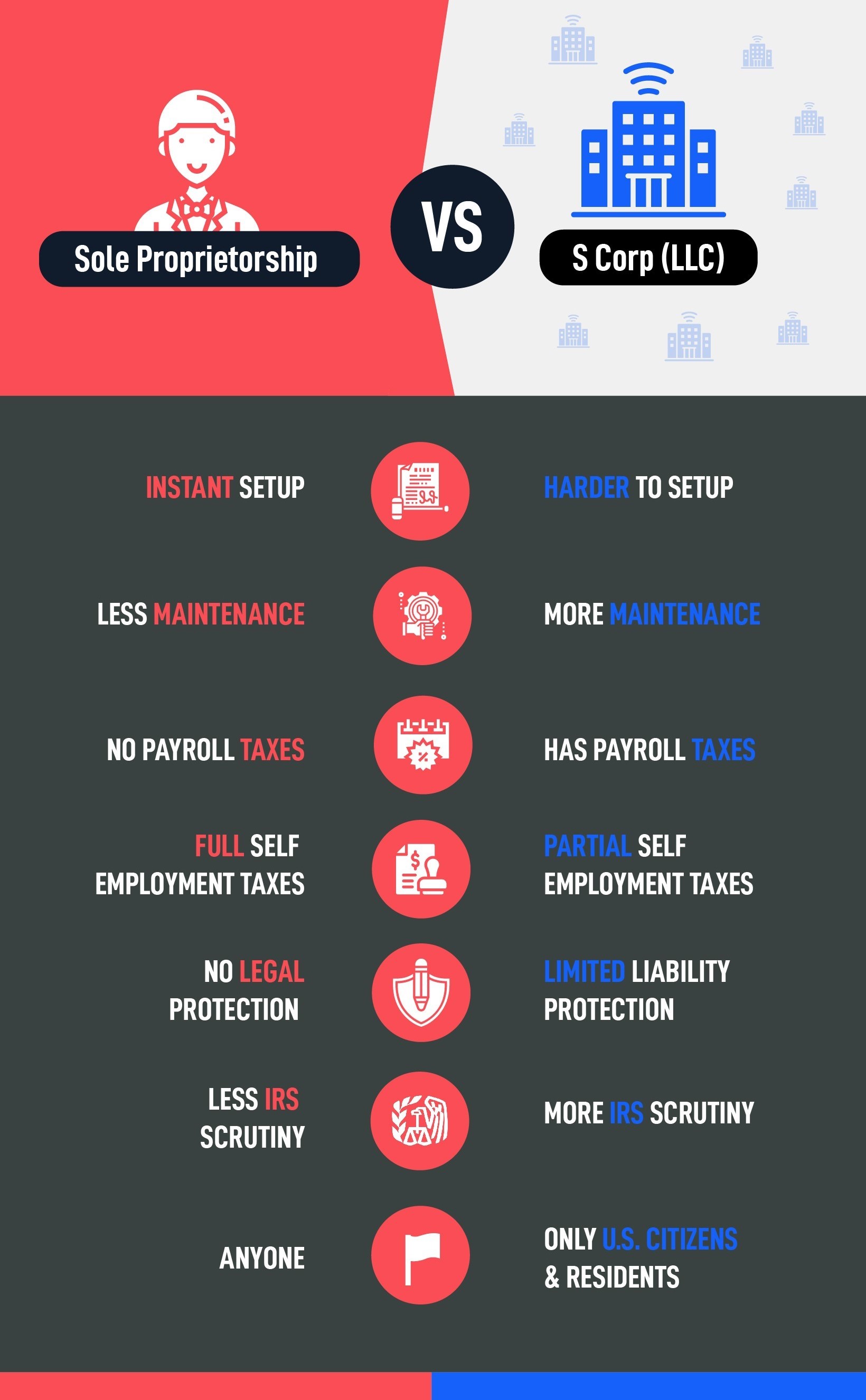

If you organize your business as an S-corporation, you can classify some of your income as salary and some as a distribution. You'll still be liable for self-employment taxes on the salary portion of your income, but you'll just pay ordinary income tax on the distribution portion.

Cached

Do S corp owners have to pay self-employment tax

The S Corp advantage is that you only pay FICA payroll tax on your employment wages. The remaining profits from your S Corp are not subject to self-employment tax or FICA payroll taxes. Those profits are only subject to income tax.

Cached

What is the difference between self-employed and S corp

The main difference is you can save on self-employment taxes. As S corps allow profits to be dispersed through distributions, rather than income, there are no Social Security taxes or Medicare taxes taken out on them.

Cached

Can an S corp owner be a 1099 employee

You generally belong to one of two groups when you operate your business as an S corporation and also pay yourself on a 1099. The first group consists of those S corporation owners who pay their entire compensation on the 1099.

What are the benefits of being on payroll if you own an S corp

Single person S-corporations don't have to pay self-employment tax because the owner generally earns a salary. Payroll taxes are deducted from these earnings and the S-corporation pays the employer portion of the Medicare and Social Security taxes.

Why is S corp income not subject to self-employment tax

An S corporation isn't subject to tax at the corporate level. Instead, the corporation's items of income, gain, loss and deduction are passed through to the shareholders. However, the income passed through to the shareholder isn't treated as self-employment income.

Is LLC or S corp better for self-employed

As an LLC owner, you'll incur steep self employment taxes on all net earnings from your business, whereas an S corporation classification would allow you to only pay those taxes on the salary you take from your company. However, itemized deductions could make an LLC a more lucrative choice for tax purposes.

How do I pay myself as the owner of an S corp

An S corp offers business owners three ways for paying themselves: distributions, salary, or a combo of both. Choosing which option is best has a lot to do with how you contribute to the company and how well the business does financially.

How much should I pay myself as an S corp owner

The S Corp 60/40 Rule

The 60/40 rule describes where owners pay 60% of their salary and the remaining 40% as a distribution. For example, if an S Corp owner earns $50,000 annually, they'd pay themselves a $30,000 salary and a $20,000 profit distribution.

What is the best way to pay yourself as an S Corp owner

If you're not active in your company's operations and don't provide services to the S corp, you can draw money from the business by using shareholder distributions rather than a salary. A distribution is a payment of earnings to shareholders, usually in the form of cash or stock, and is taxed at the shareholder level.

How much should I pay myself as an S Corp owner

The S Corp 60/40 Rule

The 60/40 rule describes where owners pay 60% of their salary and the remaining 40% as a distribution. For example, if an S Corp owner earns $50,000 annually, they'd pay themselves a $30,000 salary and a $20,000 profit distribution.

How to save on self-employment tax with S corp

How do S corps help you save money on taxesLowering Owner's Salary.Employing your child.Covering Owner's Health Insurance Premiums.Deducting Home-Office Expenditure.Renting out your home to your S corp.Implementing a plan to reimburse cell phone and travel expenses.Utilizing Section 179 – Depreciation for vehicles.

What are the tax advantages of an S corp over an LLC

Taxes on S corporations are lower than on non-S corp. LLCs. As an LLC owner, you'll incur steep self employment taxes on all net earnings from your business, whereas an S corporation classification would allow you to only pay those taxes on the salary you take from your company.

Why would anyone choose LLC over S corp

Advantages of LLCs over S corporations. One of the reasons many people prefer the LLC over the corporation is that there is more flexibility in how it is managed. Corporation laws (which, as noted apply equally to S corps and C corps) contain more provisions regarding managing the company than LLC laws.

How do I take money out of my S corp without paying taxes

Take A Distribution

Distributions are the best way to get money from your S Corp. Because you'll report it as “passive income” on your income tax return, it won't be subject to employment taxes.

Is it better to take owners draw or salary

It's also worth remembering that every time an owner takes a draw, it reduces the company's equity, and therefore fewer funds are available for future purchases. The salary method is more predictable and better for tax purposes since you know exactly when your paycheck will hit your account and what the amount will be.

How does an S corp owner pay taxes

Because of pass-through taxation, the S corporation doesn't pay federal income tax on its business income the way a C corporation does. Instead, business income, deductions, losses, and other tax items flow through (or pass through) to the business owners (e.g., the shareholders).

Can I transfer money from S corp to personal account

If you're running short on cash or have an unexpected expense on the homefront, you can borrow money from your S Corporation. However, you can't simply just scribble out an IOU or do a quick transfer of money between accounts. You will need to obtain an official promissory note that is properly prepared and executed.

What is the best way to pay yourself as an S corp

If you're not active in your company's operations and don't provide services to the S corp, you can draw money from the business by using shareholder distributions rather than a salary. A distribution is a payment of earnings to shareholders, usually in the form of cash or stock, and is taxed at the shareholder level.

Is LLC or S corp better for self employed

As an LLC owner, you'll incur steep self employment taxes on all net earnings from your business, whereas an S corporation classification would allow you to only pay those taxes on the salary you take from your company. However, itemized deductions could make an LLC a more lucrative choice for tax purposes.