Is auto refinancing a hard inquiry?

How many points does refinancing a car affect credit score

Refinancing your auto loan can save you money with lower interest rates and payments. It may cause a temporary five- to 10-point dip in your credit score, but the drop only lasts a few months with proper management.

Cached

Would refinancing hurt my credit

Refinancing will hurt your credit score a bit initially, but might actually help in the long run. Refinancing can significantly lower your debt amount and/or your monthly payment, and lenders like to see both of those. Your score will typically dip a few points, but it can bounce back within a few months.

Cached

Is refinancing a car based on credit score

There is no minimum credit score required to refinance a car loan. That being said, there is a range that is considered a “good credit score” to refinance a car loan. In general, a credit score over 700 will unlock the best interest rates, and a credit score between 660-700 will give you access to standard rates.

Does autopay refinance hurt credit score

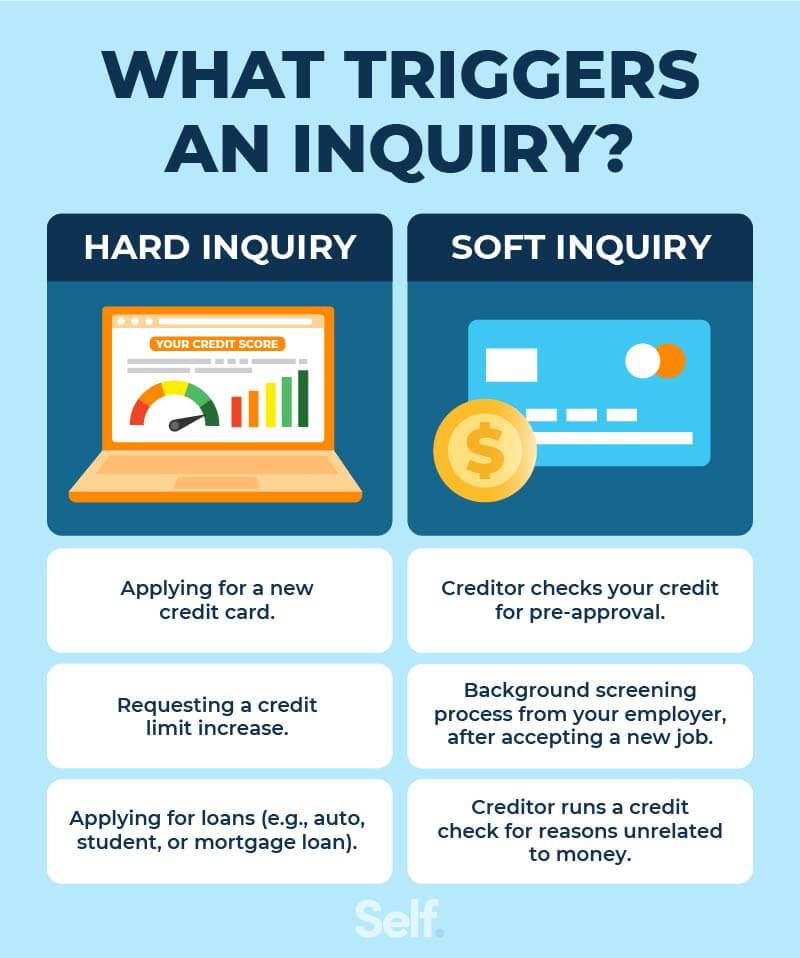

Does an Autopay loan affect your credit score Autopay offers a soft credit check when you apply for pre-qualification. This will not affect your credit score. But lenders might do a hard inquiry if you select a loan for approval, which can affect your credit score.

How long should I wait to refinance my car

six months to one year

How long should you wait to refinance a car Because new loans negatively impact your credit, you should wait to refinance until your credit score has recovered. Most experts recommend waiting at least six months to one year before refinancing.

What matters when refinancing a car

Your credit report and credit score play a key role in determining if you're able to refinance and what your borrowing costs will be. A higher credit score makes you a less risky borrower and can help you secure a lower interest rate.

What are the negative effects of refinancing

Below are some downsides to refinancing you may consider before applying.You Might Not Break Even.The Savings Might Not Be Worth The Effort.Your Monthly Payment Could Increase.You Could Reduce The Equity In Your Home.

What is the disadvantage of refinancing a car loan

The downsides to auto loan refinancing can include paying lender fees and additional interest if you extend the loan term or cash out auto equity. You could also end up owing more than your car is worth.

Is it good to refinance with autopay

If you want to refinance at a lower interest rate, Autopay might be ideal — especially if you have excellent credit and can qualify for the starting interest rate. Lastly, Autopay may be a good choice if you need to finance only a small amount or want options when it comes to your loan term.

Is it smart to refinance your auto loan

Refinancing and extending your loan term can lower your payments and keep more money in your pocket each month — but you may pay more in interest in the long run. On the other hand, refinancing to a lower interest rate at the same or shorter term as you have now will help you pay less overall.

How many payments should you make before refinancing your car

At least 6 months into the car loan

This way, you'll have time to build a good history of on-time payments. Some lenders require six to 12 months of on-time payments before they'll consider a refinancing application.

What not to do when refinancing a car

Avoid these common pitfalls when refinancing your vehicle loan.Not checking refinancing requirements.Not checking with your current lender first.Extending your loan term too much.Not considering your credit.Only shopping with one lender.Becoming upside down on your loan.Giving up after your first rejection.

What is the downside of refinancing a car

The downsides to auto loan refinancing can include paying lender fees and additional interest if you extend the loan term or cash out auto equity. You could also end up owing more than your car is worth.

What happens when you refinance a car loan

Refinancing your auto loan may lower your monthly payments. You could reduce your payments with a better interest rate or by extending the term of the loan. However, if you increase the loan's length, its overall cost may increase because you'll pay more in interest.

How long should you wait to refinance a car

How long should you wait to refinance a car Because new loans negatively impact your credit, you should wait to refinance until your credit score has recovered. Most experts recommend waiting at least six months to one year before refinancing.

What is the downside of autopay

Overdraft Risk: Automatic payments do have some drawbacks. If you're not carefully tracking how much you spend each month and making sure you have enough money in your account to cover your automatic payments, you could forget about a large upcoming payment and end up overdrawing your account.

What is the downfall of refinancing a car

The downsides to auto loan refinancing can include paying lender fees and additional interest if you extend the loan term or cash out auto equity. You could also end up owing more than your car is worth.

How long should I wait until I refinance my car loan

six months to one year

How long should you wait to refinance a car Because new loans negatively impact your credit, you should wait to refinance until your credit score has recovered. Most experts recommend waiting at least six months to one year before refinancing.

What are the disadvantages of refinancing a car

The downsides to auto loan refinancing can include paying lender fees and additional interest if you extend the loan term or cash out auto equity. You could also end up owing more than your car is worth.

What disqualifies you from refinancing

What disqualifies me from refinancing Homeowners are commonly disqualified from refinancing because they have too much debt. If your debt-to-income ratio is above your lender's maximum allowed percentage, you may not qualify to refinance your home. A low credit score is also a common hindrance.