Is Cosigning a hard inquiry?

Does Cosigning hurt your credit score

Being a co-signer itself does not affect your credit score. Your score may, however, be negatively affected if the main account holder misses payments.

Cached

Whose credit score is used when co signing

Whose credit is used for a co-signed auto loan In a co-signed auto loan, the lender will consider the credit scores of both the primary borrower and the co-signer.

Does a cosigner get their credit checked

The landlord will conduct a credit check on the co-signer, just like he did on you. If your potential co-signer does not have acceptable credit, the landlord makes the decision on how to proceed with your application. Choose your co-signer carefully.

Will Cosigning affect me buying a car

Cosigning an auto loan doesn't disqualify you from obtaining financing of your own — you can still get approved for an auto loan if you have a solid credit history and can afford your car payments.

What are the cons of cosigning

Cons of Cosigning a LoanIncreased responsibility — Once again, if you cosign for a loan, you are responsible for paying if the other party can't.Potentially strained relationship — Many personal relationships have been damaged or ended because of financial strain.

What are the dangers of cosigning

If you are asked to pay and cannot, you could be sued or your credit rating could be damaged. Consider that, even if you are not asked to repay the debt, your liability for this loan may keep you from getting other credit you may want.

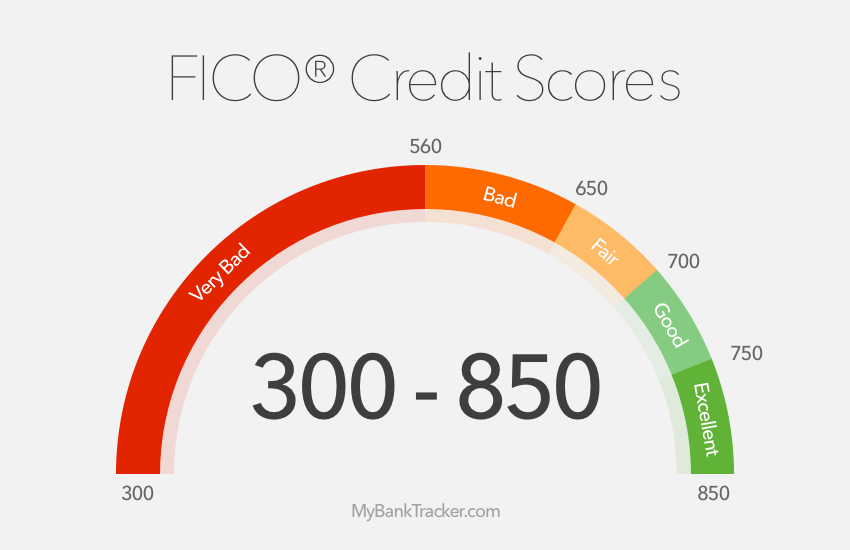

Can I cosign with a 650 credit score

Typically, a cosigner needs a credit score of 670 or better to be approved. This range is usually classified as very good to excellent credit.

How high does a co-signer’s credit have to be

Although there might not be a required credit score, a cosigner typically will need credit in the very good or exceptional range—670 or better. A credit score in that range generally qualifies someone to be a cosigner, but each lender will have its own requirement.

Will Cosigning affect me getting a loan

Cosigning can affect your ability to get financing.

In addition to the impact on your credit scores, lenders may include the payments you cosigned for when calculating your debt-to-income (DTI) ratio. A high DTI can make getting a loan or line of credit more difficult.

What is the minimum credit score to cosign a car

700 or above

In order for your cosigner to be accepted by the bank or lender, the cosigner is usually required to have a good or excellent personal credit rating. Generally, lenders will require a potential cosigner to have a credit rating score of 700 or above.

Whose credit score is used when buying a car with a co-signer

Whose credit score is used when buying a car with a co-signer Lenders can consider the credit scores of both borrowers when co-signing an auto loan. If you have a lower credit score, having a co-signer with a higher score could work in your favor.

Does cosigning affect my ability to get a loan

Cosigning can affect your ability to get financing.

In addition to the impact on your credit scores, lenders may include the payments you cosigned for when calculating your debt-to-income (DTI) ratio. A high DTI can make getting a loan or line of credit more difficult.

Why is it risky to be a co-signer

The lender can sue the cosigner for interest, late fees, and any attorney's fees involved in collection. If the primary borrower falls on hard times financially and cannot make payments, AND the cosigner fails to make the payments, the lender may also decide to pursue garnishment of the wages of the cosigner.

Is it ever a good idea to cosign

The bottom line is this: co-signing on a loan for anyone is never a good idea. If you feel compelled, lend them some money with a written agreement on how it is to be repaid. But never put your credit on the line by co-signing documents with a lender.

Can a cosigner have worse credit than you

Cosigning a loan can affect the co-signer's credit score—for better or for worse. The loan will be added to the co-signer's credit history and impact their credit score.

Can I get a loan with a 500 credit score with a cosigner

Apply with a cosigner

The cosigner's credit and income impact the lender's decision more than those of the primary applicant, so it can help people with a credit score of 500 get approved for loans they might not normally qualify for.

Can I cosign for a car with a 500 credit score

So, if someone has a bad credit score, there is still a chance that they can be a cosigner. If the credit score is in the 500s, then it is relatively easier to get a loan, but that will come at a high-interest rate, but getting the loan will still be possible.

Can I cosign with a 600 credit score

If you're planning to ask a friend or family member to co-sign on your loan or credit card application, they must have a good credit score with a positive credit history. Lenders and card issuers typically require your co-signer to have a credit score of 700 or above.

Can I cosign with a 580 credit score

Cosigning does have some limitations. If your credit score is lower than the 620 minimum for conventional and the 580 for FHA, a cosigner can't help. A cosigner also can't make up for a recent bankruptcy or foreclosure. You still need a down payment—in most cases, at least 3 to 5%, depending on the loan type.

Is it easier to get approved for a loan with a cosigner

Yes, it may be easier to get a loan with a cosigner than without one as long as the person cosigning has a higher credit score and income than you do. Applying with a cosigner increases your chances of getting approved since they are promising to repay the loan if you are unable to.