Is Credit Suisse a Tier 2 bank?

What is the rank of Credit Suisse bank

Credit Suisse (Schweiz) AG is the 5th largest bank in Switzerland in terms of total assets. In 2023 its total assets were 250,37 bln CHF, providing the bank with the market share of 7.24%.

Which bank is bigger UBS or Credit Suisse

UBS has finalized its emergency takeover of fallen rival Credit Suisse, creating a giant Swiss bank with nearly $1.7 trillion in assets in the biggest banking tie-up since the 2008 global financial crisis.

Is Credit Suisse too big to fail

The failure of Credit Suisse was a serious test of the reforms of banking regulation made after the global financial crisis of 2007-09. It was the first failure of a large, interconnected bank that was considered 'too big to fail'.

What went wrong with Credit Suisse

Credit Suisse suffered from a lack of oversight, communication, and alignment among its top management, board, and stakeholders. It also faced regulatory scrutiny for its involvement in various misconduct cases.

Is JP Morgan better than Credit Suisse

J.P. Morgan scored higher in 9 areas: Overall Rating, Culture & Values, Diversity and Inclusion, Senior Management, Compensation & Benefits, Career Opportunities, CEO Approval, Recommend to a friend and Positive Business Outlook. Credit Suisse scored higher in 1 area: Work-life balance.

Which is better Citi or Credit Suisse

Citi scored higher in 2 areas: CEO Approval and Positive Business Outlook. Credit Suisse employees rated their Recommend to a friend 4% higher than Citi employees rated theirs. Citi employees rated their Positive Business Outlook 12% higher than Credit Suisse employees rated theirs.

Is Credit Suisse a prestigious bank

Credit Suisse is one of the most prestigious investment banks in the world. Its interns receive extensive hands-on training and work alongside senior bankers. Full-time employees have access to top-notch training programs, mentoring opportunities, and internal mobility options.

Is J.P. Morgan better than Credit Suisse

J.P. Morgan scored higher in 9 areas: Overall Rating, Culture & Values, Diversity and Inclusion, Senior Management, Compensation & Benefits, Career Opportunities, CEO Approval, Recommend to a friend and Positive Business Outlook. Credit Suisse scored higher in 1 area: Work-life balance.

Why does Credit Suisse have such a bad reputation

Credit Suisse's failings have included a criminal conviction for allowing drug dealers to launder money in Bulgaria, entanglement in a Mozambique corruption case, a spying scandal involving a former employee and an executive and a massive leak of client data to the media.

Has Credit Suisse collapsed

Battered by years of scandals and losses, Credit Suisse had been fighting a crisis of confidence for months, before its demise was sealed in just a matter of days last week when Swiss authorities brokered a takeover of the bank by larger rival UBS.

Is Credit Suisse a Tier 1 investment bank

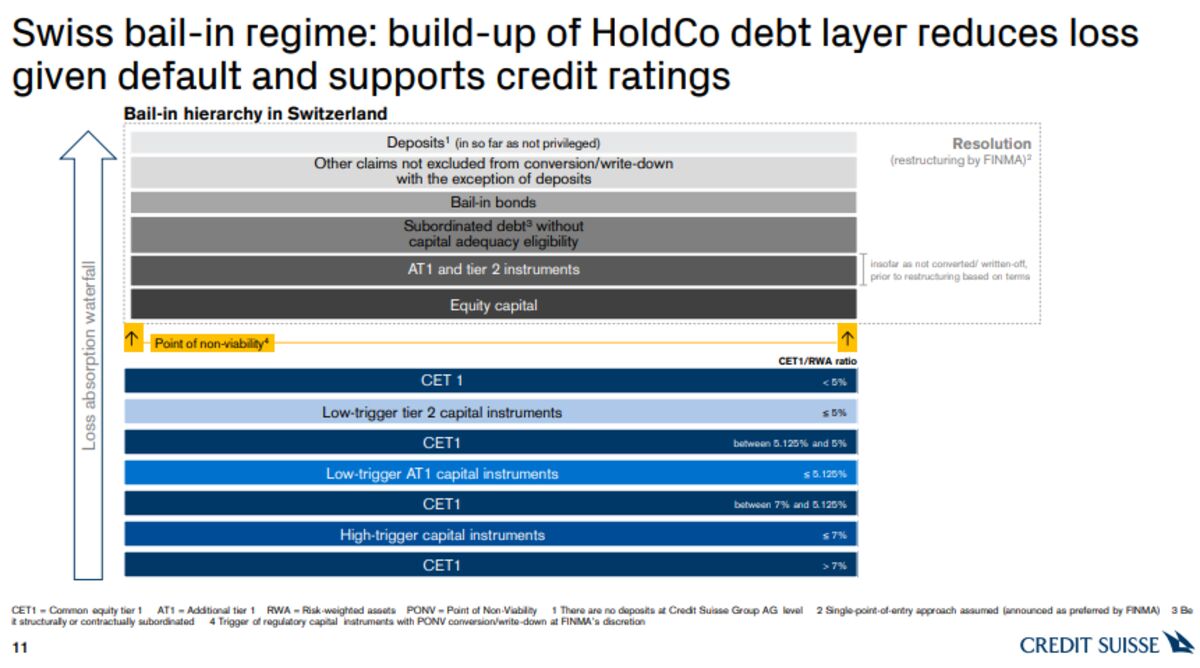

At the end of 2023, Credit Suisse had a Common Equity Tier 1 (CET1) ratio of 14.1% and an average liquidity coverage ratio (LCR) of 144%, both of which are comparable with other large UK banks including HSBC and Barclays.

Is Credit Suisse bank in trouble

Credit Suisse had been plagued by scandals and compliance failures in recent years that wiped out its profit and caused it to lose clients. Customers withdrew 111 billion francs ($121 billion) in the final three months of 2023, when the bank was hit by social media speculation that it was on the brink of collapse.

Will Credit Suisse be bought out

Credit Suisse Group AG has been merged into UBS Group AG and the combined entity will operate as a consolidated banking group. Zurich, 12 June 2023 – UBS has completed the acquisition of Credit Suisse today, crossing an important milestone.

Why did UBS buy Credit Suisse

Last month, Swiss authorities announced that UBS would buy Credit Suisse in a shotgun merger to stem further banking turmoil after the smaller lender had come to the brink of collapse.

Which banks are Tier 2 banks

Tier two would be Goldman Sachs, Barclays Capital, Credit Suisse, Deutsche Bank, and Citigroup. Examples of tier three would be UBS, BNP Paribas, and SocGen.

What is the future outlook for Credit Suisse

Stock Price Forecast

The 10 analysts offering 12-month price forecasts for Credit Suisse Group AG have a median target of 0.86, with a high estimate of 1.00 and a low estimate of 0.81. The median estimate represents a -3.49% decrease from the last price of 0.89.

Is UBS going to buy Credit Suisse

Acquiring Credit Suisse's capabilities in wealth, asset management and Swiss universal banking will augment UBS's strategy of growing its capital-light businesses. The transaction will bring benefits to clients and create long-term sustainable value for our investors.”

Who are Tier 3 banks

Tier 3 capital is capital banks hold to support market risk in their trading activities. Unsecured, subordinated debt makes up tier 3 capital and is of lower quality than tier 1 and tier 2 capital.

What are the Tier 2 investment banks in the US

Tier two would be Goldman Sachs, Barclays Capital, Credit Suisse, Deutsche Bank, and Citigroup.

Is Credit Suisse better than Morgan Stanley

Employee Ratings

Credit Suisse scored higher in 5 areas: Overall Rating, Diversity and Inclusion, Work-life balance, Compensation & Benefits and Career Opportunities.