Is CreditWise or FICO more accurate?

Why is my FICO score different from CreditWise

Scores are calculated differently by each credit-scoring company using complex formulas called scoring models. Some scoring companies even have multiple scoring models. Because of this, a person might have several different credit scores—even from the same scoring company.

Cached

Does CreditWise give an accurate credit score

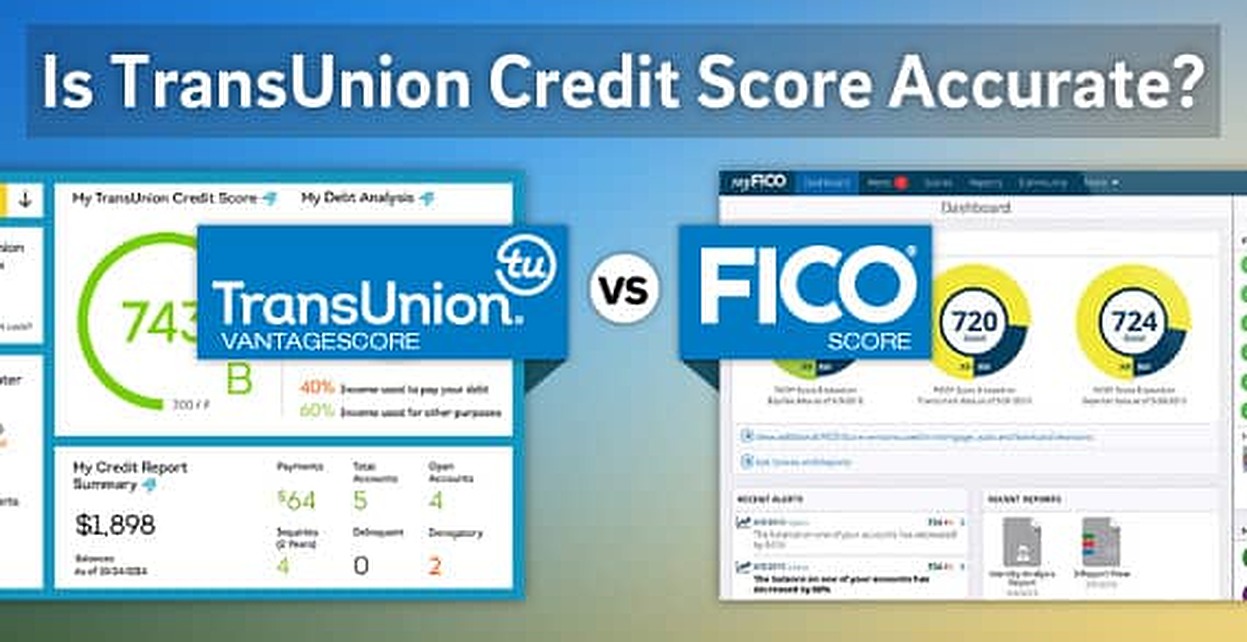

Your CreditWise score is calculated using the TransUnion® VantageScore® 3.0 model, which is one of many credit scoring models. It may not be the same model your lender uses, but it can be one accurate measure of your credit health.

Cached

Is CreditWise the same as FICO score

The primary similarities when comparing CreditWise versus FICO are that both allow you to view your credit score and credit report. But while CreditWise uses the VantageScore, FICO — as its name implies — uses the FICO Score.

Cached

Which credit score is the most accurate

Simply put, there is no “more accurate” score when it comes down to receiving your score from the major credit bureaus.

Cached

How close is CreditWise to FICO score

Is Credit Wise accurate Capital One Credit Wise does NOT provide you with a FICO score. Instead, it provides you with a TransUnion Vantage 3.0 score. So Credit Wise is accurate; it's just that it won't necessarily give you an accurate idea of where your FICO score stands since it's a different model.

Why is my CreditWise score lower than my FICO score

The main reason why credit scores can vary is because they use different scoring models. A FICO® Score is calculated using a different formula than a VantageScore. And while most credit scores use a scale of 300 to 850, that isn't always the case.

How off is CreditWise

The Capital One CreditWise score is pretty accurate, considering that it monitors your TransUnion VantageScore 3.0 score. As for how accurate is CreditWise from Capital One vs. FICO, it's really hard to determine. The methods they use aren't that clear.

Why is my FICO score 100 points lower than Credit Karma

Some lenders report to all three major credit bureaus, but others report to only one or two. Because of this difference in reporting, each of the three credit bureaus may have slightly different credit report information for you and you may see different scores as a result.

Which of the 3 credit scores is usually the highest

As noted earlier, the credit score that matters the most is your FICO Score, since it's used in the vast majority of lending decisions.

Why is my FICO score higher than my credit score

Why is my FICO® score different from my credit score Your FICO Score is a credit score. But if your FICO score is different from another of your credit scores, it may be that the score you're viewing was calculated using one of the other scoring models that exist.

Which credit score is the hardest

Here are FICO's basic credit score ranges:Exceptional Credit: 800 to 850.Very Good Credit: 740 to 799.Good Credit: 670 to 739.Fair Credit: 580 to 669.Poor Credit: Under 580.

Is Capital One CreditWise real

CreditWise from Capital One is a free credit monitoring service that alerts you of changes to your credit. Here's how to register and benefit from CreditWise. Staying on top of changes to your credit file isn't easy to do alone, but a credit monitoring service like CreditWise® can make the process a lot easier.

What credit score do lenders use

the FICO credit score

Which credit score do lenders actually use Most lenders use the FICO credit score when assessing your creditworthiness for a loan. According to FICO, 90% of the top lenders use FICO credit scores.

How far off is Credit Karma from FICO

Your Credit Karma score should be the same or close to your FICO score, which is what any prospective lender will probably check. The range of your credit score (such as "good" or "very good") is more important than the precise number, which will vary by source and edge up or down often.

How far off is Credit Karma from your actual credit score

Here's the short answer: The credit scores and reports you see on Credit Karma come directly from TransUnion and Equifax, two of the three major consumer credit bureaus. The credit scores and reports you see on Credit Karma should accurately reflect your credit information as reported by those bureaus.

How close is your FICO score to your credit score

Is "credit score" the same as "FICO® score" Basically, "credit score" and "FICO® score" are all referring to the same thing. A FICO® score is a type of credit scoring model. While different reporting agencies may weigh factors slightly differently, they are all essentially measuring the same thing.

Which of the 3 credit scores is usually the lowest

Your Equifax score is lower than the other credit scores because there is a slight difference in what is reported to each credit agency and each one uses a slightly different method to score your data. Your Experian, Equifax and TransUnion credit reports should be fairly similiar.

Does checking FICO score hurt credit

Good news: Credit scores aren't impacted by checking your own credit reports or credit scores. In fact, regularly checking your credit reports and credit scores is an important way to ensure your personal and account information is correct, and may help detect signs of potential identity theft.

Why is my FICO score so much higher than Credit Karma

Some lenders report to all three major credit bureaus, but others report to only one or two. Because of this difference in reporting, each of the three credit bureaus may have slightly different credit report information for you and you may see different scores as a result.

Is FICO usually higher or lower than Credit Karma

Your Credit Karma score should be the same or close to your FICO score, which is what any prospective lender will probably check. The range of your credit score (such as "good" or "very good") is more important than the precise number, which will vary by source and edge up or down often.