Is Apple Card like a credit card?

Can you use the Apple Card as a credit card

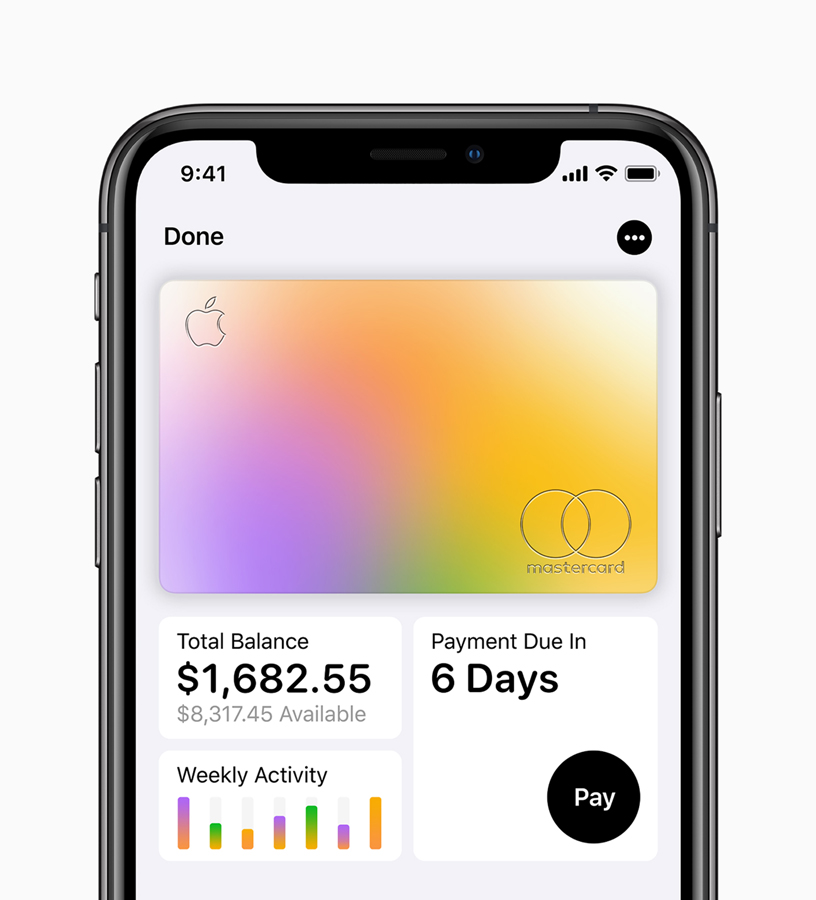

Pay with your titanium Apple Card

You can request a titanium Apple Card and use it to pay anywhere in the world that Mastercard is accepted.

Is an Apple Card the same as a credit card

Apple Card is the first consumer credit card Goldman Sachs has issued, and they were open to doing things in a new way. And the strength of the Mastercard network means Apple Card is accepted all over the world.

Cached

Does Apple Pay work like a credit card

Apple Pay is a mobile payment service by Apple Inc. that allows users to make payments in person, in iOS apps, and on the web. It is supported on iPhone, Apple Watch, iPad, and Mac. It digitizes and can replace a credit or debit card chip and PIN transaction at a contactless-capable point-of-sale terminal.

Is Apple Card a major credit card

The Apple Card is a Mastercard. You can use your Apple Card at nearly 11 million merchants that accept Mastercard nationwide.

Cached

What is Apple Card credit limit

It does have credit limits. The limits are determined by the cardholder's credit score, credit age, and income at the time of application. Cardholders have reported credit limits as low as $50 and as high as $15,000. An Apple Card may be shared using Apple Card Family.

What are the benefits of an Apple Card

Get 2% Daily Cash back every time you pay with your iPhone or Apple Watch. Simple, secure, magical card activation. It's hard to steal a credit card number when it's locked away. Your purchase history.

Is Apple Card hard to get

Yes, it is hard to get the Apple Card because it requires at least good credit for approval. Unless your credit score is 700 or higher and you have a lot of income, it will be difficult for you to get approved for the Apple Card.

What are the disadvantages of Apple Pay

Cons:Supported only on iPhones and Apple devices (unlike Google Pay)Reports of face recognition based payment being slightly trickier than in Android phones.Transactions are not synced across devices.

Is Apple Pay better than physical card

Apple Pay is designed with your security and privacy in mind, making it a simpler and more secure way to pay than using your physical credit, debit, and prepaid cards. Apple Pay uses security features built-in to the hardware and software of your device to help protect your transactions.

What is the max credit limit for Apple Card

The Apple Card has no yearly fees, no fees for transactions, and no fees for penalties. It does have credit limits. The limits are determined by the cardholder's credit score, credit age, and income at the time of application. Cardholders have reported credit limits as low as $50 and as high as $15,000.

What is the minimum income for the Apple Card

There is no minimum income limit you need to have. The amount is used in part to determine your available credit limit if you are approved. Check your last year's tax return.

What is the minimum payment on Apple Card

The Apple Card minimum payment is either $25 or 1% of the statement balance, plus fees, past-due amounts, and interest – whichever is higher. If your balance is less than $25, the entire amount is your minimum payment. Note that if you recently missed a payment, the issuer may add a late fee to your minimum payment.

Will getting an Apple Card affect my credit score

If you apply for Apple Card and your application is approved, there's no impact to your credit score until you accept your offer. If you accept your offer, a hard inquiry is made. This may impact your credit score.

What is the credit limit on the Apple Card

It does have credit limits. The limits are determined by the cardholder's credit score, credit age, and income at the time of application. Cardholders have reported credit limits as low as $50 and as high as $15,000. An Apple Card may be shared using Apple Card Family.

What is the max credit limit on Apple Card

The Apple Card has no yearly fees, no fees for transactions, and no fees for penalties. It does have credit limits. The limits are determined by the cardholder's credit score, credit age, and income at the time of application. Cardholders have reported credit limits as low as $50 and as high as $15,000.

What is the minimum income for Apple Card

There is no minimum income limit you need to have.

Why use Apple Pay vs credit card

Apple Pay is safer than using a physical credit, debit, or prepaid card. Face ID, Touch ID, or your passcode are required for purchases on your iPhone, Apple Watch, Mac, or iPad. Your card number and identity aren't shared with merchants, and your actual card numbers aren't stored on your device or on Apple servers.

Does Apple Pay charge a monthly fee

There's no cost to use Apple Pay.

What is the downside of Apple Pay

Apple Pay requires you to disclose various personal information. Apart from the standard data like your name and address, the company will also access your transaction history—which could amount to a lot if you use it frequently.

What is the point of physical Apple Card

If you need to pay for purchases that can't be made with Apple Pay, you can use the physical version of the Apple Card that Apple sends once you sign up. In addition to Goldman Sachs, Apple is partnering with Mastercard, so the physical Apple Card can be used wherever Mastercard is accepted.