Is deduction a good thing?

Are deductions good or bad

Deductions can help you qualify for other tax breaks

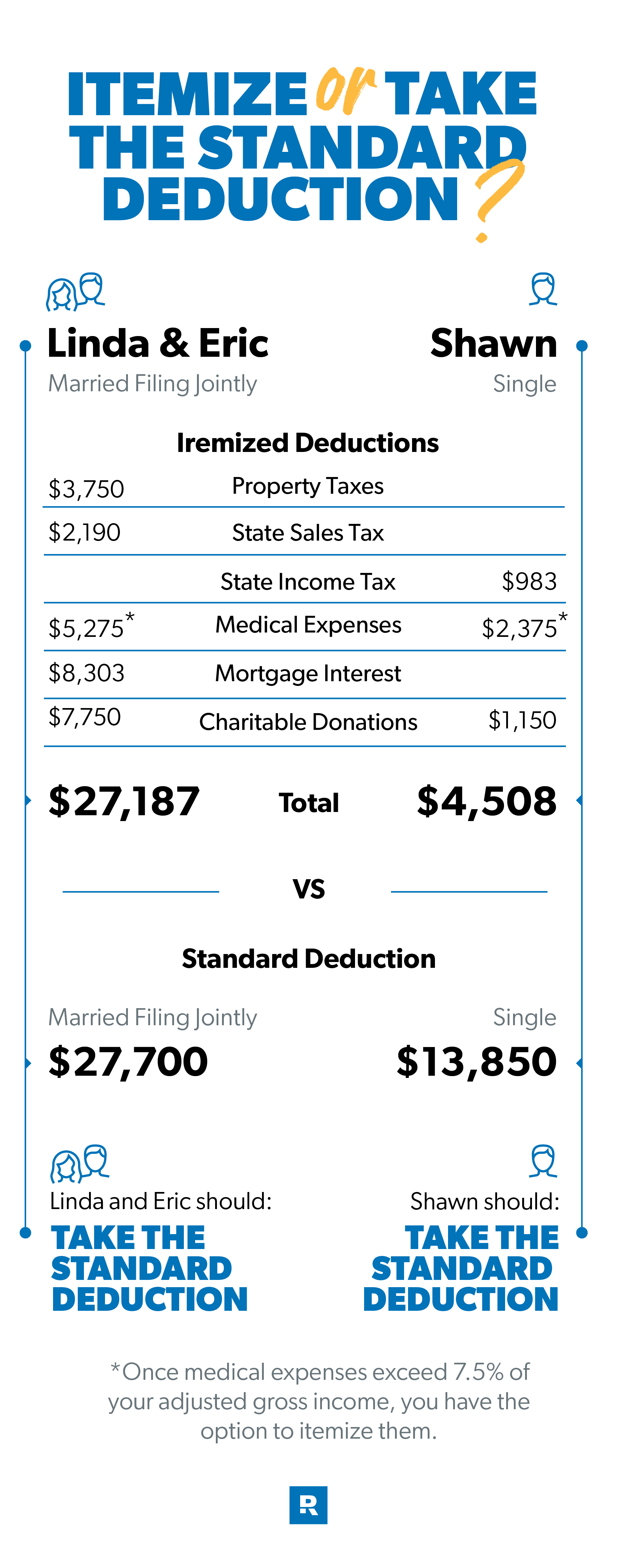

Taxpayers generally opt to itemize their deductions — such as those for charitable donations, mortgage interest, state and local taxes, and certain medical and dental expenses — if their total value exceeds the standard deduction amount.

What is the advantage of deduction

Saving tax with deductions

When you claim a tax deduction, it reduces the amount of your income that is subject to tax. The amount of the deduction you are eligible to claim is precisely the amount of the reduction to your taxable income.

Is a deduction better than a credit

Tax Deduction: Which One Is Better Tax credits are generally considered to be better than tax deductions because they directly reduce the amount of tax you owe. The effect of a tax deduction on your tax liability depends on your marginal tax bracket.

Is it better to take standard deduction or itemize

You should itemize deductions if your allowable itemized deductions are greater than your standard deduction or if you must itemize deductions because you can't use the standard deduction. You may be able to reduce your tax by itemizing deductions on Schedule A (Form 1040), Itemized Deductions.

Cached

Do deductions increase refund

A tax deduction reduces your adjusted gross income or AGI and thus your taxable income on your tax return. As a result, this either increases your tax refund or reduces your taxes owed.

How do deductions affect my paycheck

Post-tax deductions are taken from an employee's paycheck after all required taxes have been withheld. Since post-tax deductions reduce net pay, rather than gross pay, they don't lower the individual's overall tax burden.

What is effect of deduction

The effect of deduction summarises the cost of the policy; it includes the price of marketing the policy, the cost of the administrative work, and the income generated for the insurer for covering you.

How do deductions lower a person’s taxes

Tax deductions, on the other hand, reduce how much of your income is subject to taxes. Deductions lower your taxable income by the percentage of your highest federal income tax bracket. So if you fall into the 22% tax bracket, a $1,000 deduction saves you $220.

How much does a deduction save on taxes

For most non-business deductions, the savings are based upon your tax bracket. For example, if you are in the 12% tax bracket, a $1,000 deduction would save you $120 in taxes. On the other hand, if you are in the 32% tax bracket, the $1,000 deduction will save you $320 in taxes.

Do deductions lower income

Tax deductions, on the other hand, reduce how much of your income is subject to taxes. Deductions lower your taxable income by the percentage of your highest federal income tax bracket. So if you fall into the 22% tax bracket, a $1,000 deduction saves you $220.

Is it worth itemizing deductions anymore

If your standard deduction is less than your itemized deductions, you probably should itemize and save money. If your standard deduction is more than your itemized deductions, it might be worth it to take the standard and save some time.

Do most people itemize or standard

Most taxpayers claim the standard deduction. The standard deduction: Allows you to take a tax deduction even if you have no expenses that qualify for claiming itemized deductions.

Why does my refund go down when I add deductions

If your refund doesn't budge after you've entered your medical expenses, charitable contributions, mortgage interest, sales taxes, or your state, local, or property taxes, it's probably because your Standard Deduction is currently higher than your itemized deductions.

Do deductions give you more money

Deductions can reduce the amount of your income before you calculate the tax you owe. Credits can reduce the amount of tax you owe or increase your tax refund. Certain credits may give you a refund even if you don't owe any tax.

What do we mean by deduction

A deduction is an expense that can be subtracted from taxable income to reduce the amount owed.

Does deduction mean conclusion

Deduction is generally defined as "the deriving of a conclusion by reasoning." Its specific meaning in logic is "inference in which the conclusion about particulars follows necessarily from general or universal premises." Simply put, deduction—or the process of deducing—is the formation of a conclusion based on …

Do tax deductions increase your refund

Deductions can reduce the amount of your income before you calculate the tax you owe. Credits can reduce the amount of tax you owe or increase your tax refund. Certain credits may give you a refund even if you don't owe any tax.

Do you get more money back for deductions

Deductions lower your taxable income by the percentage of your highest federal income tax bracket. So if you fall into the 22% tax bracket, a $1,000 deduction saves you $220.

Do deductions add to your refund

Deductions can reduce the amount of your income before you calculate the tax you owe. Credits can reduce the amount of tax you owe or increase your tax refund. Certain credits may give you a refund even if you don't owe any tax.

Do tax deductions give you a bigger refund

In terms of your tax refund, credits typically yield a bigger tax return than deductions. But that doesn't mean you should overlook key write-offs for which you qualify. Instead of reducing the amount of tax you owe, deductions reduce the amount of income that is subject to tax.